NY-02-82 free printable template

Show details

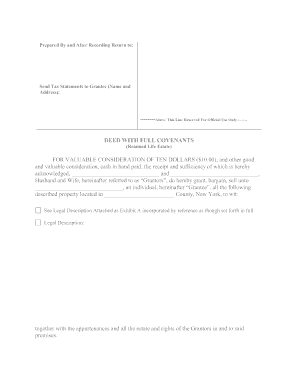

2016 U.S. Legal Forms, Inc. NEW YORK ENHANCED LIFE ESTATE WARRANTY DEED Individual to Two Individuals Control Number: NY0282I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life estate form

Edit your enhanced estate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life estate deed form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bird deed form online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lady deed form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lady bird deed form

How to fill out NY-02-82

01

Obtain the NY-02-82 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information at the top, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Provide details regarding your income, including wages, self-employment income, and any other relevant earnings.

05

Report any deductions or credits you are eligible for, according to the instructions provided with the form.

06

Calculate your total tax liability or refund due by following the formulas laid out on the form.

07

Review your completed form for accuracy and sign where indicated.

08

Submit the completed form by mail or electronically, based on what is permitted by New York State law.

Who needs NY-02-82?

01

Individuals who have received payments that require reporting to the state.

02

Residents of New York State who are required to file an income tax return.

03

Filers who have specific deductions or credits they wish to claim.

04

Taxpayers who need to report income from investments, self-employment, or other sources.

Fill

new york life estate deed

: Try Risk Free

People Also Ask about

What are the advantages of a transfer on death deed in Wisconsin?

When a property owner who has recorded a Wisconsin TOD deed dies, the property interest automatically passes to the TOD beneficiary, with no need for probate. The beneficiary receives the property subject to any existing liens or mortgages.

Who can draft a deed in Wisconsin?

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.

How do I add a name to a deed in Wisconsin?

Use form 9400-623 if you are primary owner on record and you want to add or remove an owner to the certificate of title or if you want to add a lien (i.e. to request a lien notation). Form 9400-193. Use form 9400-193 if you want to transfer title of the boat and you are removing the primary owner on record. Fee.

Who pays real estate transfer tax in Wisconsin?

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value.

Does Wisconsin have a transfer on death deed?

Yes, Wisconsin's TOD deed statute lets property owners name more than one beneficiary in a TOD deed. Wisconsin's general rule is that multiple beneficiaries receive equal shares in a deceased owner's interest, but a property owner can specify different shares within a TOD deed.

How much does it cost to transfer a deed in Wisconsin?

Fee of $3.00 per $1000 is due on the deed in satisfaction of land contract. The deferred fee is also triggered when any modification such as an amendment or assignment of vendee's interest is recorded.

What are the disadvantages of a transfer on death deed?

Disadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.

How much does a quitclaim deed cost in Wisconsin?

Under Wisconsin Statute § 706.08, a quitclaim deed must be recorded for the deed to be effective against most subsequent purchasers. Deeds are recorded with the Register of Deeds in the county where the property is located per Wisconsin Statute § 706.05(1). A $30 filing fee must be paid at the recording time.

How do I transfer a deed after death in Wisconsin?

You must file a real estate transfer return at a Register of Deeds office when terminating a life estate or joint tenancy interest with a Termination of Decedent's Property Interest Form (HT-110). Filing this form meets the definition of a conveyance under state law (sec. 77.21, Wis.

What is HT 110 form Wisconsin?

You must file a real estate transfer return at a Register of Deeds office when terminating a life estate or joint tenancy interest with a Termination of Decedent's Property Interest Form (HT-110). Filing this form meets the definition of a conveyance under state law (sec. 77.21, Wis. Stats.)

How does a quitclaim deed work in Wisconsin?

A quitclaim deed conveys to the new owner—the deed's grantee—whatever interest the current owner holds when signing the deed. As quitclaim deeds provide no warranty, the current owner—the deed's grantor—makes no representations as to the quantity or quality—or even the existence—of the transferred interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my life estate deed form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your life estate deed form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find life estate deed form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific life estate deed form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit life estate deed form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like life estate deed form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NY-02-82?

NY-02-82 is a form used by certain taxpayers in New York State for specific tax reporting purposes.

Who is required to file NY-02-82?

Taxpayers who engage in activities that necessitate the use of this form, typically including businesses or individuals involved in certain income-generating activities in New York State, are required to file NY-02-82.

How to fill out NY-02-82?

To fill out NY-02-82, you need to provide your personal or business information, income details, and any applicable deductions or credits as specified in the form's instructions.

What is the purpose of NY-02-82?

The purpose of NY-02-82 is to report specific tax information to the New York State Department of Taxation and Finance, ensuring compliance with state tax laws.

What information must be reported on NY-02-82?

Information that must be reported on NY-02-82 includes taxpayer identification details, income amounts, types of income, deductions, and any relevant tax credits.

Fill out your life estate deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Estate Deed Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.