TX-04-83 free printable template

Show details

2016 U.S. Legal Forms, Inc. TEXAS ENHANCED LIFE ESTATE WARRANTY DEED Two Individuals / Husband and Wife to Two Individuals / Husband and Wife Control Number: TX0483I. TIPS ON COMPLETING THE FORMS

We are not affiliated with any brand or entity on this form

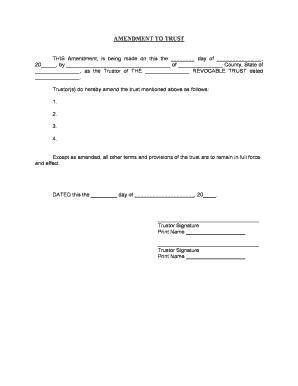

Get, Create, Make and Sign texas lady bird form

Edit your texas enhanced life estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas life estate deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing enhanced estate deed online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas life estate form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas life estate form

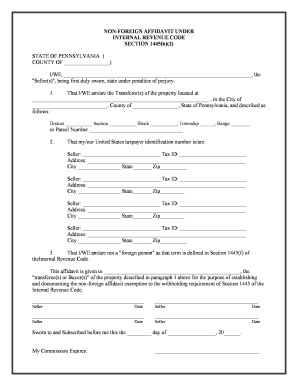

How to fill out TX-04-83

01

Obtain the TX-04-83 form from the relevant authority's website or office.

02

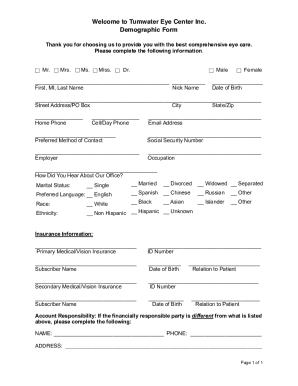

Begin by filling out the personal information section including your name, address, and contact details.

03

Provide any relevant identification numbers, such as a Social Security Number or Tax ID.

04

Complete the sections that pertain to the purpose of the form, following the instructions provided.

05

Review all entries for accuracy and completeness.

06

Sign and date the form in the designated area.

07

Submit the TX-04-83 form according to the guidelines provided, whether via mail or electronically.

Who needs TX-04-83?

01

Individuals who are applying for a specific service or benefit that requires the TX-04-83 form.

02

Businesses that need to submit documentation for regulatory compliance or assistance.

Fill

form

: Try Risk Free

People Also Ask about

What does a life estate deed mean in Texas?

A life estate is property such as land or a residence that a person owns and can use for as long as they are alive. They often share ownership of that property with another person or persons, which means that when the owner dies the title of that property is automatically transferred to the other owner or owners.

How do I set up a life estate in Texas?

Creating a Life Estate in Texas First, there must be clear evidence of an intention to create a life estate through a deed, will, or trust document. No particular language is needed to draw up a life estate, but you must clarify your intent.

Who pays taxes on Texas life estate?

While in possession of the land, a life tenant owes the following duties to future interest holders: The duty to pay ordinary taxes on the land and interest on a mortgage: A life tenant has a duty to pay taxes to the extent the property produces income.

Who is responsible for property taxes on a life estate in Texas?

First, you must pay the principal of the mortgage each month. Additionally, you must pay all property taxes, mortgage interest, and insurance premiums after the life tenant's death. Finally, you cannot convey your interest in the property to another person without the permission of the life tenant.

How does a life estate work in Texas?

A life estate is property such as land or a residence that a person owns and can use for as long as they are alive. They often share ownership of that property with another person or persons, which means that when the owner dies the title of that property is automatically transferred to the other owner or owners.

What is a ladybird document in Texas?

What Are Lady Bird Deeds? A Lady Bird deed is a special kind of deed that is commonly recognized by Texas law. Also called an enhanced life estate deed, it can be used to transfer property to beneficiaries outside of probate. It gives the current owner continued control over the property until his or her death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find texas life estate form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the texas life estate form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute texas life estate form online?

pdfFiller has made it simple to fill out and eSign texas life estate form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit texas life estate form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign texas life estate form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

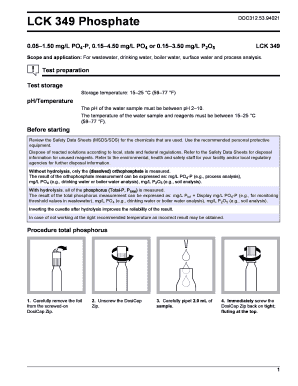

What is TX-04-83?

TX-04-83 is a tax form used in the state of Texas, specifically for reporting certain financial information to the Texas Comptroller's office.

Who is required to file TX-04-83?

Businesses and organizations that meet specific criteria set by the Texas state laws are required to file TX-04-83, particularly those involved in certain financial transactions.

How to fill out TX-04-83?

To fill out TX-04-83, follow the instructions provided on the form, ensuring to provide all required information accurately, including financial details and identification of the reporting entity.

What is the purpose of TX-04-83?

The purpose of TX-04-83 is to collect data on financial transactions for the purpose of tax assessment and compliance within the state of Texas.

What information must be reported on TX-04-83?

TX-04-83 requires the reporting of information such as the entity's identification details, financial transaction amounts, and any relevant financial statements or summaries.

Fill out your texas life estate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Life Estate Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.