Get the free agreement sole proprietorship

Show details

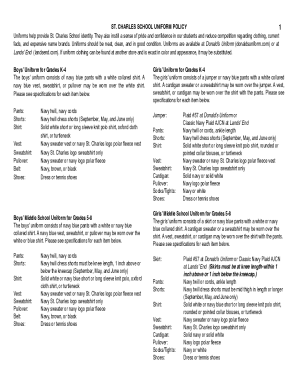

Agreement for Sale of Business Asset Purchase Agreement by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law This Asset Purchase Agreement made on the between day of of Name of Seller Street Address City County State Zip Code referred to herein as Seller and Name of Buyer Whereas Seller is engaged in the Business Description of Business in Name of City and Name of State right title and interest in the Business and the goodwill of the Business In consideration of the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proprietorship law form

Edit your agreement proprietorship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agreement business form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business law form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sole proprietorship closing form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proprietorship law get form

How to fill out business sole proprietorship:

01

Research the requirements and regulations for sole proprietorship in your jurisdiction.

02

Choose a business name and register it if necessary.

03

Determine the business structure and obtain any required licenses or permits.

04

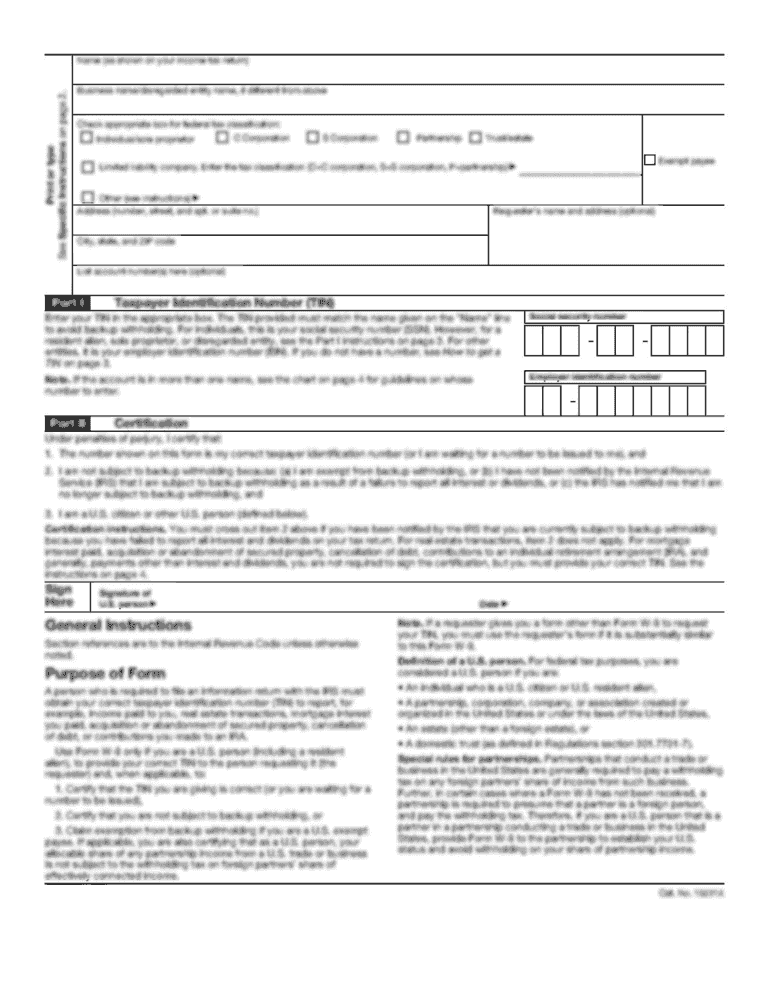

Obtain a Tax Identification Number from the appropriate government agency.

05

Open a separate business bank account to keep personal and business finances separate.

06

Keep thorough records of all business income and expenses.

07

Determine whether you need to register for sales tax and other applicable taxes.

08

Consider obtaining business insurance to protect against potential liabilities.

09

Familiarize yourself with all legal and financial obligations of being a sole proprietor.

10

Regularly review and update your business plan to adapt to changing market conditions and opportunities.

Who needs business sole proprietorship:

01

Individuals who want to start and run a business on their own, without partners or shareholders.

02

Those who prefer a simple and flexible business structure.

03

Entrepreneurs in various industries, including consulting, freelancing, retail, and service-based businesses.

Fill

form

: Try Risk Free

People Also Ask about

What is under a sole proprietorship form of business?

A sole proprietor is someone who owns an unincorporated business by himself or herself. However, if you are the sole member of a domestic limited liability company (LLC), you are not a sole proprietor if you elect to treat the LLC as a corporation.

How do I establish myself as a sole proprietorship?

7 Steps to Start a Sole Proprietorship Decide on a Business Name. Register Your Business DBA Name. Buy and Register a Domain Name. Apply For An EIN. Obtain Business License and Permits. Get Business Insurance. Open a Business Bank Account.

What form should a sole proprietor use?

Filing requirements A sole proprietorship operates as an individual for tax purposes. This requires the individual to report all business income or losses on their individual income tax return (Form 540 ).

What tax forms do I file as a sole proprietor?

Use Schedule SE (Form 1040 or 1040-SR) to figure the tax due on net earnings from self-employment. Transmit paper Forms 1099, 1098, 5498, and W-2G to the IRS.

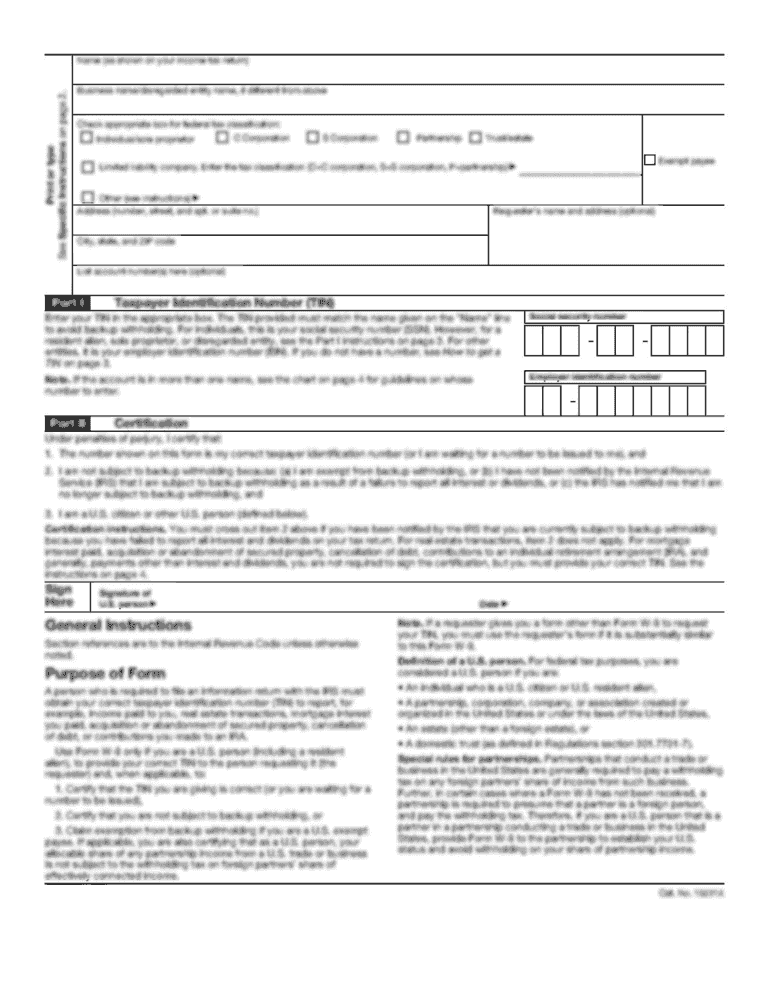

Does a sole proprietor need a w9?

Yes. If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC.

What tax forms does a sole proprietor need?

Use Schedule SE (Form 1040 or 1040-SR) to figure the tax due on net earnings from self-employment. Transmit paper Forms 1099, 1098, 5498, and W-2G to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete agreement sole proprietorship form online?

Filling out and eSigning agreement sole proprietorship form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in agreement sole proprietorship form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your agreement sole proprietorship form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit agreement sole proprietorship form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing agreement sole proprietorship form, you need to install and log in to the app.

What is agreement sole proprietorship?

An agreement sole proprietorship is a legal document that outlines the terms and conditions under which a sole proprietorship operates. This may include details about the business's operations, ownership, and obligations of the sole proprietor.

Who is required to file agreement sole proprietorship?

Individuals who are starting or operating a sole proprietorship are generally required to file an agreement sole proprietorship, especially if they intend to formalize their business structure and comply with local regulations.

How to fill out agreement sole proprietorship?

To fill out an agreement sole proprietorship, the proprietor should provide their personal information, business name, business address, description of business activities, and any other required terms as outlined by local business regulations.

What is the purpose of agreement sole proprietorship?

The purpose of an agreement sole proprietorship is to formalize the business's legal standing, clarify the responsibilities of the owner, and provide a clear framework for the operation and management of the business.

What information must be reported on agreement sole proprietorship?

The information that must be reported typically includes the owner's name, the business name, business location, the nature of the business, financial details, and any other relevant business regulations that apply.

Fill out your agreement sole proprietorship form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agreement Sole Proprietorship Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.