Last updated on Feb 20, 2026

Get the free pdffiller

Show details

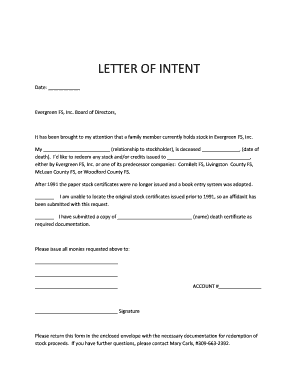

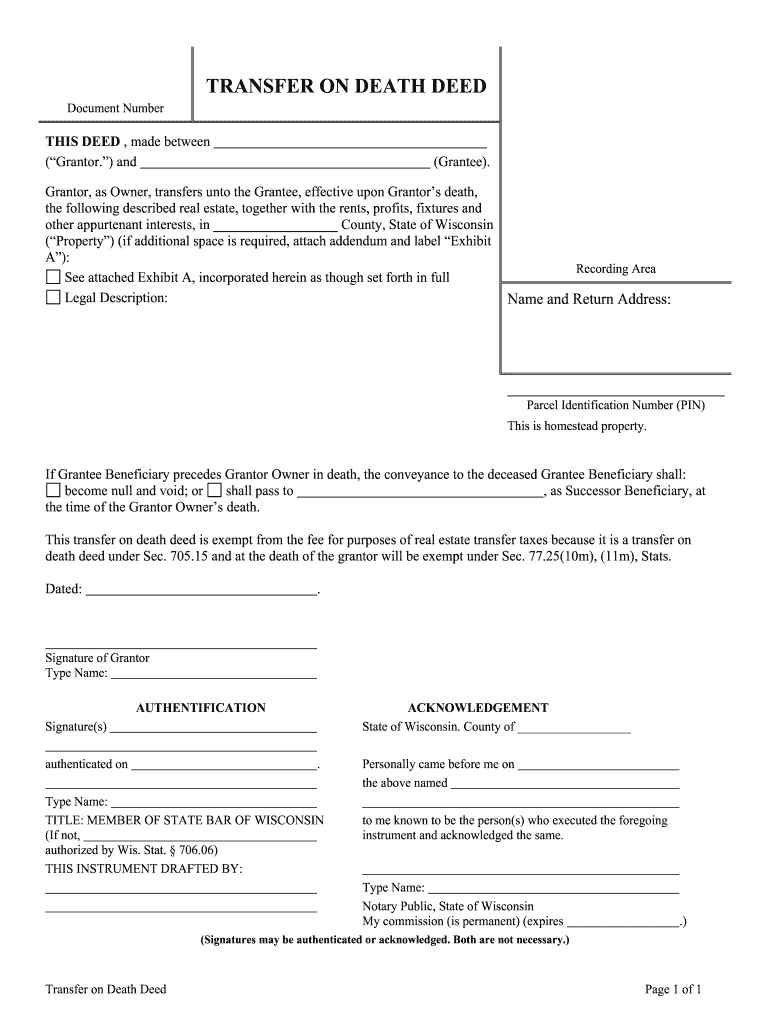

2016 U.S. Legal Forms, Inc. WISCONSIN TRANSFER ON DEATH DEED (Includes provision for Alternative Beneficiary) Individual to Individual Control Number: WI0182I. TIPS ON COMPLETING THE FORMS The form(s)

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer death deed

A transfer death deed is a legal document that allows a property owner to transfer their real estate to a beneficiary upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

This system makes it so easy to fill out and submit claim forms. It saves me so much time!!!

This makes form filling a lot easier than with typewriter.

I have never used a filler app so awesome like this one!

I Have used PDF Filler for 8 mos. on all kinds of documents I love it.

Great and easy tool to use. Very user friendly and powerful

just started but seems to be real helpful

Who needs pdffiller form?

Explore how professionals across industries use pdfFiller.

How to Fill Out the Transfer Death Deed Form on pdfFiller

How to fill out a transfer death deed form

Filling out a transfer death deed form can be a straightforward process if you follow the proper steps. This guide will help you understand the components of the form and how to ensure it is filled out accurately using pdfFiller. By designating a beneficiary and following your state's guidelines, you can secure the transfer of your property upon death.

What is a transfer death deed?

A transfer death deed is a legal document that allows a property owner to transfer real estate to a designated beneficiary upon their death. This type of deed enables the property to bypass probate, making the transfer smoother and quicker. It's crucial to clearly define whom you are passing your property to, as this will help ensure your wishes are honored.

-

The primary benefit of using a transfer death deed is that it allows for a direct transfer of property to beneficiaries without the need for probate, thus eliminating delays and extra costs associated with the probate process.

-

Naming a primary beneficiary is essential because, without it, the property may not be transferred as intended. This can lead to disputes among potential heirs.

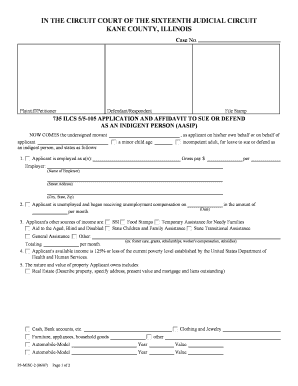

State laws regarding transfer death deeds can vary. For instance, Wisconsin has specific requirements that must be met for the deed to be valid. It's important to familiarize yourself with these laws.

Essential sections of the transfer death deed form

-

This section requires the full legal name and information of the grantor, the person transferring the property.

-

Here, you must clearly specify who will receive the property. This includes the full name and relationship to the grantor.

-

Consider naming alternative beneficiaries in case the primary beneficiary cannot inherit the property, ensuring your intentions are fulfilled.

-

If there are any specific wishes or conditions related to the property transfer, they should be clearly stated here.

How to fill out the transfer death deed form step by step

Filling out the transfer death deed form can be done effectively using pdfFiller. Start by opening the form on the platform and navigating its various fields.

-

pdfFiller offers editing tools, eSignature options, and collaboration features to enhance your document filling experience.

-

Ensure accuracy when entering information—double-check names and legal descriptions to avoid errors that could invalidate the deed.

Safety checks are vital before submission. Verify that all necessary fields are filled and look out for any state-specific requirements, particularly in regions like Wisconsin.

Common mistakes to avoid when completing the form

-

Forgetting to name a primary beneficiary can render the deed ineffective, resulting in potential legal complications.

-

Ensure you understand how to correctly describe the property in legal terms to prevent issues during the transfer.

-

In Wisconsin, there may be additional stipulations that need to be adhered to, making it crucial to conduct thorough research.

-

Failure to properly sign and date the form is a common mistake that can jeopardize the document's validity.

Finalizing the transfer death deed

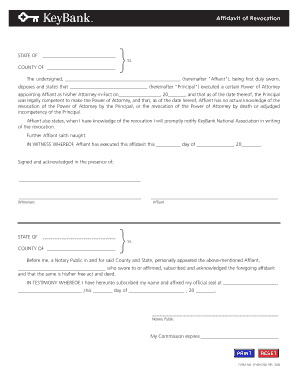

Once you've filled out the transfer death deed form, it's time to complete the process by printing and signing the document. Make sure that you do so in the presence of a notary if required by state law.

-

Consider using pdfFiller to securely store your document in the cloud, ensuring you can access it anytime and from anywhere.

-

Share the completed deed with trusted parties to keep them informed of your final wishes, which can alleviate potential disputes.

Legal considerations and best practices

It's always beneficial to consult with a legal professional to ensure the transfer death deed is being executed correctly. In Wisconsin, a valid execution requires adherence to specific statutory requirements, such as notarization.

-

Engaging with a legal expert can help clarify any concerns and prevent mistakes that could invalidate your document.

-

Keep yourself updated on any changes in state laws regarding transfer death deeds, as this can affect your legal rights.

Using pdfFiller for document management

pdfFiller not only helps in filling out the transfer death deed form but also provides a robust platform for document management. Creating, editing, and storing documents in the cloud simplifies access and collaboration.

-

With pdfFiller, you can organize all your documents in a centralized location, making them easy to manage and retrieve.

-

pdfFiller offers a range of functionalities like document scanning and PDF combination, enhancing your overall document management capabilities.

How to fill out the pdffiller form

-

1.Obtain the transfer death deed template from pdfFiller.

-

2.Open the form in pdfFiller and begin by entering the property owner's name in the designated field.

-

3.Fill in the property description, including the address and any relevant details needed to identify the property.

-

4.Next, provide the name of the beneficiary who will receive the property upon the owner's death.

-

5.Include the date of execution at the bottom of the form to signify when the deed is completed.

-

6.Review all entered information for accuracy to ensure the deed is filled out correctly.

-

7.Save the completed transfer death deed on pdfFiller for future reference and printing.

-

8.Optionally, print the document to sign it in front of a notary public if required by state laws.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.