Get the free reporting in kind donations on 990 Forms and Document ...

Show details

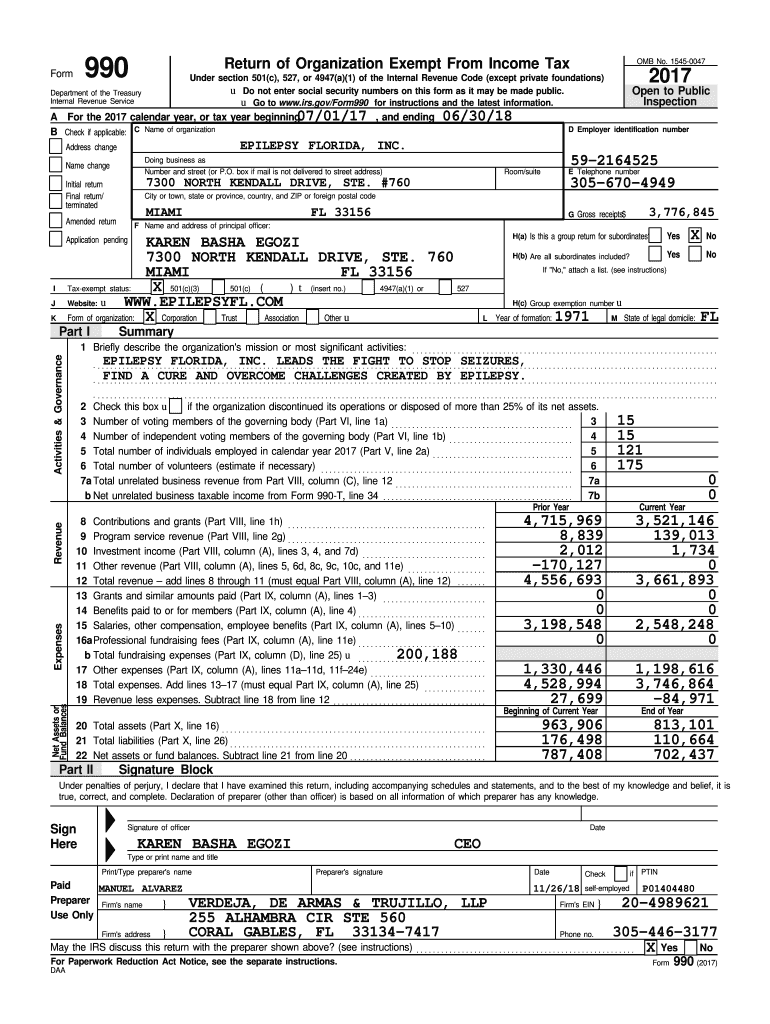

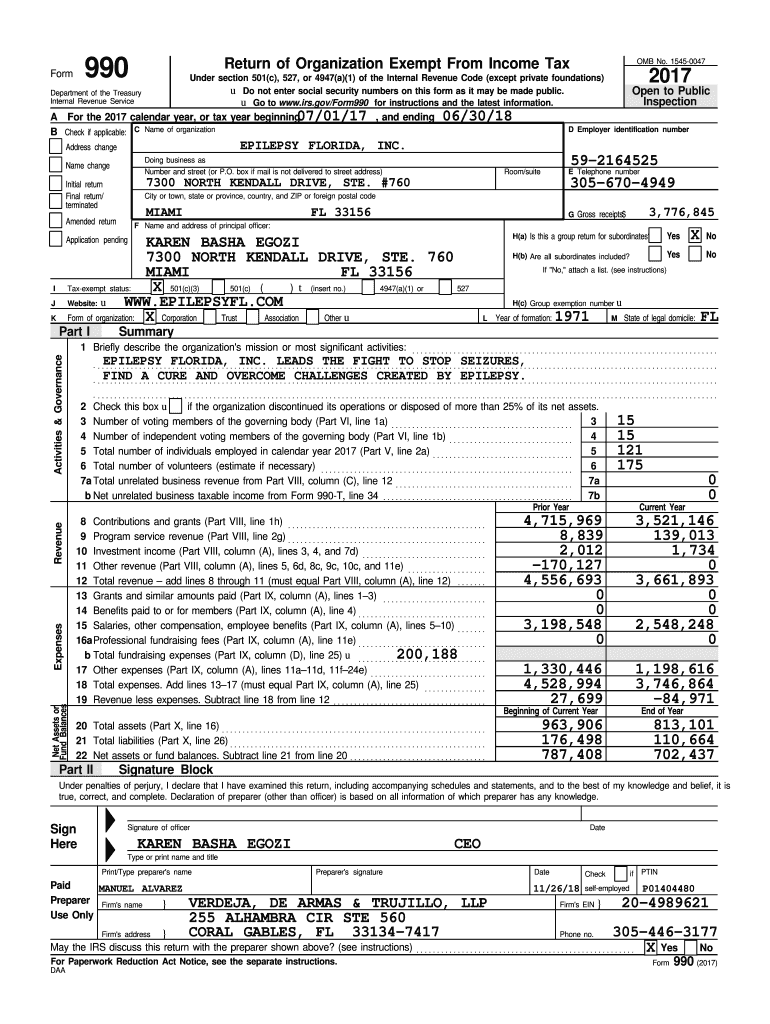

990FormReturn of Organization Exempt From Income Taxa For the 2017 calendar year, or tax year beginning07/01/17, and ending

B Check if applicable: C Name of organization

Name changeling business as

Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reporting in kind donations

Edit your reporting in kind donations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reporting in kind donations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reporting in kind donations online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit reporting in kind donations. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reporting in kind donations

How to fill out reporting in kind donations

01

To fill out reporting in kind donations, follow these steps:

02

Start by gathering all the necessary information about the in-kind donation, such as the donor's name, contact information, and a detailed description of the donated items.

03

Make sure to categorize the donated items appropriately, whether it is goods, services, or other non-monetary donations.

04

Determine the fair market value of each donated item. This may require research or consulting with experts to properly assess the value.

05

Record the date of the donation and any restrictions or conditions imposed by the donor.

06

Prepare a formal acknowledgment letter or receipt for the donor, including all the relevant information about the donation.

07

Keep a copy of the donation documentation for your records, including the acknowledgment letter and any supporting documents.

08

Update your financial records and reporting system to reflect the in-kind donations accurately.

09

Finally, ensure that you comply with any legal and reporting requirements specific to your organization or jurisdiction.

10

Remember to consult with a professional accountant or advisor if you have any doubts or unique situations regarding reporting in kind donations.

Who needs reporting in kind donations?

01

Organizations and nonprofits that accept and utilize in kind donations need to report them.

02

This includes but is not limited to:

03

- Charitable organizations and nonprofits

04

- Non-governmental organizations (NGOs)

05

- Educational institutions

06

- Healthcare organizations

07

- Community centers and social service providers

08

Reporting in kind donations is crucial for these organizations as it helps them track and demonstrate the value of non-monetary contributions they receive.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my reporting in kind donations directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your reporting in kind donations and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find reporting in kind donations?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific reporting in kind donations and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in reporting in kind donations?

The editing procedure is simple with pdfFiller. Open your reporting in kind donations in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is reporting in kind donations?

Reporting in kind donations is the process of documenting and disclosing non-monetary donations or gifts received by an individual or organization.

Who is required to file reporting in kind donations?

Individuals and organizations that receive in kind donations are required to file reporting in kind donations.

How to fill out reporting in kind donations?

Reporting in kind donations can be filled out by providing details of the donation received, including the description, quantity, and estimated value of each item.

What is the purpose of reporting in kind donations?

The purpose of reporting in kind donations is to ensure transparency and accountability in recording non-monetary contributions.

What information must be reported on reporting in kind donations?

Information such as the donor's name, description of the donation, quantity, estimated value, and date of receipt must be reported on reporting in kind donations.

Fill out your reporting in kind donations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reporting In Kind Donations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.