Get the free Small Business Bookkeeping, Accounting & Tax Guide

Show details

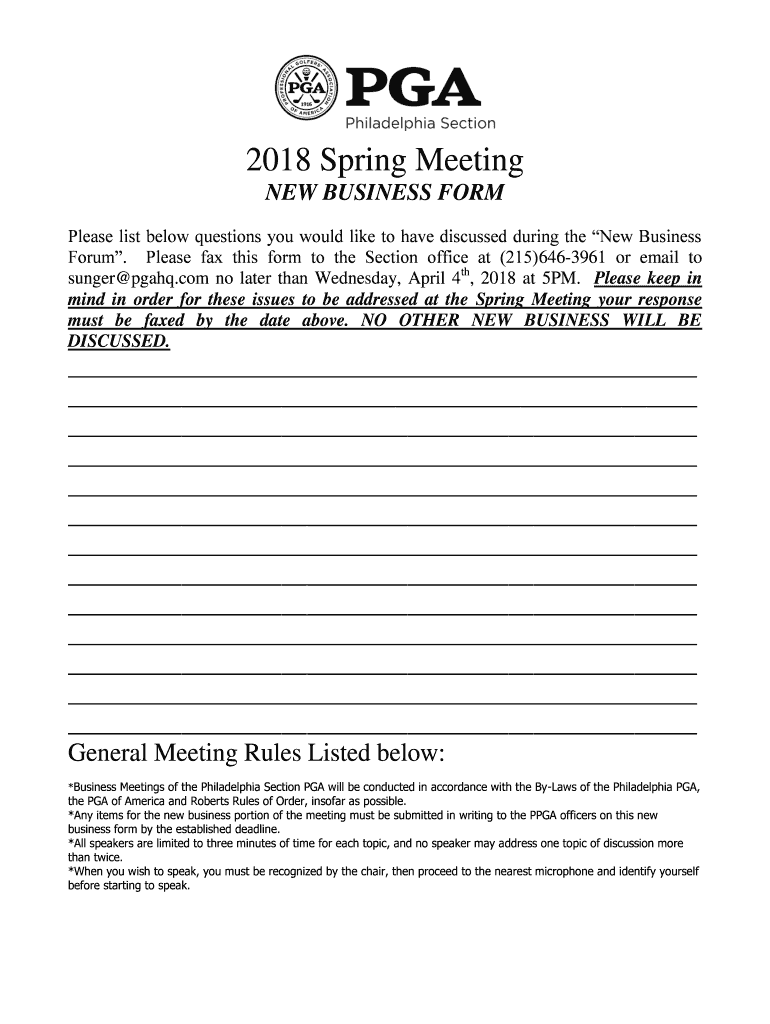

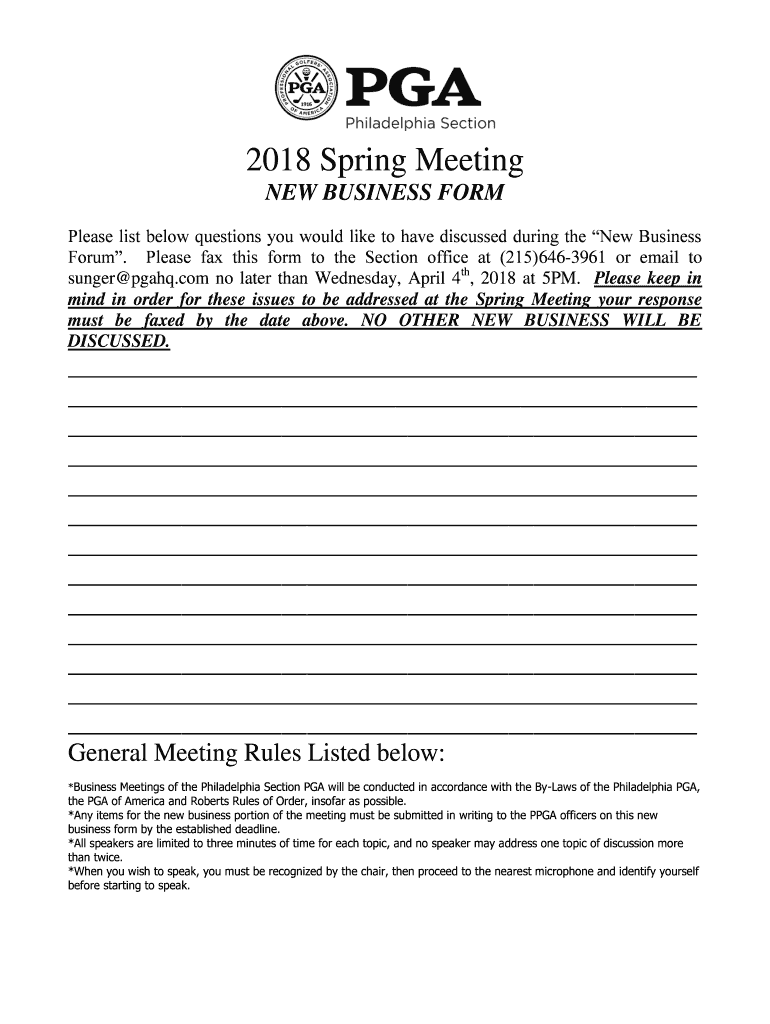

2018 Spring Meeting NEW BUSINESS FORM Please list below questions you would like to have discussed during the New Business Forum. Please fax this form to the Section office at (215)6463961 or email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business bookkeeping accounting

Edit your small business bookkeeping accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business bookkeeping accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business bookkeeping accounting online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small business bookkeeping accounting. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business bookkeeping accounting

How to fill out small business bookkeeping accounting

01

To fill out small business bookkeeping accounting, follow these steps:

02

Organize your financial documents, such as receipts, invoices, and bank statements.

03

Set up a chart of accounts to categorize your income and expenses.

04

Record all financial transactions, including sales, purchases, and expenses.

05

Reconcile your bank statements with your accounting records regularly.

06

Generate financial reports, such as profit and loss statements and balance sheets.

07

Review and analyze your financial data to make informed business decisions.

08

Keep accurate and up-to-date records for easy tax filing and compliance.

09

Consider using small business accounting software for ease and efficiency.

10

Consult with a professional bookkeeper or accountant for expert advice and support.

11

Stay organized and maintain good financial habits to ensure accurate bookkeeping.

Who needs small business bookkeeping accounting?

01

Small business owners, including sole proprietors, partnerships, and limited liability companies, need small business bookkeeping accounting.

02

Entrepreneurs who want to track their income, expenses, and financial health rely on bookkeeping accounting.

03

Any business that wants to have accurate financial records for tax purposes and compliance requires small business bookkeeping accounting.

04

Startups, freelancers, and self-employed individuals can benefit from bookkeeping accounting to manage their finances effectively.

05

Small businesses seeking loans or investors often need properly maintained bookkeeping accounting to demonstrate financial stability and potential.

06

Anyone running a business who wants to make informed financial decisions and track the growth and profitability of their enterprise should prioritize small business bookkeeping accounting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send small business bookkeeping accounting to be eSigned by others?

Once you are ready to share your small business bookkeeping accounting, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the small business bookkeeping accounting in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your small business bookkeeping accounting directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out small business bookkeeping accounting on an Android device?

Use the pdfFiller app for Android to finish your small business bookkeeping accounting. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

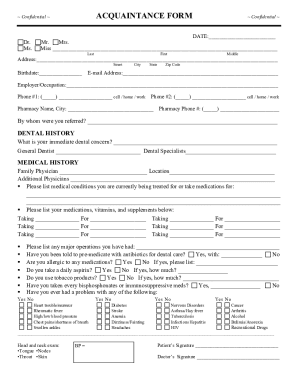

What is small business bookkeeping accounting?

Small business bookkeeping accounting involves managing the financial transactions of a small business, including recording income and expenses, tracking accounts payable and receivable, and producing financial statements.

Who is required to file small business bookkeeping accounting?

Small business owners or individuals responsible for the financial management of a small business are required to file small business bookkeeping accounting.

How to fill out small business bookkeeping accounting?

To fill out small business bookkeeping accounting, one must record all financial transactions accurately, categorize income and expenses, reconcile accounts, and prepare financial reports.

What is the purpose of small business bookkeeping accounting?

The purpose of small business bookkeeping accounting is to track the financial health of a small business, make informed business decisions, comply with tax requirements, and secure financing.

What information must be reported on small business bookkeeping accounting?

Information that must be reported on small business bookkeeping accounting includes income, expenses, accounts receivable and payable, assets and liabilities, and financial statements like balance sheet and income statement.

Fill out your small business bookkeeping accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Bookkeeping Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.