Get the free SeCNUAL AUDITED REPORT - SEC.gov

Show details

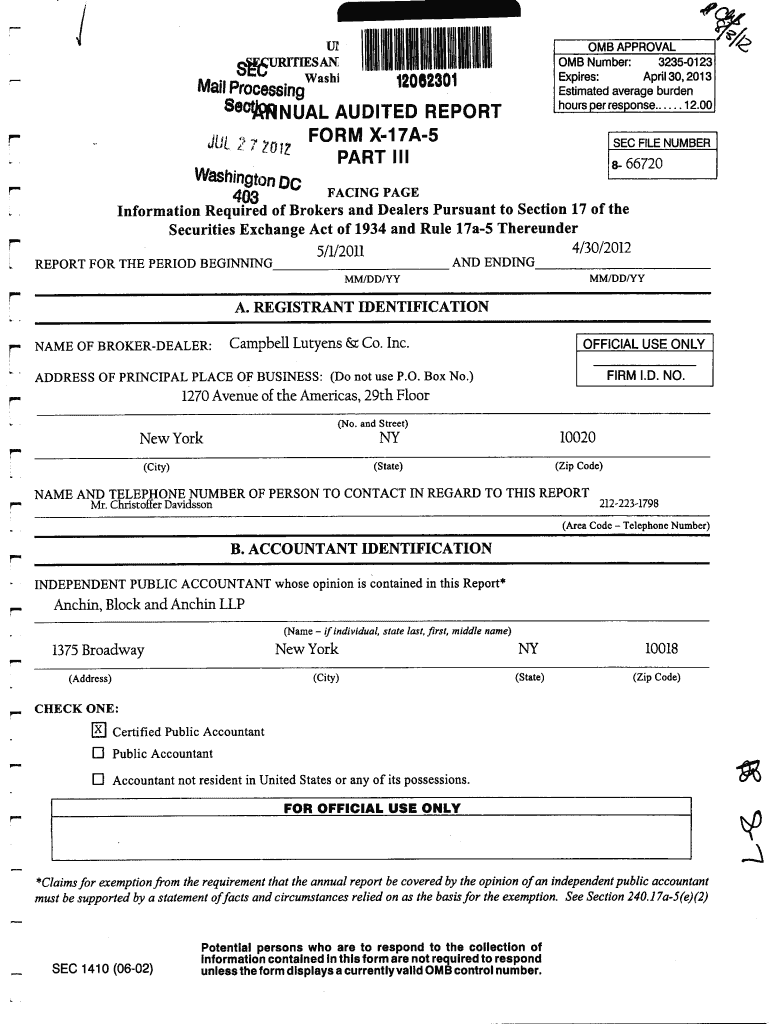

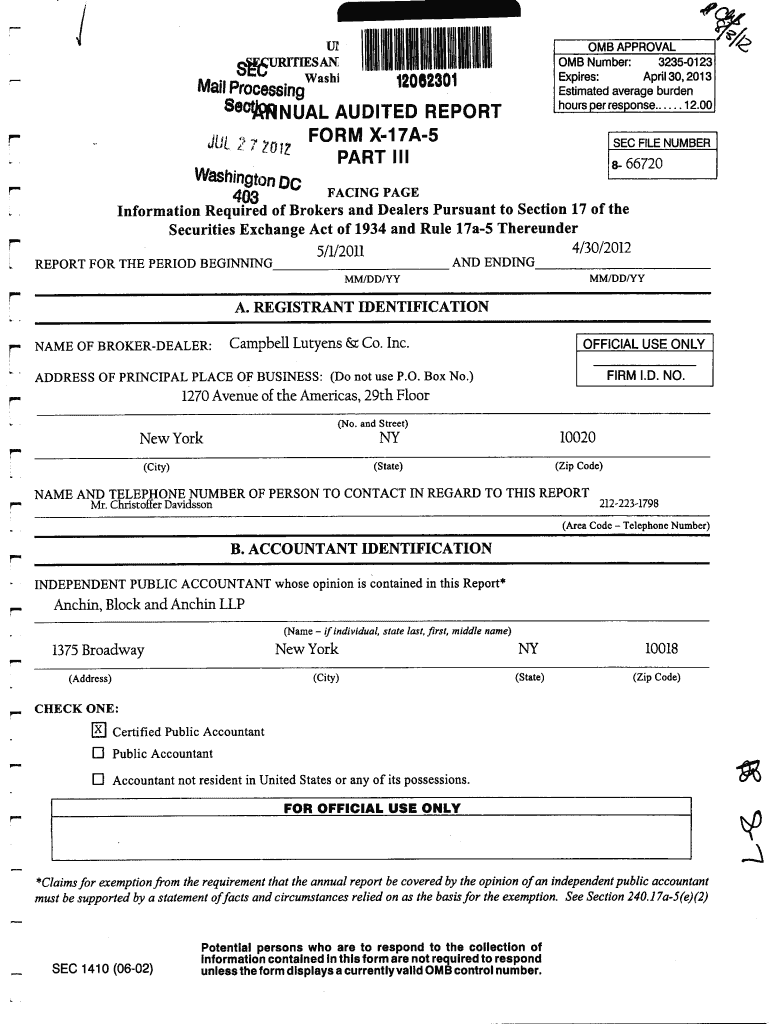

IiSi5URITIESANWashiMadEstimatedWashingt0 403 Securities12.00responseSEC 8FILENUMBER66720FACING PAGE PursuanttoSection17 of that of 1934 and Rule 17a5 ThereunderExchange4/30/20125/1/2011AND ENDING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secnual audited report

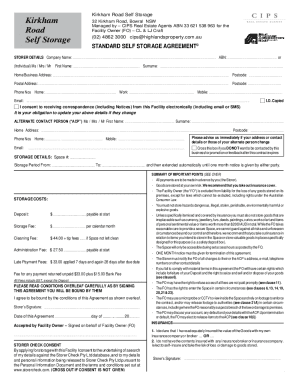

Edit your secnual audited report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secnual audited report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit secnual audited report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit secnual audited report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secnual audited report

How to fill out secnual audited report

01

To fill out a secnual audited report, follow these steps:

02

Start by gathering all necessary financial documents such as balance sheets, income statements, cash flow statements, and any other relevant financial records.

03

Review the financial records and ensure their accuracy and completeness.

04

Prepare a summary of the financial activities and transactions for the reporting period.

05

Analyze the financial data and identify any potential errors or discrepancies.

06

Conduct an internal audit to verify the accuracy of the financial information.

07

Prepare the actual report by organizing the financial data in a structured manner, following the prescribed format.

08

Include relevant notes, explanations, and supporting documentation for the financial figures and statements.

09

Have the report reviewed and approved by the appropriate individuals within the organization.

10

Once the report is finalized, submit it to the relevant regulatory bodies or stakeholders as required by law or company policy.

11

Keep a copy of the report for future reference and audits.

Who needs secnual audited report?

01

Several entities and stakeholders may require a secnual audited report, such as:

02

- Publicly traded companies: They need to provide audited financial reports to shareholders, investors, and regulatory authorities to maintain transparency and trust in the market.

03

- Government agencies: They may require audited reports from businesses to ensure compliance with tax regulations and financial standards.

04

- Financial institutions: Banks and other lending institutions often request audited financial reports to assess the creditworthiness and financial stability of businesses before providing loans or credit facilities.

05

- Non-profit organizations: Non-profit entities often need audited reports to demonstrate accountability and transparency to donors, grantors, and the general public.

06

- Internal stakeholders: Even private companies may opt for audited reports to evaluate their financial performance, identify areas of improvement, and make informed business decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify secnual audited report without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your secnual audited report into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find secnual audited report?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the secnual audited report in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out secnual audited report on an Android device?

Use the pdfFiller mobile app to complete your secnual audited report on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is secnual audited report?

Secnual audited report is a detailed financial report that has been audited by an independent auditor to verify its accuracy and compliance with the relevant accounting standards and regulations.

Who is required to file secnual audited report?

Companies, organizations, and entities that meet certain criteria, such as a certain level of revenue or number of employees, are typically required to file a secnual audited report.

How to fill out secnual audited report?

Secnual audited reports are usually filled out by qualified accountants or financial professionals who have access to the company's financial records and transactions.

What is the purpose of secnual audited report?

The purpose of a secnual audited report is to provide stakeholders, such as shareholders, investors, and creditors, with reliable and accurate information about the company's financial performance and position.

What information must be reported on secnual audited report?

A secnual audited report typically includes financial statements, notes to the financial statements, auditor's report, management discussion and analysis, and other relevant information.

Fill out your secnual audited report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secnual Audited Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.