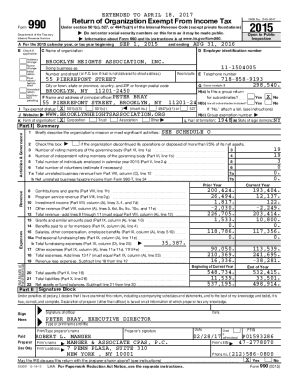

Truliant Federal Credit Union Debit Card free printable template

Show details

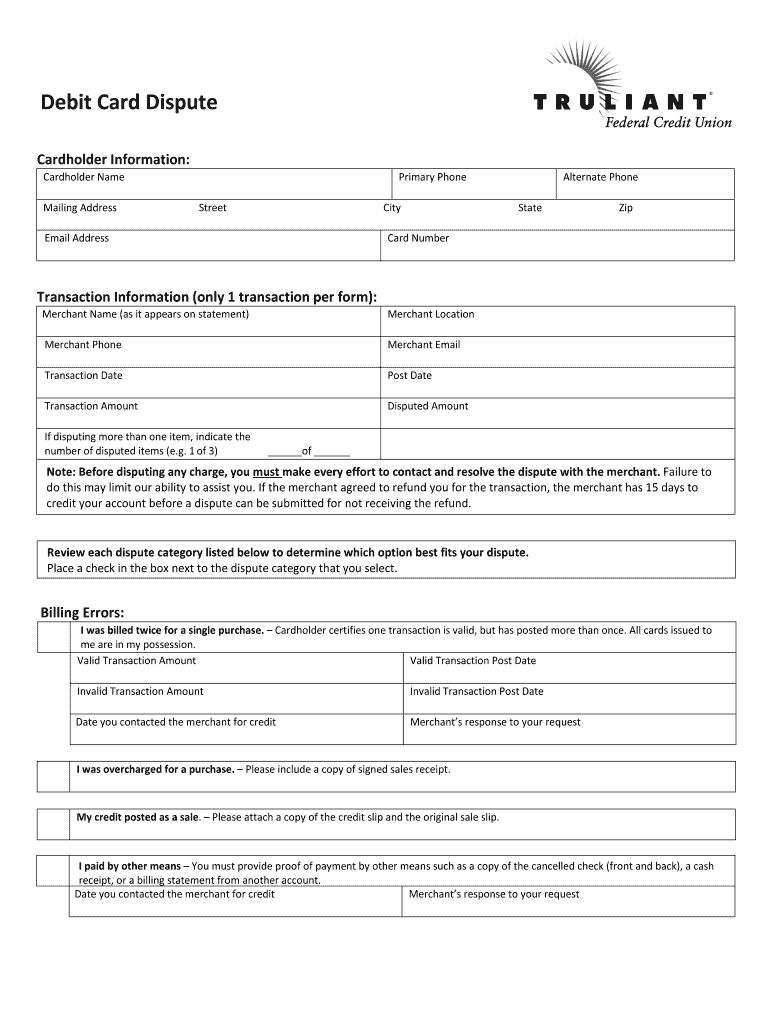

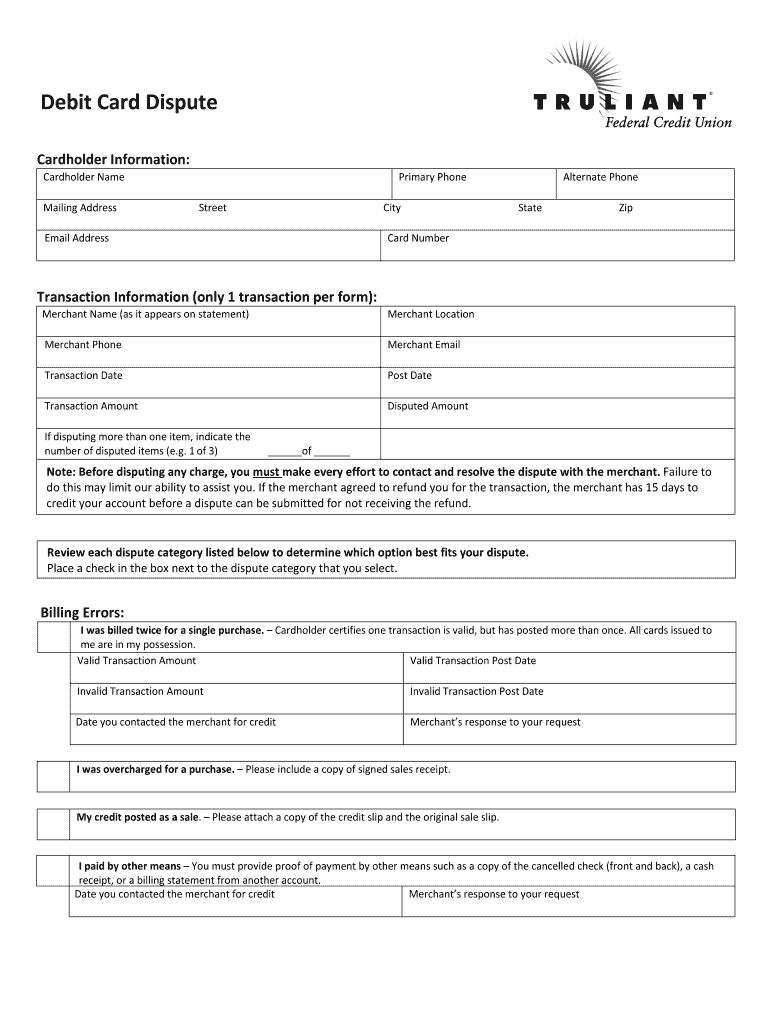

Debit Card Dispute

Cardholder Information:

Cardholder Name

Mailing AddressPrimary Phone

StreetCityEmail AddressStateZipCard NumberTransaction Information (only 1 transaction per form):

Merchant Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dispute forms

Edit your dispute form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dispute form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dispute form online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dispute form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dispute form

How to fill out Truliant Federal Credit Union Debit Card Dispute

01

Gather all relevant information regarding the disputed transaction, including date, amount, and merchant name.

02

Access the Truliant Federal Credit Union website or mobile app to locate the dispute form.

03

Fill out the necessary personal information, such as your name, account number, and contact details.

04

Provide detailed information about the disputed transaction, including the reason for dispute.

05

Attach any supporting documents, such as receipts or statements, to substantiate your claim.

06

Review all information for accuracy before submitting the form.

07

Submit the dispute form either online or by mail as instructed on the form.

08

Monitor your email or account for any updates regarding the status of your dispute.

Who needs Truliant Federal Credit Union Debit Card Dispute?

01

Anyone who has experienced unauthorized transactions or billing errors on their Truliant Federal Credit Union Debit Card.

02

Members of Truliant Federal Credit Union who wish to resolve discrepancies in their account statements.

03

Individuals seeking to recover funds lost due to fraud or mistaken charges on their debit card.

Fill

form

: Try Risk Free

People Also Ask about

Can I dispute a debit card charge that I willingly paid for?

Bad service and service not rendered are also eligible reasons to dispute a charge, even if you willingly made the purchase. For example, if you purchase something online that shows up broken, your credit card issuer can assist with getting your money back.

What if my debit card dispute is denied?

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

What is cardholder dispute form?

A cardholder dispute is the process by which a cardholder claims a charge on their account is illegitimate and requests a chargeback, which may be granted by their issuing bank.

What happens if a debit card dispute is denied?

If your dispute is denied, which occasionally happens, you can request an explanation and appeal the dispute. However, you only have 10 days to make your appeal. Another option is to report the incident to the Federal Trade Commission, the Consumer Finance Protection Bureau or the Better Business Bureau.

What happens if a dispute is denied?

If your dispute is denied, then the charge will go back on your credit card. You're legally entitled to an explanation about why your dispute was denied and how you can appeal the decision. Your credit card company will likely send you both the explanation and instructions on how to appeal in writing.

How do I file a dispute with my debit card?

How to dispute a charge on a debit card Contact your bank's main customer service hotline. Explain that you'd like to dispute a charge. Identify the charge(s) that you'd like to dispute. Explain whether these were fraudulent transactions or simply charges that you are disputing with the merchant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find dispute form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific dispute form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the dispute form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your dispute form in seconds.

Can I edit dispute form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign dispute form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Truliant Federal Credit Union Debit Card Dispute?

A Truliant Federal Credit Union Debit Card Dispute is a formal process initiated by a member to challenge a transaction made with their debit card that they believe is incorrect, unauthorized, or fraudulent.

Who is required to file Truliant Federal Credit Union Debit Card Dispute?

Any member who has encountered an issue with a debit card transaction, such as unauthorized charges or errors, is required to file a dispute.

How to fill out Truliant Federal Credit Union Debit Card Dispute?

To fill out a Truliant Federal Credit Union Debit Card Dispute, members need to obtain the dispute form from the credit union, provide their account details, describe the disputed transaction, and submit any supporting documentation.

What is the purpose of Truliant Federal Credit Union Debit Card Dispute?

The purpose of the debit card dispute is to provide a mechanism for members to resolve issues related to unauthorized or incorrect transactions and to recover funds if applicable.

What information must be reported on Truliant Federal Credit Union Debit Card Dispute?

The information that must be reported includes the member's account number, transaction date, amount, merchant name, a description of the dispute, and any relevant evidence to support the claim.

Fill out your dispute form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dispute Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.