Get the free Anti-Money Laundering (AML) Source Tool for Broker-Dealers - SEC.gov

Show details

GENERAL INSTRUCTIONS

What is this form?

To help the government fight financial crime, federal regulation requires certain financial institutions to

obtain, verify, and record information about the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering aml source

Edit your anti-money laundering aml source form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering aml source form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit anti-money laundering aml source online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit anti-money laundering aml source. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering aml source

How to fill out anti-money laundering aml source

01

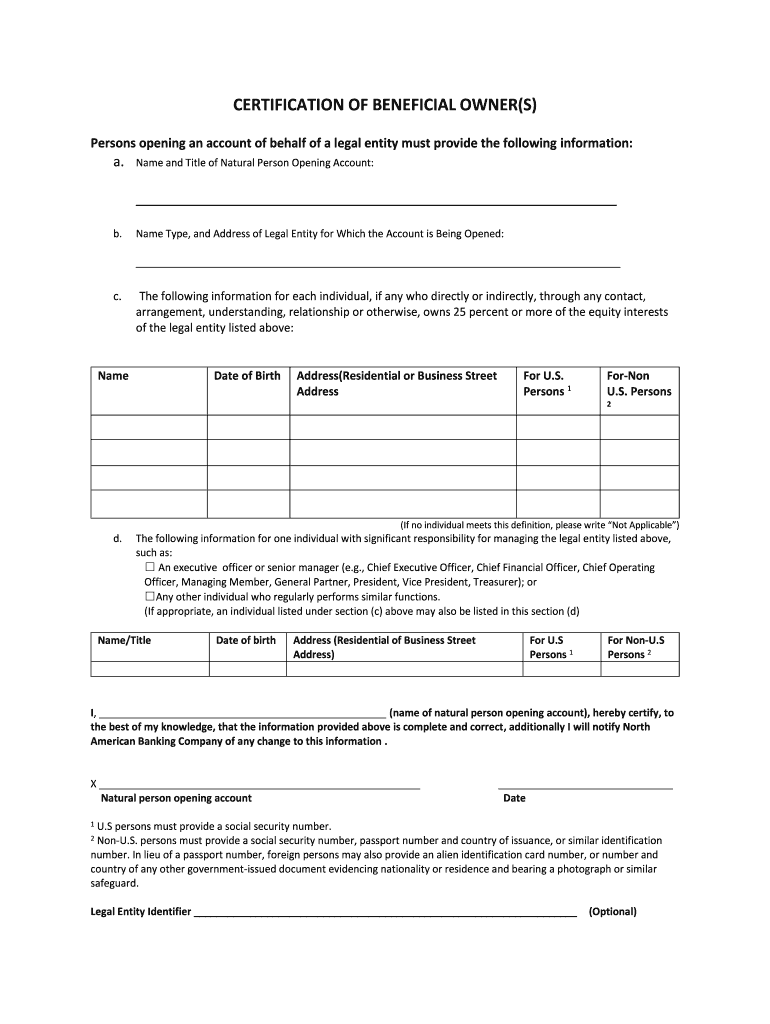

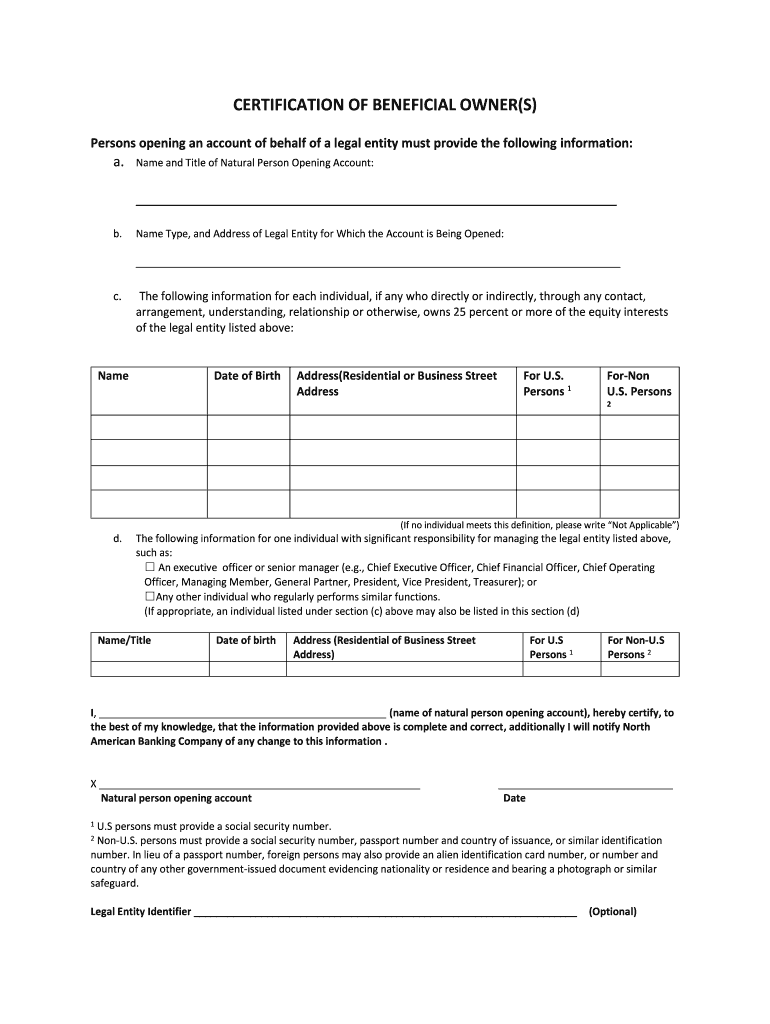

To fill out an anti-money laundering (AML) source, follow these steps:

02

Start by gathering all the necessary information about the transaction or individual involved in the financial activity.

03

Identify and evaluate any potential risks associated with the transaction or individual. This may include conducting background checks, verifying identities, and assessing the source of funds.

04

Document all the relevant information in the AML source form or template. This typically includes details such as the transaction amount, origin and destination of funds, purpose of the transaction, and any supporting documentation.

05

Review and validate the collected information to ensure its accuracy and compliance with AML regulations.

06

If any red flags or suspicious activities are identified during the process, report them to the appropriate authorities and follow the necessary procedures outlined by your organization's AML compliance program.

07

Finally, store the completed AML source form in a secure and organized manner for future reference and potential audits.

Who needs anti-money laundering aml source?

01

Various entities and individuals require access to anti-money laundering (AML) sources, including:

02

- Financial institutions such as banks, credit unions, and insurance companies that are subject to AML regulations and need to verify customers' identities, track transactions, and detect suspicious activities.

03

- Government regulatory agencies and law enforcement bodies that use AML sources to investigate and prevent money laundering and terrorist financing.

04

- Auditors and compliance officers who assess financial institutions' compliance with AML regulations and standards.

05

- Businesses and organizations involved in high-risk sectors, such as casinos, money services businesses, and real estate professionals, as they are more vulnerable to money laundering activities.

06

- Lawyers, accountants, and other professionals who may be obligated to report suspicious transactions or assist in AML investigations.

07

Overall, anyone involved in financial transactions or responsible for ensuring compliance with AML regulations can benefit from access to AML sources.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find anti-money laundering aml source?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the anti-money laundering aml source in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in anti-money laundering aml source without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your anti-money laundering aml source, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit anti-money laundering aml source on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign anti-money laundering aml source on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is anti-money laundering aml source?

Anti-money laundering (AML) source refers to the documents, records, and information used to identify potential money laundering activities.

Who is required to file anti-money laundering aml source?

Financial institutions, including banks, credit unions, and money services businesses, are required to file anti-money laundering (AML) source.

How to fill out anti-money laundering aml source?

To fill out anti-money laundering (AML) source, financial institutions must provide detailed information about transactions, clients, and any suspicious activities.

What is the purpose of anti-money laundering aml source?

The purpose of anti-money laundering (AML) source is to prevent and detect money laundering activities, terrorist financing, and other financial crimes.

What information must be reported on anti-money laundering aml source?

Information reported on anti-money laundering (AML) source includes client information, transaction details, and any suspicious activities that may indicate money laundering.

Fill out your anti-money laundering aml source online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Aml Source is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.