Get the free HOME EQUITY LINE OF CREDIT - INSTRUCTIONS

Show details

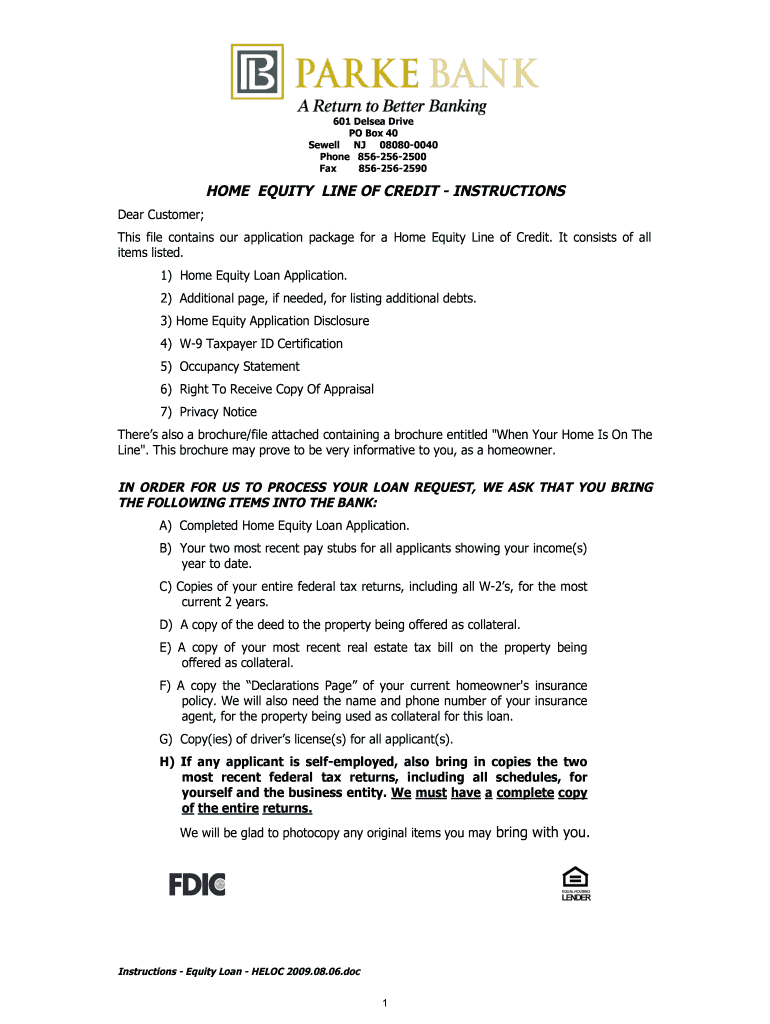

601 Del sea Drive PO Box 40 Sewell NJ 080800040 Phone 8562562500 Fax 8562562590HOME EQUITY LINE OF CREDIT INSTRUCTIONS Dear Customer; This file contains our application package for a Home Equity Line

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home equity line of

Edit your home equity line of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home equity line of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home equity line of online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit home equity line of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home equity line of

How to fill out home equity line of

01

Determine the purpose of the home equity line of credit (HELOC).

02

Gather all necessary documents, such as income verification, tax returns, mortgage statements, and proof of property ownership.

03

Research different lenders and compare their interest rates and terms.

04

Fill out the application form provided by the chosen lender.

05

Provide accurate information about your financial situation, property value, and outstanding debts.

06

Wait for the lender to review your application and assess the value of your property.

07

If approved, sign the necessary loan documents and complete any additional requirements from the lender.

08

Begin using the home equity line of credit as needed, keeping track of your expenses and payments.

09

Make regular payments to repay the borrowed amount and interest.

10

Keep communication with the lender to address any questions or concerns that may arise during the repayment period.

Who needs home equity line of?

01

Homeowners who have built substantial equity in their property.

02

Individuals who need funds for home improvements, education expenses, debt consolidation, or other financial needs.

03

Borrowers who prefer a flexible source of funding that allows them to borrow as needed.

04

Those looking for potentially lower interest rates compared to other types of loans or credit options.

05

People who have a reliable source of income to make regular payments towards the borrowed amount.

06

Individuals who are comfortable using their home as collateral for the line of credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in home equity line of?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your home equity line of to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit home equity line of on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign home equity line of right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit home equity line of on an Android device?

The pdfFiller app for Android allows you to edit PDF files like home equity line of. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is home equity line of?

A home equity line of credit, also known as HELOC, is a type of loan that allows homeowners to use the equity in their home as collateral.

Who is required to file home equity line of?

Homeowners who have a HELOC are required to file the necessary paperwork with their lender.

How to fill out home equity line of?

To fill out a HELOC application, homeowners will need to provide information about their income, credit history, and the value of their home.

What is the purpose of home equity line of?

The purpose of a HELOC is to provide homeowners with access to funds that can be used for a variety of purposes, such as home improvements or debt consolidation.

What information must be reported on home equity line of?

Homeowners must report information such as their income, credit history, and the amount of equity in their home.

Fill out your home equity line of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Equity Line Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.