Get the free SBI Fixed Maturity Plan (FMP)- Series 10 (1178 ... - SBI Mutual Fund

Show details

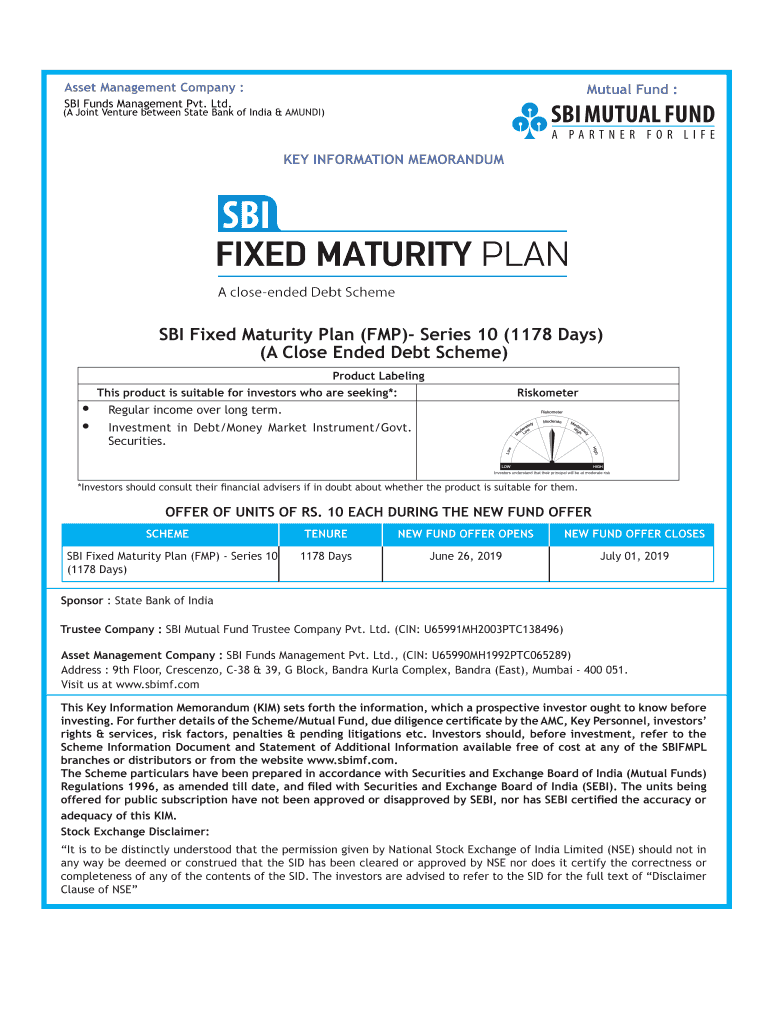

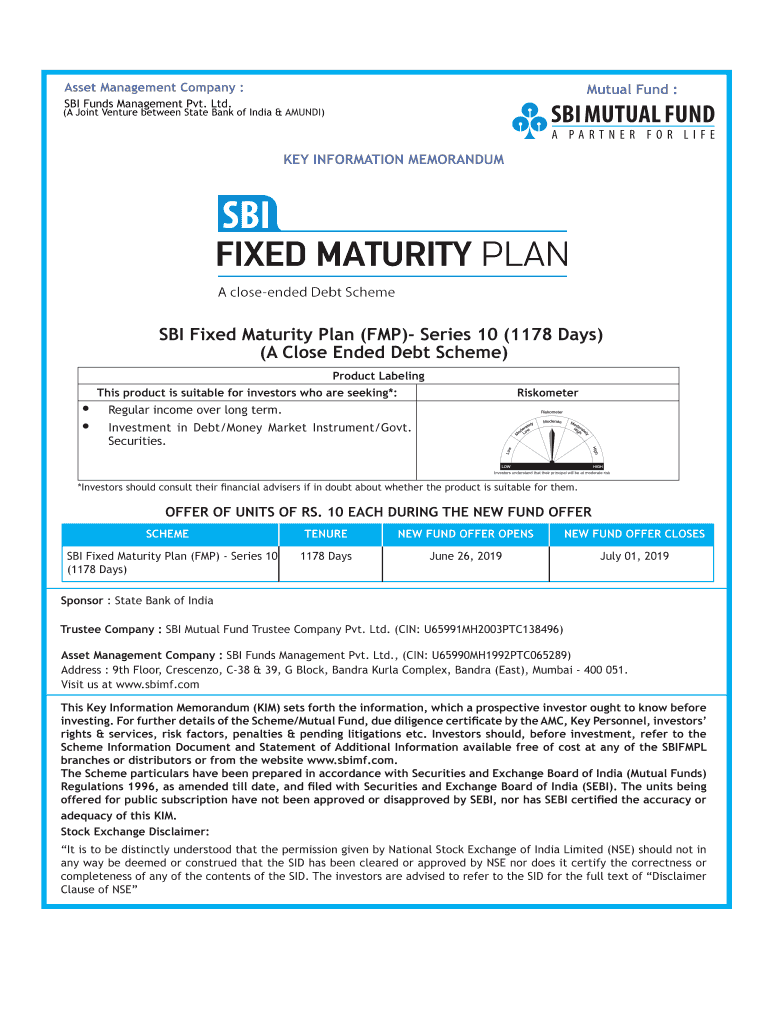

Asset Management Company :Mutual Fund :SBI Funds Management Pvt. Ltd.(A Joint Venture between State Bank of India & AMANDA)KEY INFORMATION MEMORANDUM SBI Fixed Maturity Plan (FMP) Series 10 (1178

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbi fixed maturity plan

Edit your sbi fixed maturity plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbi fixed maturity plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sbi fixed maturity plan online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sbi fixed maturity plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbi fixed maturity plan

How to fill out sbi fixed maturity plan

01

Here is how you can fill out SBI Fixed Maturity Plan:

02

Visit the SBI website or the nearest SBI branch to obtain the application form for the Fixed Maturity Plan.

03

Fill out the application form with accurate and necessary details such as your personal information, contact details, and investment amount.

04

Select the maturity period for your investment. The SBI Fixed Maturity Plan offers different maturity periods, so choose the one that aligns with your financial goals.

05

Decide the investment option based on your risk tolerance. SBI Fixed Maturity Plan offers both growth and dividend options.

06

Attach the required documents such as identity proof, address proof, PAN card copy, and a passport-sized photograph with the filled-out application form.

07

Review the filled-out form and attached documents to ensure everything is accurate and complete.

08

Submit the filled-out form along with the required documents to the SBI branch or through online portal if available.

09

Pay the investment amount through the available payment options provided by SBI.

10

Keep the acknowledgement receipt or transaction confirmation as proof of your investment in SBI Fixed Maturity Plan.

11

Monitor your investment periodically and stay updated with any communication or updates from SBI regarding your Fixed Maturity Plan.

Who needs sbi fixed maturity plan?

01

SBI Fixed Maturity Plan is suitable for individuals who:

02

- Are looking for a short to medium-term investment option

03

- Want to earn fixed returns and avoid the volatility of the stock market

04

- Have a specific financial goal to achieve within a defined timeframe

05

- Prefer the convenience of investing in a mutual fund scheme managed by a reputed bank like SBI

06

- Are willing to explore different maturity periods and investment options offered by SBI Fixed Maturity Plan.

07

It is important to note that individuals should assess their risk profile and consult with a financial advisor before investing in any financial product, including SBI Fixed Maturity Plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sbi fixed maturity plan for eSignature?

Once your sbi fixed maturity plan is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the sbi fixed maturity plan in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your sbi fixed maturity plan and you'll be done in minutes.

How can I fill out sbi fixed maturity plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your sbi fixed maturity plan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is sbi fixed maturity plan?

SBI Fixed Maturity Plan (FMP) is a type of mutual fund scheme provided by State Bank of India that invests in fixed-income securities with a specific maturity date.

Who is required to file sbi fixed maturity plan?

Individuals or entities who have invested in SBI Fixed Maturity Plan (FMP) are required to file the necessary forms related to the investment.

How to fill out sbi fixed maturity plan?

To fill out SBI Fixed Maturity Plan (FMP), investors need to provide details of their investment, personal information, and any other required information in the prescribed forms provided by State Bank of India.

What is the purpose of sbi fixed maturity plan?

The purpose of SBI Fixed Maturity Plan (FMP) is to provide investors with an opportunity to invest in fixed-income securities that mature on a specific date, aiming to generate returns over the investment period.

What information must be reported on sbi fixed maturity plan?

Information such as investment amount, maturity date, interest rate, and any additional terms and conditions related to the investment must be reported on SBI Fixed Maturity Plan (FMP).

Fill out your sbi fixed maturity plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbi Fixed Maturity Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.