Get the free Understanding Nonprofit Finances

Show details

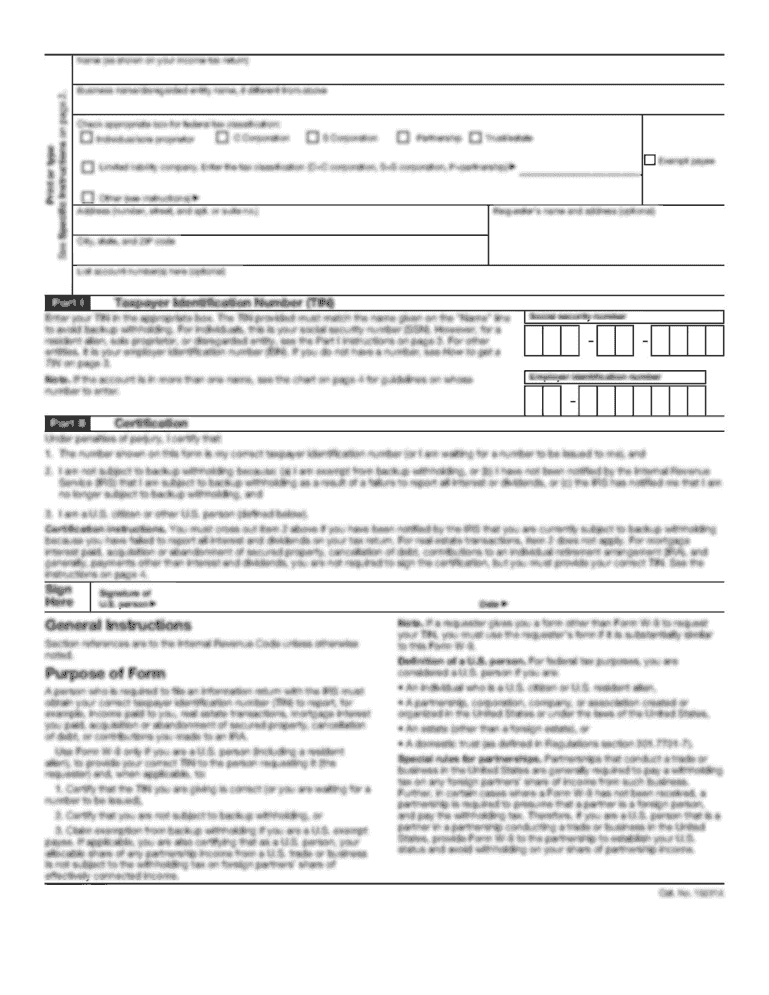

Form** PUBLIC DISCLOSURE COPY **990Return of Organization Exempt From Income Thunder section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Do not enter social

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding nonprofit finances

Edit your understanding nonprofit finances form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding nonprofit finances form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding nonprofit finances online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding nonprofit finances. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding nonprofit finances

How to fill out understanding nonprofit finances

01

Start by gathering all the necessary financial documents of the nonprofit organization, such as balance sheets, income statements, and cash flow statements.

02

Familiarize yourself with the different sections and components of these financial statements, including revenue, expenses, assets, liabilities, and net assets.

03

Analyze the financial trends and patterns by comparing the information from different years or periods to identify any changes or significant events.

04

Calculate key financial ratios, such as liquidity ratios, profitability ratios, and efficiency ratios, to assess the financial health and performance of the nonprofit.

05

Understand the budgeting process of the nonprofit organization and how it aligns with its strategic goals and objectives.

06

Evaluate the sources of revenue and fundraising initiatives, including grants, donations, and sponsorships, to determine their impact on the financial sustainability of the nonprofit.

07

Identify any financial risks or challenges that the nonprofit may face and develop strategies to mitigate or address them.

08

Stay updated with the regulatory and compliance requirements for nonprofit finances, such as filing tax returns and maintaining transparency in financial reporting.

09

Seek professional advice or assistance from accountants, financial advisors, or consultants specializing in nonprofit finances, if needed.

10

Regularly review and monitor the financial performance of the nonprofit to make informed decisions and ensure its long-term sustainability.

Who needs understanding nonprofit finances?

01

Board members and directors of nonprofit organizations who are responsible for overseeing the financial management and decision-making processes.

02

Nonprofit staff and employees involved in finance, accounting, and budgeting functions.

03

Donors, philanthropists, and foundations interested in understanding the financial health and accountability of the nonprofit organizations they support.

04

Grantmakers and funding organizations who require a thorough understanding of nonprofit finances before awarding grants or funding.

05

Volunteers and individuals considering involvement in nonprofit organizations who want to evaluate their financial stability and effectiveness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit understanding nonprofit finances from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including understanding nonprofit finances. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the understanding nonprofit finances in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your understanding nonprofit finances in minutes.

How do I complete understanding nonprofit finances on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your understanding nonprofit finances from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is understanding nonprofit finances?

Understanding nonprofit finances involves comprehending the financial statements, budgeting processes, and funding sources of a nonprofit organization.

Who is required to file understanding nonprofit finances?

Nonprofit organizations are required to file understanding nonprofit finances to comply with financial reporting regulations.

How to fill out understanding nonprofit finances?

Understanding nonprofit finances can be filled out by gathering financial documents, reconciling accounts, and preparing financial statements.

What is the purpose of understanding nonprofit finances?

The purpose of understanding nonprofit finances is to ensure transparency, accountability, and proper management of financial resources within a nonprofit organization.

What information must be reported on understanding nonprofit finances?

Information such as income, expenses, assets, liabilities, grants received, and donations must be reported on understanding nonprofit finances.

Fill out your understanding nonprofit finances online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Nonprofit Finances is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.