Get the free moderate growth fund - Irish Life Investment Managers

Show details

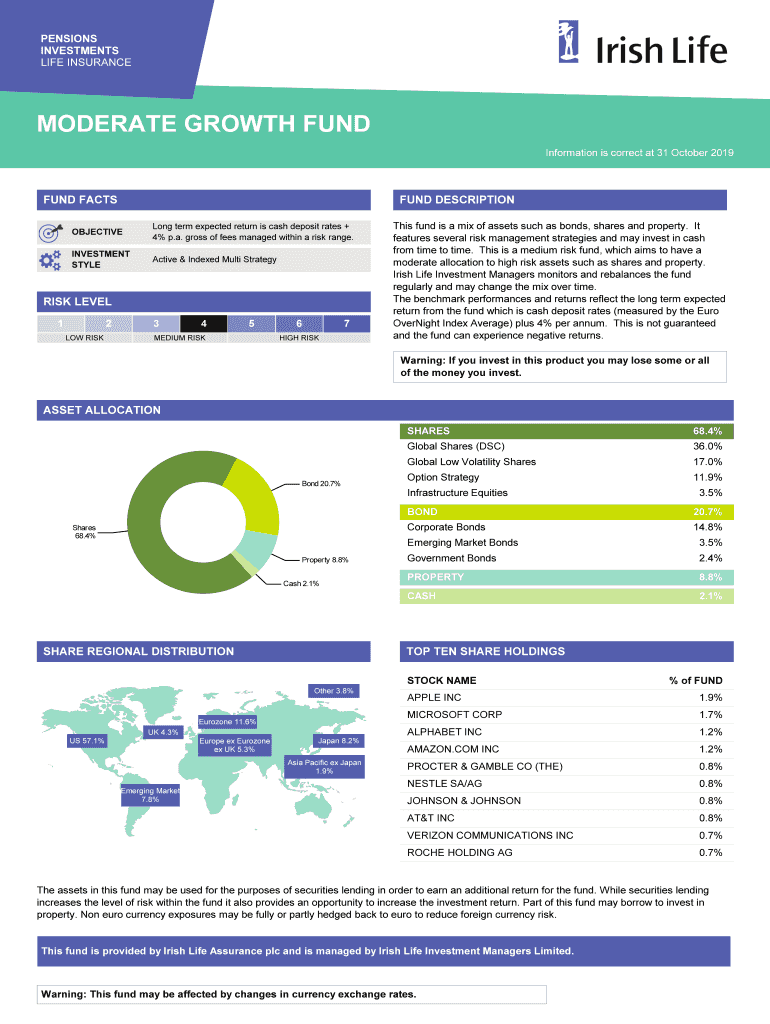

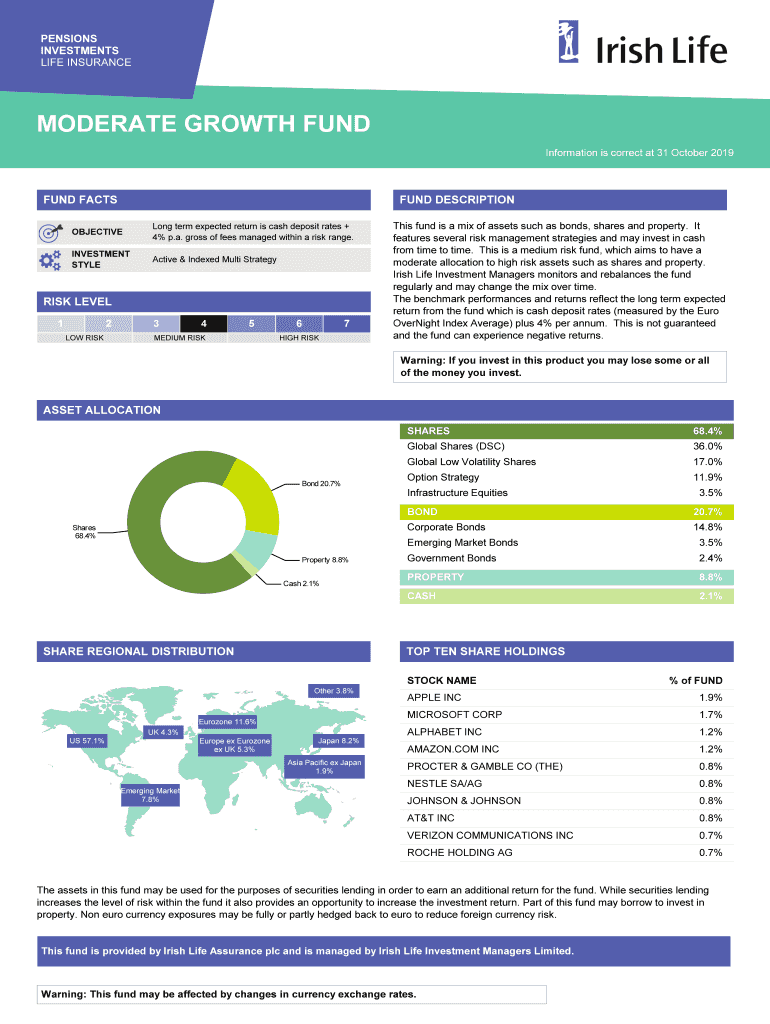

PENSIONS INVESTMENTS LIFE INSURANCEMODERATE GROWTH FUND Information is correct at 31 October 2019FUND DACHSHUND DESCRIPTIONOBJECTIVELong term expected return is cash deposit rates + 4× p.a. gross

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign moderate growth fund

Edit your moderate growth fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your moderate growth fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit moderate growth fund online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit moderate growth fund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out moderate growth fund

How to fill out moderate growth fund

01

Start by researching and understanding the moderate growth fund you are interested in. Look for information about the fund's investment goals, past performance, fees, and any specific requirements or restrictions.

02

Gather all the necessary documents and information you will need to fill out the application form. This may include your personal identification, contact details, financial information, and investment preferences.

03

Read through the application form carefully and ensure that you understand all the questions and requirements. If you have any doubts or need clarification, reach out to the fund provider or consult a financial advisor.

04

Provide accurate and complete information in the application form. Double-check all the details before submitting to avoid any errors that could delay the processing of your application.

05

Review any additional documents or paperwork that may be required, such as proof of income or identification. Make sure you have everything ready and attach the necessary documents to the application form.

06

Consider seeking professional advice or guidance if you are unsure about the suitability of the moderate growth fund for your financial goals and risk tolerance. A financial advisor can help assess your needs and guide you in making an informed decision.

07

Submit the completed application form and supporting documents to the fund provider. Follow any specific instructions provided regarding submission method and deadlines.

08

Wait for the fund provider to process your application. This may take some time depending on their internal procedures and workload. If you have any concerns or need updates, don't hesitate to contact the fund provider.

09

Once your application is approved, you may be required to make an initial investment or set up a payment plan. Follow the instructions provided by the fund provider to complete this process.

10

Monitor your investment and review your portfolio periodically. Consider consulting with a financial professional to ensure that the moderate growth fund continues to align with your financial goals and risk tolerance.

Who needs moderate growth fund?

01

Moderate growth funds are suitable for individuals who are willing to take on a moderate level of risk in exchange for potential long-term capital growth.

02

Investors who have a medium-term investment horizon (around 5-10 years) and can tolerate moderate fluctuations in the value of their investments may find moderate growth funds suitable.

03

Those who are looking for a balanced approach between growth and income may also find moderate growth funds appealing.

04

Individuals who have a moderate risk tolerance and prefer a diversified investment portfolio across different asset classes may benefit from investing in moderate growth funds.

05

It is important to note that investment decisions should be based on individual financial goals, risk tolerance, and personal circumstances. Consulting with a financial advisor can provide personalized guidance on whether a moderate growth fund is suitable for a specific investor.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit moderate growth fund from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your moderate growth fund into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit moderate growth fund online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your moderate growth fund to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the moderate growth fund electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is moderate growth fund?

Moderate growth fund is a type of investment fund that aims to achieve a balance between capital growth and income generation.

Who is required to file moderate growth fund?

Investors who have investments in moderate growth funds are required to report it on their tax returns.

How to fill out moderate growth fund?

To fill out a moderate growth fund, investors need to provide information about their investments, including the fund name, ticker symbol, and the total value of the investment.

What is the purpose of moderate growth fund?

The purpose of moderate growth fund is to provide investors with a diversified portfolio that offers moderate returns with lower risk compared to aggressive growth funds.

What information must be reported on moderate growth fund?

Investors must report the name of the fund, the total value of the investment, any dividends or capital gains received, and any fees associated with the fund.

Fill out your moderate growth fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Moderate Growth Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.