Get the free Life Insurance: Annuity Products in New YorkDepartment of ...

Show details

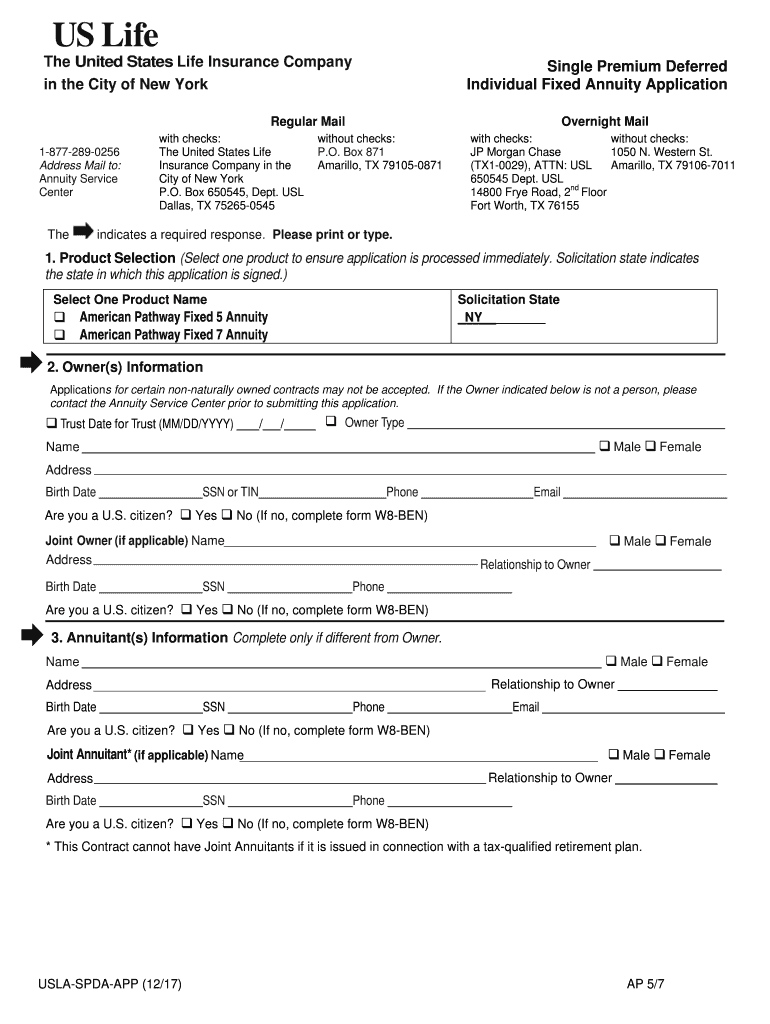

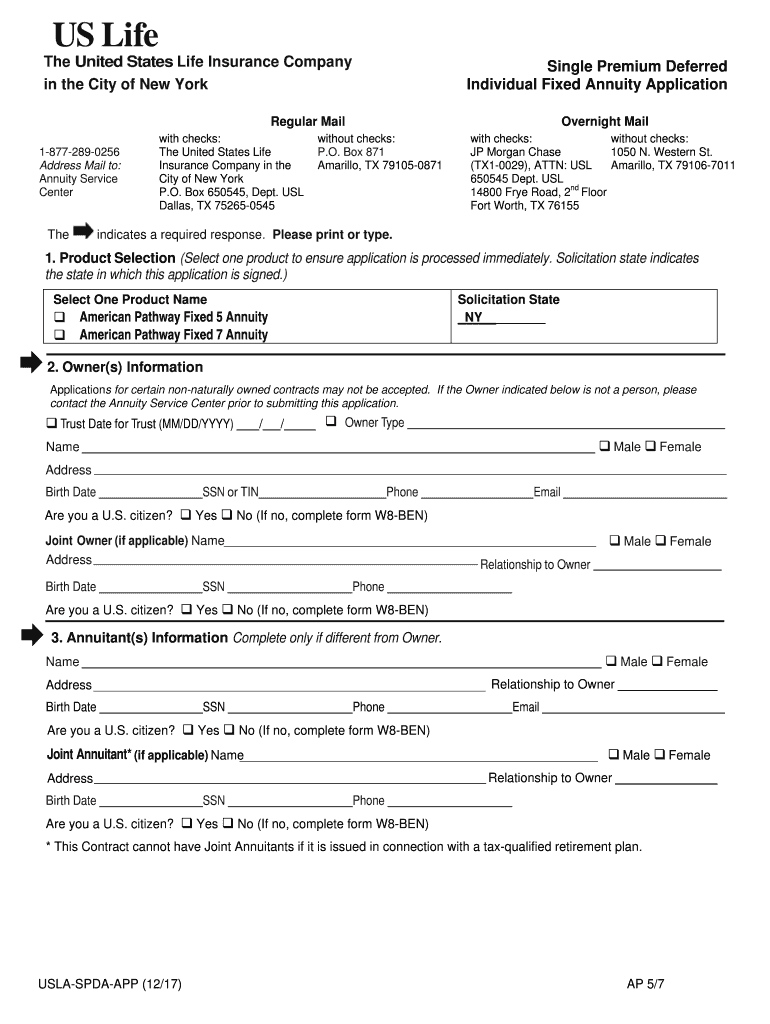

The United States Life Insurance CompanySingle Premium Deferred Individual Fixed Annuity Application in the City of New York Regular Mail 18772890256 Address Mail to: Annuity Service CenterThewith

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance annuity products

Edit your life insurance annuity products form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance annuity products form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance annuity products online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit life insurance annuity products. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance annuity products

How to fill out life insurance annuity products

01

Understand the different types of life insurance annuity products available in the market.

02

Determine your need for life insurance annuity products by assessing your financial goals, age, health condition, and risk tolerance.

03

Research and compare different insurance companies and their annuity products to find the one that suits your needs.

04

Gather all the necessary documents required to fill out the application form accurately.

05

Fill out the application form with your personal information, including name, address, date of birth, and social security number.

06

Provide details about your health condition, lifestyle habits, and any existing medical conditions or medication you are taking.

07

Specify the amount of coverage and the type of annuity product you want to purchase.

08

Review the policy terms, conditions, and premium payment details thoroughly before submitting the application.

09

Pay the required premium amount either in a lump sum or installments.

10

Submit the completed application form along with the necessary documents to the insurance company for processing.

11

Await the underwriting process, which involves the evaluation of your application, medical exams if necessary, and financial assessment.

12

Once approved, review the policy document carefully to ensure it matches your requirements.

13

Make regular premium payments as per the agreed schedule to keep the policy active.

14

Seek professional advice if you have any doubts or questions throughout the process.

Who needs life insurance annuity products?

01

Individuals who have financial dependents and want to provide them with a financial safety net in case of their death.

02

People who want to ensure their loved ones receive a sum of money as a death benefit to cover expenses like funeral costs, outstanding debts, or mortgage payments.

03

Individuals who want to accumulate a tax-deferred savings account for retirement by investing in life insurance annuity products.

04

People with substantial assets who want to protect their wealth and preserve it for future generations by using life insurance annuity products.

05

Individuals who want a guaranteed income stream during retirement to supplement their other sources of income.

06

Someone who wants to use the cash value of their life insurance annuity product as collateral for loans or other financial needs.

07

People who want to take advantage of the death benefit, living benefits, and tax advantages offered by life insurance annuity products.

08

Individuals who have specific financial goals that can be achieved through the use of life insurance annuity products, such as estate planning or charitable giving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my life insurance annuity products directly from Gmail?

life insurance annuity products and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute life insurance annuity products online?

pdfFiller makes it easy to finish and sign life insurance annuity products online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit life insurance annuity products straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing life insurance annuity products.

What is life insurance annuity products?

Life insurance annuity products are financial products that provide a guaranteed stream of income in retirement or upon the death of the policyholder.

Who is required to file life insurance annuity products?

Insurance companies are required to file life insurance annuity products with the appropriate regulatory authorities.

How to fill out life insurance annuity products?

Life insurance annuity products can be filled out by submitting the necessary forms and documents to the insurance company or regulatory authority.

What is the purpose of life insurance annuity products?

The purpose of life insurance annuity products is to provide financial security and stability to policyholders and their beneficiaries.

What information must be reported on life insurance annuity products?

Information such as policy details, premiums, beneficiaries, and payout options must be reported on life insurance annuity products.

Fill out your life insurance annuity products online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Annuity Products is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.