Get the free Accounts Payable - New Mexico Highlands University

Show details

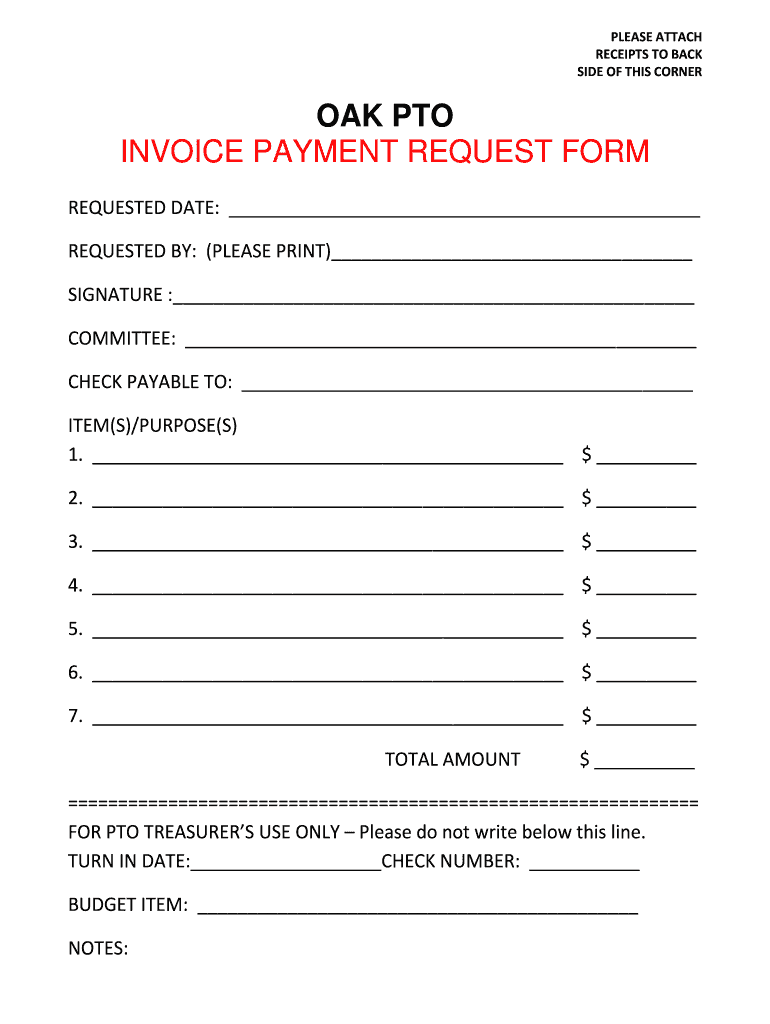

PLEASE ATTACH RECEIPTS TO BACK SIDE OF THIS CORNER PTO INVOICE PAYMENT REQUEST FORM REQUESTED DATE: REQUESTED BY: (PLEASE PRINT) SIGNATURE : COMMITTEE: CHECK PAYABLE TO: ITEM(S)/PURPOSE(S) 1. $2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable - new

Edit your accounts payable - new form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable - new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts payable - new online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts payable - new. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable - new

How to fill out accounts payable - new

01

To fill out accounts payable, you need to follow these steps:

02

Collect all invoices received from vendors or suppliers.

03

Match the invoices with the corresponding purchase orders or receiving reports.

04

Determine the payment terms and due dates for each invoice.

05

Enter the vendor information, invoice details, and payment terms into the accounts payable system.

06

Verify the accuracy of the entered information and make any necessary corrections.

07

Calculate the total amount payable for each invoice, including any applicable taxes or discounts.

08

Prepare payment batches based on due dates or other criteria.

09

Obtain necessary approvals for the payment batches.

10

Process the payments by issuing checks, initiating electronic transfers, or using any other designated payment method.

11

Record the payment information in the accounts payable system, updating the invoice status to 'paid'.

12

Reconcile the accounts payable ledger with the financial statements to ensure accuracy.

13

Keep proper documentation of all invoices, payments, and related records for future reference and audit purposes.

Who needs accounts payable - new?

01

Accounts payable is needed by any organization or business that engages in purchasing goods or services on credit from vendors or suppliers.

02

This includes but is not limited to:

03

- Small businesses

04

- Large corporations

05

- Non-profit organizations

06

- Government agencies

07

Accounts payable is essential for maintaining accurate financial records, tracking expenses, and managing cash flow.

08

It plays a crucial role in ensuring timely payment to suppliers, maintaining good vendor relationships, and avoiding late payment penalties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete accounts payable - new online?

pdfFiller has made filling out and eSigning accounts payable - new easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out accounts payable - new using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign accounts payable - new and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit accounts payable - new on an iOS device?

Use the pdfFiller mobile app to create, edit, and share accounts payable - new from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is accounts payable - new?

Accounts payable - new refers to the money a company owes to its suppliers for goods or services purchased on credit.

Who is required to file accounts payable - new?

All businesses that have outstanding invoices from suppliers are required to file accounts payable - new.

How to fill out accounts payable - new?

To fill out accounts payable - new, one must list all outstanding invoices, the amount owed, and the supplier information.

What is the purpose of accounts payable - new?

The purpose of accounts payable - new is to track and manage the money owed to suppliers and ensure timely payment.

What information must be reported on accounts payable - new?

On accounts payable - new, one must report the invoice number, amount owed, due date, and supplier details.

Fill out your accounts payable - new online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable - New is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.