Get the free Gift Aid FAQs - What Is Gift Aid - St John Ambulance

Show details

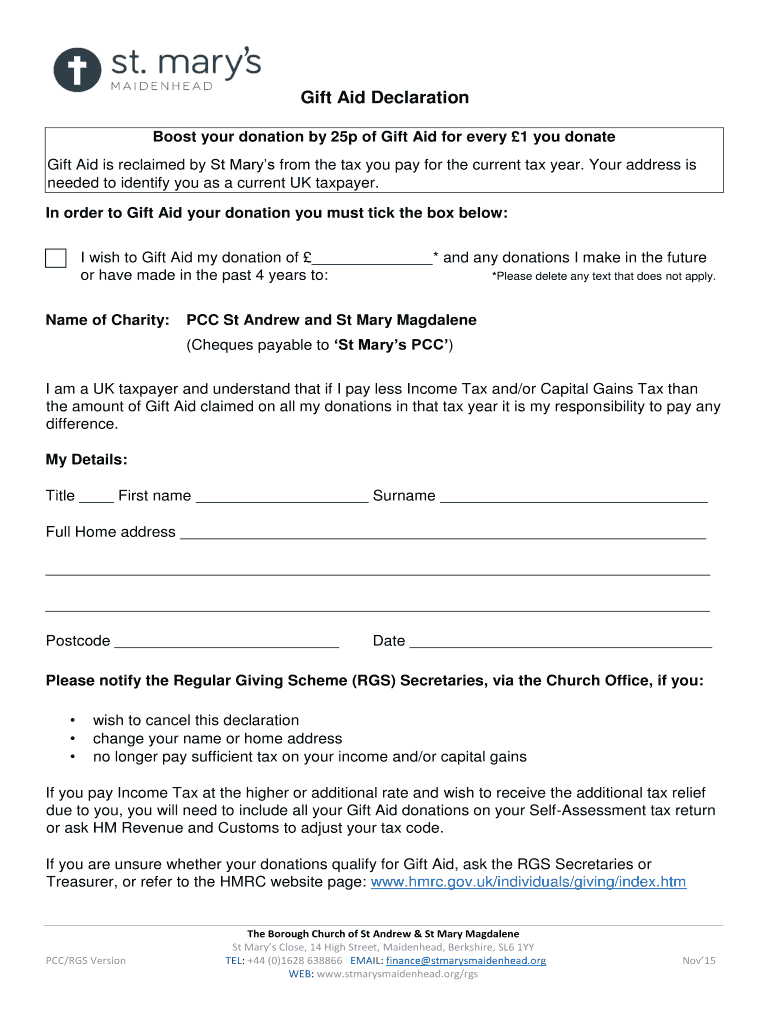

Gift Aid Declaration Boost your donation by 25p of Gift Aid for every 1 you donate Gift Aid is reclaimed by St Mary's from the tax you pay for the current tax year. Your address is needed to identify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift aid faqs

Edit your gift aid faqs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid faqs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift aid faqs online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift aid faqs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift aid faqs

How to fill out gift aid faqs

01

Begin by gathering all necessary information and documents related to the gift aid faqs.

02

Familiarize yourself with the requirements and guidelines set by the relevant authorities or organizations.

03

Create a clear and concise set of questions and answers that cover common doubts and concerns about gift aid.

04

Use appropriate language and terminology that is easily understandable by the intended audience.

05

Format the faqs in a visually appealing and organized manner, making them easy to read and navigate.

06

Provide examples or case studies to illustrate the application of gift aid in different scenarios.

07

Ensure that the faqs address frequently asked questions and potential challenges faced by users.

08

Include contact information or references to additional resources for further assistance.

09

Regularly review and update the faqs to incorporate any changes in policies or regulations.

10

Publish the completed gift aid faqs on the appropriate platform or channel for easy access and distribution.

Who needs gift aid faqs?

01

Organizations or individuals who are involved in or interested in utilizing gift aid for charitable donations.

02

Administrators or managers responsible for implementing and overseeing gift aid programs.

03

Donors or potential donors seeking clarification and information about the benefits and processes of gift aid.

04

Tax professionals or advisors who assist individuals or businesses in optimizing their tax relief through gift aid.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my gift aid faqs in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your gift aid faqs and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete gift aid faqs online?

pdfFiller makes it easy to finish and sign gift aid faqs online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for the gift aid faqs in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is gift aid faqs?

Gift Aid FAQs provides information about the Gift Aid scheme in the UK.

Who is required to file gift aid faqs?

Charities and other eligible organizations are required to file Gift Aid FAQs.

How to fill out gift aid faqs?

Gift Aid FAQs can be filled out online or by contacting HM Revenue & Customs.

What is the purpose of gift aid faqs?

The purpose of Gift Aid FAQs is to ensure that charities can claim back tax on donations made by UK taxpayers.

What information must be reported on gift aid faqs?

Information such as donor details, donation amounts, and declarations must be reported on Gift Aid FAQs.

Fill out your gift aid faqs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Aid Faqs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.