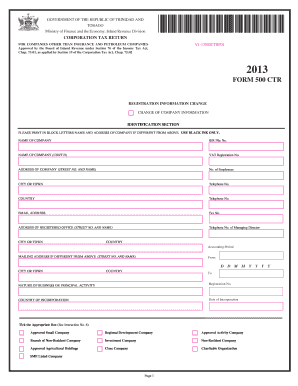

TT 500 CTR Form 2018-2026 free printable template

Show details

T TTT TT...’t. T1 t 10000****************2222rNNssrsrss22222222ssNN22ssDNNsNsNssssSsssNNsNNsNssssNDsrNNNsNNNsNN2YssNNsNsssNNNsNNNNNSNssssssssssssssssssssssssssssssssssss1)(((t((()e(e. ’t)e. ()e.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fillable ctr form

Edit your TT 500 CTR Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TT 500 CTR Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TT 500 CTR Form online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TT 500 CTR Form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TT 500 CTR Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TT 500 CTR Form

How to fill out TT 500 CTR Form

01

Obtain the TT 500 CTR Form from the relevant regulatory authority's website or office.

02

Fill in the personal details such as name, address, and contact information.

03

Provide the required financial information, including the nature of the transaction and the amounts involved.

04

Include any additional documentation or supporting records as specified in the instructions.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the appropriate agency by the specified deadline.

Who needs TT 500 CTR Form?

01

Individuals or businesses conducting certain financial transactions that require reporting.

02

Financial institutions that are obligated to report specific transactions to the authorities.

03

Taxpayers who need to disclose large cash transactions as part of their tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for filing C corporation taxes late?

For C Corps, the IRS late filing penalty is equal to five percent of the unpaid tax amount for each month or portion of a month the taxes remain unpaid, up to a maximum of 25% of the unpaid tax.

Can I get my tax forms from the IRS online?

More In Our Agency There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page.

How do I request a tax form from the IRS?

If you know what form or publication you need, call the IRS toll-free forms number at 1-800-TAX-FORM (1-800-829-3676). If you're not sure what to order, get Publication 910, "Guide to Free Tax Services," which lists publications and related forms, with descriptions and a subject matter index.

How do I file a corporate tax return with no activity?

The corporation will submit what is commonly called a "zero return." To file a corporate tax return with no activity, you'll need to use the regular corporation income tax return known as IRS Form 1120. Form 1120 instructions are the same for profitable companies and companies that are not transacting business.

What do I need to include when mailing my federal tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

Do you staple or paperclip IRS forms?

Enclose your payment loosely with your return; don't staple or otherwise attach your payment or Form 1040-V to your return. Don't mail cash with your return.

Should paper tax returns be stapled?

Is it OK to staple your tax return? The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

Should I staple or paperclip my tax return?

Is it OK to staple your tax return? The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TT 500 CTR Form in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your TT 500 CTR Form and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send TT 500 CTR Form for eSignature?

Once your TT 500 CTR Form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my TT 500 CTR Form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your TT 500 CTR Form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is TT 500 CTR Form?

The TT 500 CTR Form is a document used to report certain transactions involving currency to the relevant authorities to prevent money laundering and other financial crimes.

Who is required to file TT 500 CTR Form?

Individuals or entities that conduct transactions involving cash amounts exceeding a specified threshold are required to file the TT 500 CTR Form.

How to fill out TT 500 CTR Form?

To fill out the TT 500 CTR Form, one must provide details of the transaction, including the parties involved, the amount of cash, the date, and any other required information as specified by the filing guidelines.

What is the purpose of TT 500 CTR Form?

The purpose of the TT 500 CTR Form is to track large cash transactions and report them to authorities, thereby helping prevent illegal financial activities.

What information must be reported on TT 500 CTR Form?

The TT 500 CTR Form must report information such as the date of the transaction, the total cash amount, the identities of the individuals or entities involved, and the nature of the transaction.

Fill out your TT 500 CTR Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TT 500 CTR Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.