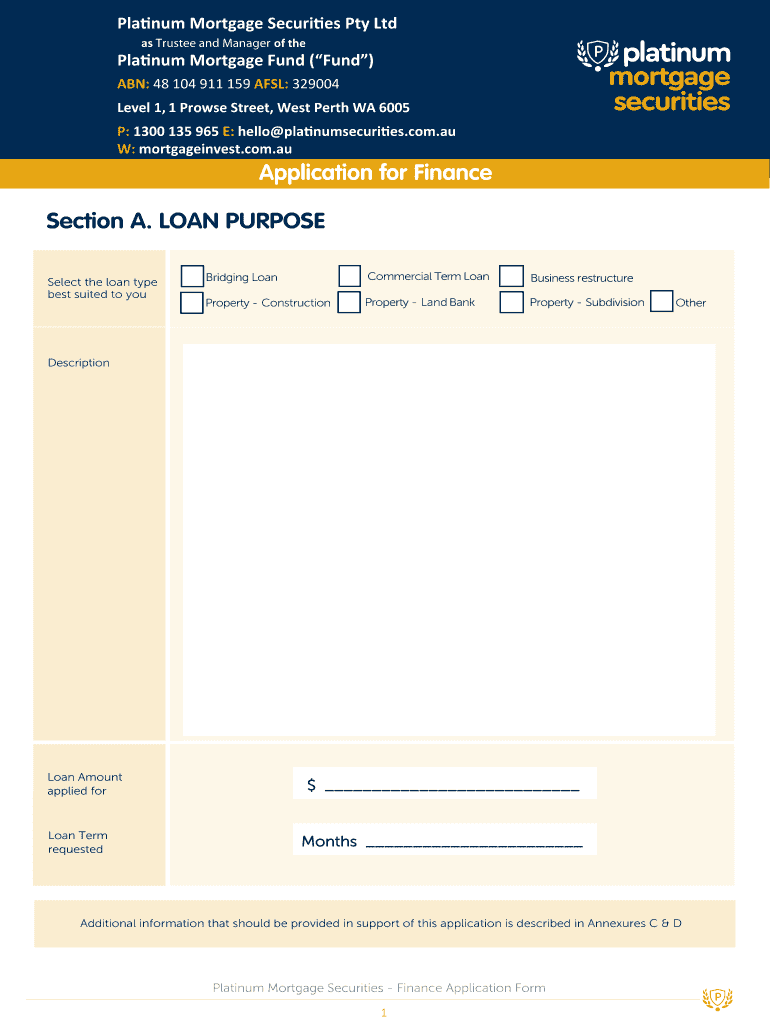

Get the free m Mortgage Secur es Pty Ltd

Show details

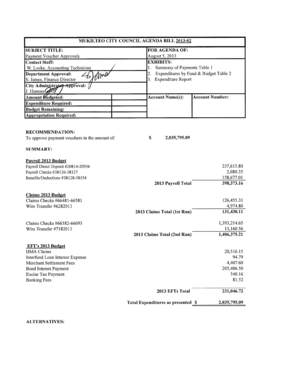

P Pm Mortgage Secures Pty Ltd as Trustee and Manager of them Mortgage Fund (Fund)ABN: 48 104 911 159 ADSL: 329004 Level 1, 1 Prose Street, West Perth WA 6005 P: 1300 135 965 E: hello W: mortgageinvest.com.auteur

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign m mortgage secur es

Edit your m mortgage secur es form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m mortgage secur es form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit m mortgage secur es online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit m mortgage secur es. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out m mortgage secur es

How to fill out m mortgage secur es

01

Step 1: Gather all necessary documents such as income proof, employment history, and credit reports.

02

Step 2: Research different mortgage security options available in the market.

03

Step 3: Choose a mortgage security that aligns with your financial goals and risk tolerance.

04

Step 4: Fill out the application form accurately and provide all requested information.

05

Step 5: Submit the completed application along with the required documents to the mortgage lender or financial institution.

06

Step 6: Wait for the lender to review your application and conduct necessary evaluations.

07

Step 7: If approved, carefully review the terms and conditions of the mortgage security before signing the contract.

08

Step 8: Fulfill any additional requirements or conditions set by the lender.

09

Step 9: Make any necessary payments or provide collateral as per the agreement.

10

Step 10: Once everything is complete, you have successfully filled out a mortgage security.

Who needs m mortgage secur es?

01

Individuals or businesses who are looking to borrow funds for purchasing real estate properties.

02

Investors who are interested in earning fixed income from mortgage-backed securities.

03

Financial institutions and banks who want to diversify their investment portfolio by incorporating mortgage securities.

04

Insurance companies or pension funds who are looking for long-term investments with stable returns.

05

Governments and municipalities who need to finance the development of housing projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the m mortgage secur es electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit m mortgage secur es on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing m mortgage secur es right away.

How do I complete m mortgage secur es on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your m mortgage secur es. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is m mortgage secur es?

Mortgage securities are financial products that are backed by a pool of mortgages.

Who is required to file m mortgage secur es?

Financial institutions and mortgage originators are required to file mortgage securities.

How to fill out m mortgage secur es?

To fill out mortgage securities, one must gather all necessary information about the underlying mortgages and follow the filing instructions provided by the regulatory authorities.

What is the purpose of m mortgage secur es?

The purpose of mortgage securities is to provide a way for investors to invest in a diversified pool of mortgages and receive a return based on the performance of those mortgages.

What information must be reported on m mortgage secur es?

Information such as the characteristics of the underlying mortgages, payment schedules, and default rates must be reported on mortgage securities.

Fill out your m mortgage secur es online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

M Mortgage Secur Es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.