Get the free Pont or

Show details

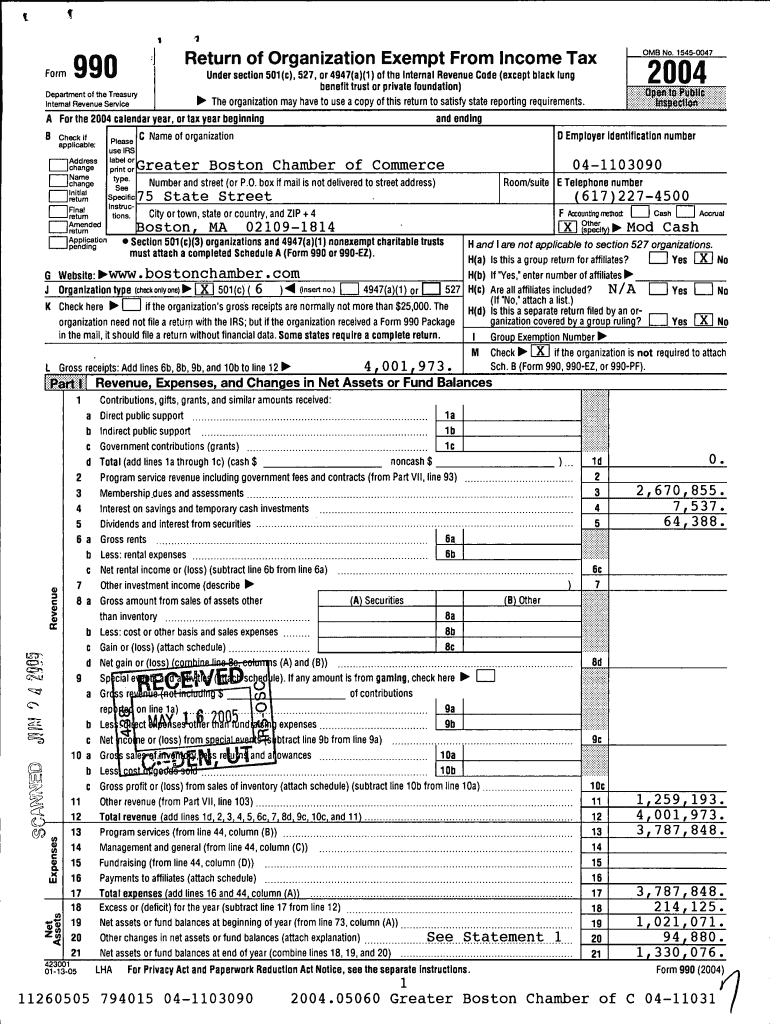

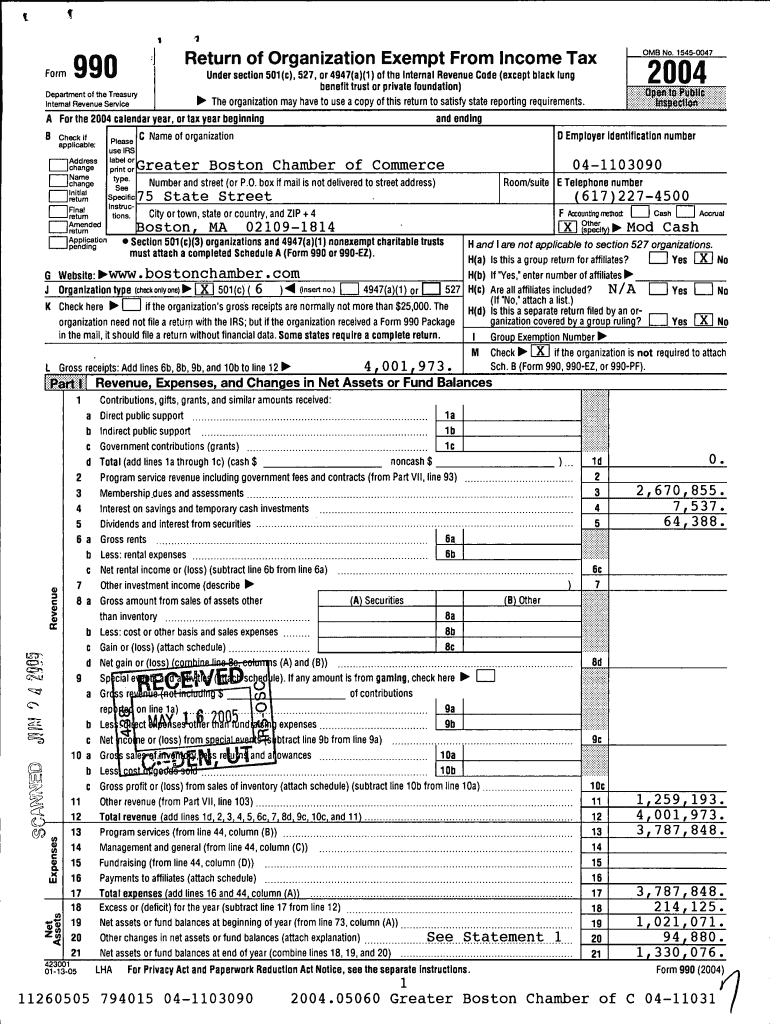

CForms990Return of Organization Exempt From Income Department of the Treasury

Internal Revenue Service For the 2004 calendar year, or tax year beginning

B Check if and end Employer identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pont or

Edit your pont or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pont or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pont or online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pont or. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pont or

How to fill out pont or

01

To fill out a pont, follow these steps:

02

Start by gathering all the necessary information that needs to be included in the pont.

03

Begin by writing down the title of the pont, which should clearly indicate the purpose or subject of the document.

04

Next, include the date and location of the pont, as it helps in providing context to the recipient.

05

In the main body of the pont, provide a concise and detailed description of the matter at hand. Use bullet points or numbered lists to organize the information if needed.

06

If applicable, include any supporting documents or references that might be helpful for the recipient to understand the content of the pont.

07

In the closing section, summarize the key points of the pont and provide any necessary contact information or instructions for further actions.

08

Before finalizing the pont, proofread it for any spelling or grammatical errors, and ensure the formatting is consistent and easy to read.

09

Once satisfied with the content, sign the pont if required, and send it to the intended recipient through the desired communication channel.

10

Remember to keep the pont concise, clear, and informative to increase its effectiveness.

Who needs pont or?

01

Pontoors are typically required by individuals, organizations, or businesses that need to communicate important information or updates in a formal manner.

02

Here are some common scenarios where ponts are needed:

03

- Business professionals may use ponts to communicate project updates, proposals, or memos to their colleagues, clients, or superiors.

04

- Educational institutions may use ponts to provide information to students, parents, or staff on various matters such as events, policy changes, or academic updates.

05

- Government agencies may utilize ponts to disseminate official announcements, regulations, or notifications to the general public or specific groups.

06

- Non-profit organizations may use ponts to inform their members, volunteers, or donors about ongoing projects, fundraisers, or important news.

07

- Individuals may use ponts to send formal invitations, express gratitude, share information, or address concerns to others in a professional manner.

08

In summary, ponts are a versatile communication tool that can be used by anyone who needs to convey information effectively and professionally.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the pont or in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pont or and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out pont or on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your pont or, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Can I edit pont or on an Android device?

The pdfFiller app for Android allows you to edit PDF files like pont or. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is pont or?

Pont or stands for Personal Property Tax Return.

Who is required to file pont or?

Individuals who own personal property that is subject to taxation are required to file pont or.

How to fill out pont or?

You can fill out pont or by providing information about your personal property and its value on the designated form.

What is the purpose of pont or?

The purpose of pont or is to assess and collect taxes on personal property owned by individuals.

What information must be reported on pont or?

You must report information such as the description of the personal property, its value, and any exemptions that may apply.

Fill out your pont or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pont Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.