Get the free Audit Law FAQ - Louisiana Legislative Auditor

Show details

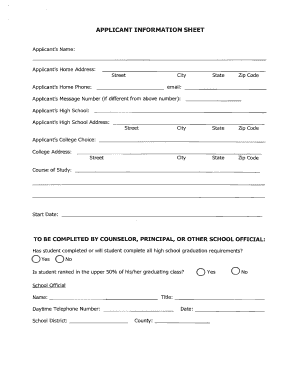

Parish Constable FW (City) Louisiana Financial Statements 7 an IRL As of and for the Year December 31, Required by Louisiana Revised Statutes 24:513 and 24:514 to be filed with the Legislative Auditor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit law faq

Edit your audit law faq form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit law faq form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit law faq online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit audit law faq. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit law faq

How to fill out audit law faq

01

Begin by reading the audit law faq document attentively to understand its purpose and requirements.

02

Familiarize yourself with the specific auditing laws and regulations relevant to your jurisdiction.

03

Analyze the frequently asked questions (FAQs) to identify the most common concerns and doubts regarding the audit law.

04

Create a clear and concise answer for each question, ensuring that it accurately addresses the query.

05

Use plain language and avoid technical jargon to make the information accessible to a wider audience.

06

Organize the answers in a logical and orderly manner, grouping related questions together.

07

Review and revise your answers to ensure they are accurate, up-to-date, and in compliance with the audit law.

08

Format the audit law faq document professionally by using headings, subheadings, and bullet points for clarity.

09

Proofread the document for any grammatical or spelling errors before finalizing it.

10

Consider seeking input from legal and auditing professionals to ensure the accuracy and comprehensiveness of the faq document.

Who needs audit law faq?

01

Individuals who are responsible for conducting audits in their organization or profession.

02

Auditors in both public and private sectors who require clarifications on audit law regulations.

03

Compliance officers and legal professionals who need to stay updated on audit law requirements.

04

Students studying auditing or pursuing a career in the field who want to enhance their understanding.

05

Organizations or businesses that undergo regular audits and need guidance on complying with audit laws.

06

Regulators and government agencies overseeing audit practices and ensuring compliance with the law.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute audit law faq online?

With pdfFiller, you may easily complete and sign audit law faq online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit audit law faq on an iOS device?

Use the pdfFiller mobile app to create, edit, and share audit law faq from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit audit law faq on an Android device?

With the pdfFiller Android app, you can edit, sign, and share audit law faq on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is audit law faq?

Audit law faq is a set of frequently asked questions related to audit laws and regulations.

Who is required to file audit law faq?

Entities or individuals subject to audit requirements are required to file audit law faq.

How to fill out audit law faq?

Audit law faq can be filled out by providing accurate and complete information as per the specified guidelines.

What is the purpose of audit law faq?

The purpose of audit law faq is to ensure compliance with audit laws and regulations and to provide clarity on frequently asked questions.

What information must be reported on audit law faq?

Audit law faq typically requires reporting of financial information, compliance with regulations, and other relevant data.

Fill out your audit law faq online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Law Faq is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.