Get the free Explanation if returns NOT filed for 4 years preceding date of death

Show details

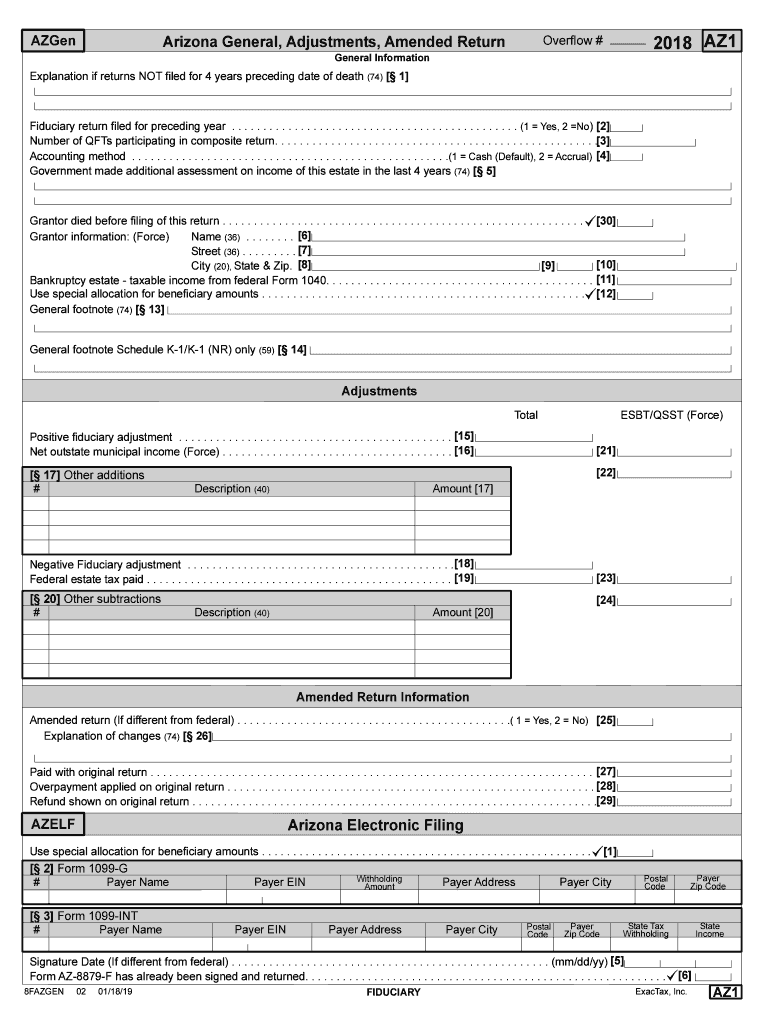

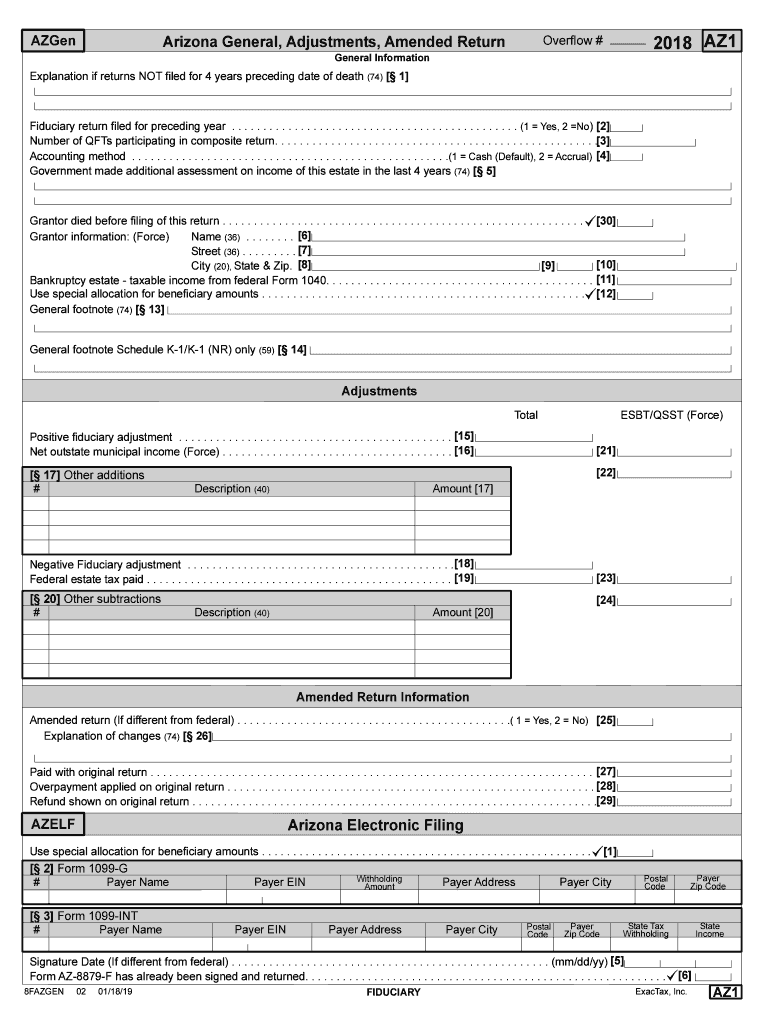

AZGen2018 AZ1Overflow #Arizona General, Adjustments, Amended Return General InformationExplanation if returns NOT filed for 4 years preceding date of death(74) 1 Fiduciary return filed for preceding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign explanation if returns not

Edit your explanation if returns not form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your explanation if returns not form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing explanation if returns not online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit explanation if returns not. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out explanation if returns not

How to fill out explanation if returns not

01

To fill out the explanation if the return is not provided, follow these steps:

02

Start by reviewing the requirements for providing an explanation. Check if the explanation is optional or mandatory.

03

If the explanation is mandatory, identify the reason for not providing the return. This could include missing documentation, technical difficulties, or other valid issues.

04

Next, compose a clear and concise explanation for why the return is not provided. Include any relevant details or supporting evidence to justify the absence of the return.

05

Make sure to format the explanation in a professional manner, using proper grammar and punctuation.

06

Double-check the explanation for any errors or inconsistencies before submitting it.

07

Finally, submit the explanation along with any required supporting documentation, if applicable.

08

It is important to note that these steps may vary depending on the specific requirements and guidelines provided by the relevant authority or organization.

Who needs explanation if returns not?

01

The person or entity who needs an explanation if the return is not provided depends on the context. Generally, it could include:

02

- The tax authorities: If the return relates to taxes and the explanation is required by the tax authorities.

03

- Financial institutions: If the return is necessary for financial reporting purposes, the institution may require an explanation for auditors or regulatory compliance.

04

- Clients or customers: In certain business contexts, clients or customers may request an explanation if the return is not provided as expected.

05

- Legal entities or partners: If the return is required as part of a legal agreement or partnership, the other party may need an explanation for non-compliance.

06

- Internal stakeholders: Within an organization, internal stakeholders such as managers or executives may require an explanation to understand the reasons for not providing the return.

07

It is crucial to determine the specific requirements and expectations of the relevant parties to ensure the appropriate explanation is provided.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find explanation if returns not?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the explanation if returns not. Open it immediately and start altering it with sophisticated capabilities.

How do I edit explanation if returns not in Chrome?

Install the pdfFiller Google Chrome Extension to edit explanation if returns not and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit explanation if returns not on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share explanation if returns not on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is explanation if returns not?

Explanation if returns not is a written statement provided to clarify why tax returns were not filed within the specified deadline.

Who is required to file explanation if returns not?

Individuals or businesses who failed to file their tax returns within the deadline are required to file an explanation if returns not.

How to fill out explanation if returns not?

To fill out explanation if returns not, individuals or businesses must provide detailed reasons for not filing their tax returns on time.

What is the purpose of explanation if returns not?

The purpose of explanation if returns not is to provide an opportunity for individuals or businesses to explain why they failed to file their tax returns on time.

What information must be reported on explanation if returns not?

Information such as reasons for not filing tax returns on time, any extenuating circumstances, and steps taken to address the issue must be reported on explanation if returns not.

Fill out your explanation if returns not online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Explanation If Returns Not is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.