Get the free EXECUTIVE SAVINGS PLAN

Show details

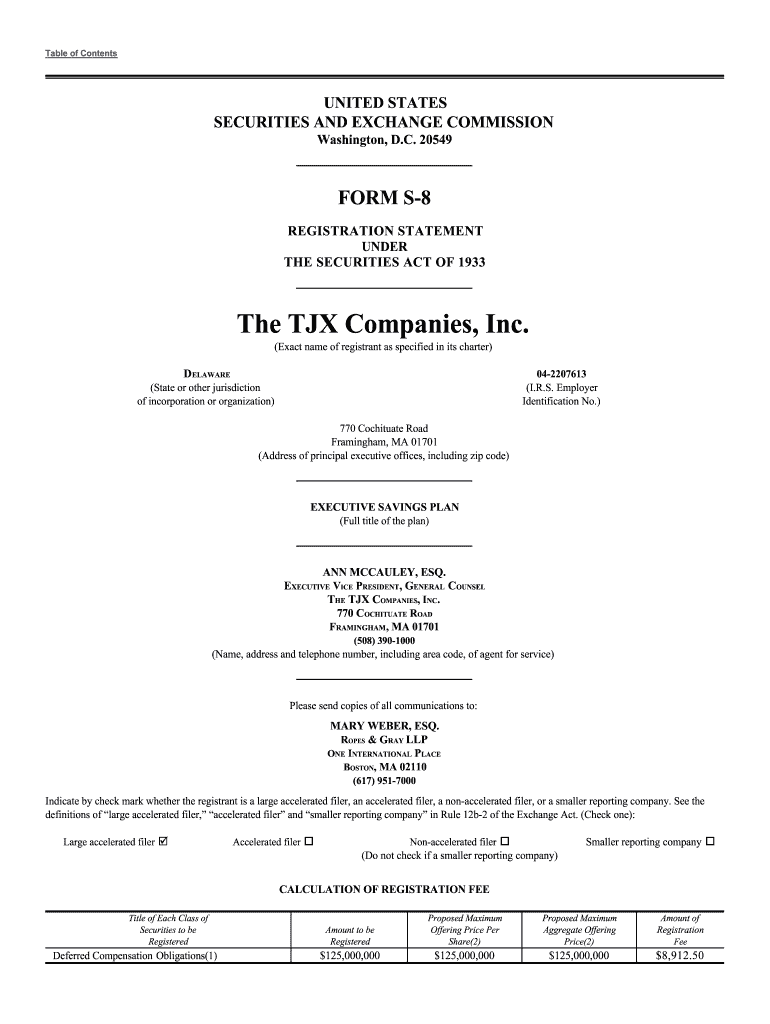

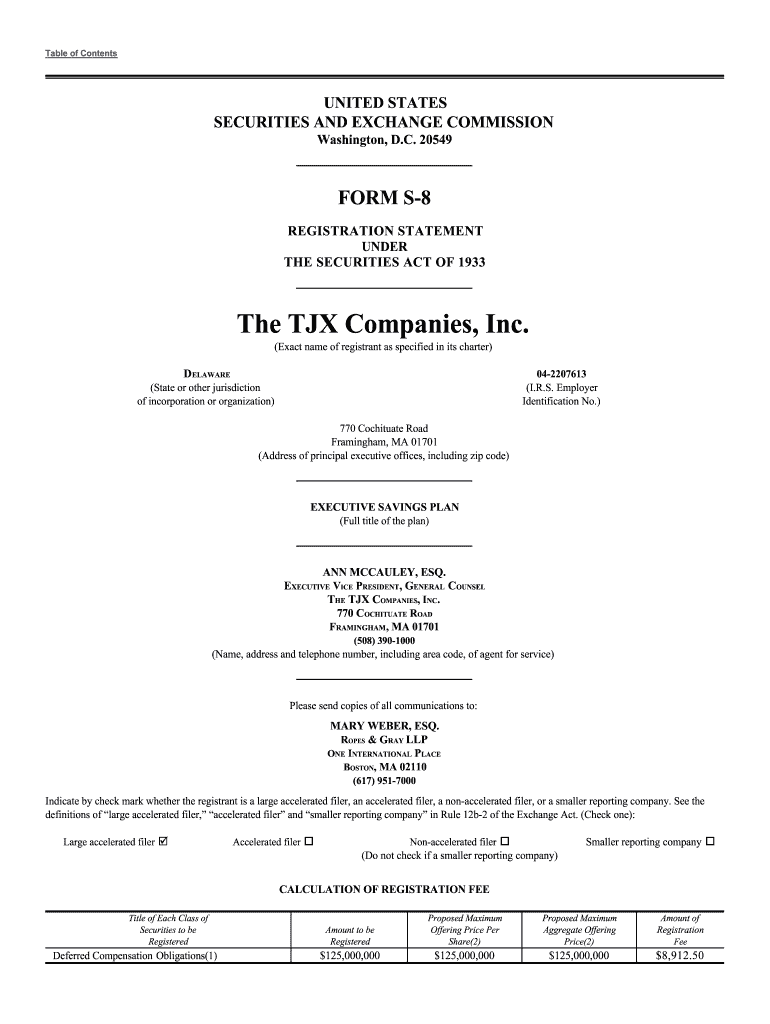

Table of ContentsUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549FORM S8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933The TAX Companies, Inc.

(Exact name of registrant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign executive savings plan

Edit your executive savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your executive savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing executive savings plan online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit executive savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out executive savings plan

How to fill out executive savings plan

01

To fill out an executive savings plan, follow these steps:

02

Start by obtaining the necessary forms from your employer or financial institution.

03

Read through the instructions and make sure you understand the terms and conditions of the plan.

04

Provide your personal information, including your full name, address, and social security number.

05

Specify the amount you want to contribute to the savings plan and choose your desired contribution frequency (e.g., monthly, quarterly).

06

Decide on the investment options for your savings, considering your risk tolerance and financial goals.

07

Review the beneficiary designation section and update it if needed.

08

Sign the form and submit it to your employer or financial institution as per their instructions.

09

Monitor and manage your executive savings plan regularly, making any necessary adjustments to your contributions or investment choices.

Who needs executive savings plan?

01

An executive savings plan is typically aimed at executives or high-income individuals who want to save and invest significant portions of their income.

02

It can be particularly beneficial for those who have a higher tax bracket and want to take advantage of tax-efficient savings options.

03

Executive savings plans may offer additional benefits such as employer matching contributions or specialized investment opportunities that cater to the needs of high-net-worth individuals.

04

However, it's important to consult with a financial advisor or tax professional to determine if an executive savings plan is suitable for your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my executive savings plan in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your executive savings plan along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit executive savings plan online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your executive savings plan to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the executive savings plan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign executive savings plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is executive savings plan?

An executive savings plan is a type of retirement plan designed for executives and high-level employees to save and invest for their future.

Who is required to file executive savings plan?

Executives and high-level employees who are eligible to participate in the plan are required to file executive savings plan.

How to fill out executive savings plan?

Executive savings plan can be filled out by providing relevant personal and financial information as required by the plan administrator.

What is the purpose of executive savings plan?

The purpose of executive savings plan is to provide a retirement savings vehicle specifically tailored for executives and high-level employees.

What information must be reported on executive savings plan?

The information reported on executive savings plan typically includes the participant's contributions, investment choices, earnings, and other relevant details.

Fill out your executive savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Executive Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.