Get the free Regulatory - Illinois CPA Society - icpas

Show details

1

ILLINOIS CPA SOCIETY

Governmental Report Review Program

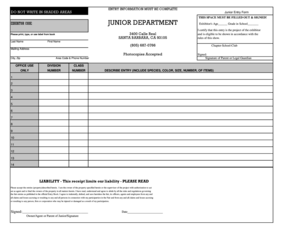

2013 Review Session Check List for

Springfield

Local Education Agencies Regulatory Basis Financial Statements

Your Name

Revised 11/4/13

Circle

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulatory - illinois cpa

Edit your regulatory - illinois cpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulatory - illinois cpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing regulatory - illinois cpa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regulatory - illinois cpa. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulatory - illinois cpa

How to Fill Out Regulatory - Illinois CPA:

01

Determine if you meet the eligibility requirements: Before filling out the regulatory application for the Illinois Certified Public Accountant (CPA) license, make sure you meet all the necessary eligibility criteria. This typically includes completing a bachelor's degree in accounting or a related field, completing the required number of semester hours in accounting and business courses, and meeting the professional experience requirements.

02

Gather the required documents: To fill out the regulatory application, you will need to gather certain documents. These may include your official transcripts from all the educational institutions you attended, proof of completing the required accounting and business courses, verification of your professional experience, and any other supporting documents required by the Illinois Board of Examiners.

03

Complete the application form: Obtain the regulatory application form from the Illinois Board of Examiners or their official website. Fill out the form accurately and provide all the requested information. This may include personal details, educational background, professional experience, and references.

04

Pay the application and examination fees: Along with the completed application form, you will need to submit the required application and examination fees. Make sure to check the current fee schedule provided by the Illinois Board of Examiners and pay the fees through the accepted payment methods specified.

05

Submit the application and supporting documents: Once you have completed the application form and gathered all the necessary documents, submit them to the Illinois Board of Examiners by the specified deadline. Ensure that all the required documents are included and the application is properly signed and dated.

Who needs Regulatory - Illinois CPA?

01

Individuals pursuing a career in accounting: Graduates or professionals aiming to advance their careers in accounting often need to obtain a CPA license to enhance their job prospects and demonstrate their knowledge and expertise in the field.

02

Accountants working in Illinois: Accountants already working in Illinois or planning to work in the state may need to obtain the Illinois CPA license to comply with the regulatory requirements set by the Illinois Board of Examiners. This license is essential to perform certain accounting services legally within the state.

03

Those seeking to provide public accounting services: Individuals wishing to provide public accounting services in Illinois, such as offering auditing, attestation, and tax services to the public, usually require the Illinois CPA license. This license ensures compliance with the applicable regulations and demonstrates professionalism and competence in the field.

04

Candidates pursuing a career in finance or business: Even individuals pursuing careers in finance, business, or related fields can benefit from obtaining the CPA license. It showcases their commitment to continuous learning, ethical standards, and enhances their credibility and marketability in the job market.

05

Professionals looking to expand their career opportunities: Having the Illinois CPA license can open up a wider range of career opportunities, including leadership roles in accounting firms, corporate finance positions, consulting positions, and more. It demonstrates a higher level of knowledge and qualifications, increasing the chances of securing prominent positions in the industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is regulatory - illinois cpa?

Regulatory - Illinois CPA refers to the regulatory requirements set forth by the Illinois Board of Examiners for CPA licensure.

Who is required to file regulatory - illinois cpa?

CPAs who are licensed in the state of Illinois are required to file regulatory - Illinois CPA.

How to fill out regulatory - illinois cpa?

To fill out regulatory - Illinois CPA, CPAs must follow the guidelines provided by the Illinois Board of Examiners and submit the required information accurately.

What is the purpose of regulatory - illinois cpa?

The purpose of regulatory - Illinois CPA is to ensure that licensed CPAs in Illinois comply with the state's regulatory requirements for maintaining their license.

What information must be reported on regulatory - illinois cpa?

The information to be reported on regulatory - Illinois CPA may include CPE credits, work experience, and any regulatory updates or changes.

How can I send regulatory - illinois cpa to be eSigned by others?

regulatory - illinois cpa is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in regulatory - illinois cpa?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your regulatory - illinois cpa to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit regulatory - illinois cpa on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign regulatory - illinois cpa. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your regulatory - illinois cpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulatory - Illinois Cpa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.