Get the free Dutch accounting and audit requirements - Welcome to Tax ...

Show details

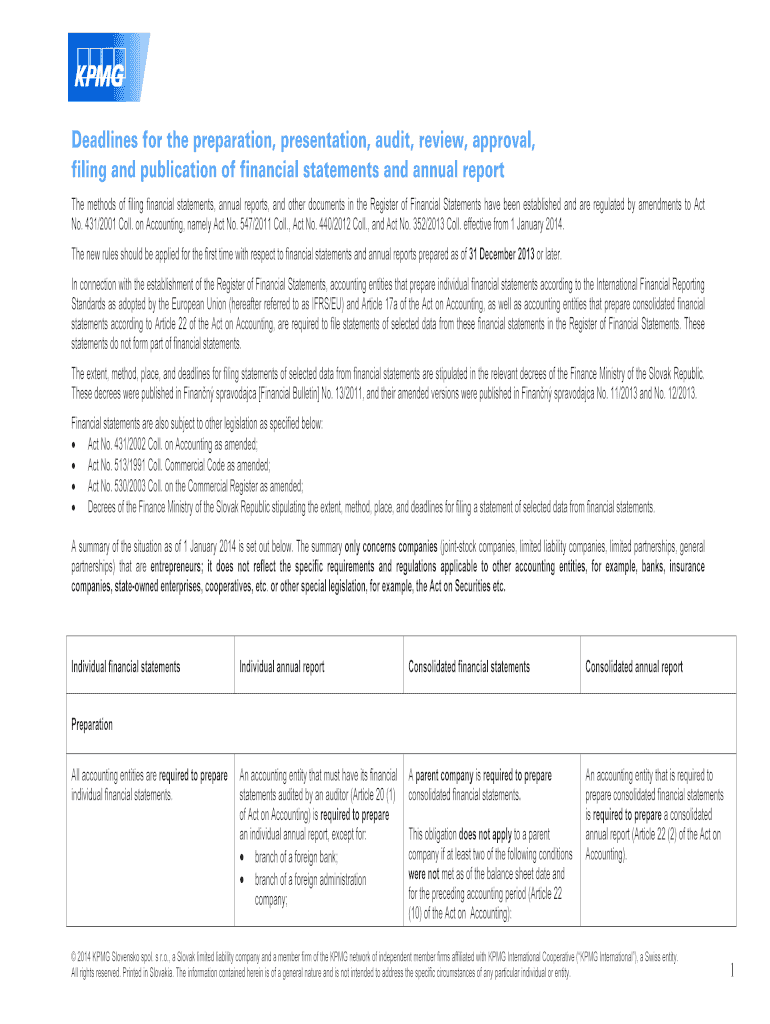

Deadlines for the preparation, presentation, audit, review, approval,

filing and publication of financial statements and annual report

The methods of filing financial statements, annual reports, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dutch accounting and audit

Edit your dutch accounting and audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dutch accounting and audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dutch accounting and audit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dutch accounting and audit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dutch accounting and audit

How to fill out dutch accounting and audit

01

To fill out Dutch accounting and audit, follow these steps:

02

- Use a reliable accounting software to record all financial transactions.

03

- Create a chart of accounts to categorize income, expenses, assets, and liabilities.

04

- Keep track of all invoices, receipts, and other financial documents.

05

- Reconcile bank statements with the accounting records regularly.

06

- Prepare financial statements like balance sheets, profit and loss statements, and cash flow statements.

07

- Comply with Dutch accounting standards and regulations.

08

- Perform an annual audit by a certified Dutch auditor to ensure accuracy and compliance.

Who needs dutch accounting and audit?

01

Dutch accounting and audit are necessary for:

02

- Companies registered in the Netherlands, regardless of their size or legal form.

03

- Self-employed individuals and freelancers operating in the Netherlands.

04

- Non-profit organizations and foundations based in the Netherlands.

05

- Any entity engaging in business activities and generating revenues in the Netherlands.

06

- Companies seeking external investments or loans.

07

- Entities involved in import/export activities or international trade.

08

- Businesses aiming to comply with Dutch tax laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dutch accounting and audit for eSignature?

To distribute your dutch accounting and audit, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute dutch accounting and audit online?

Filling out and eSigning dutch accounting and audit is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the dutch accounting and audit electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your dutch accounting and audit in seconds.

What is dutch accounting and audit?

Dutch accounting and audit refer to the financial reporting and verification process followed by companies in the Netherlands to ensure compliance with regulations and standards.

Who is required to file dutch accounting and audit?

All companies registered in the Netherlands are required to file dutch accounting and audit reports with the authorities.

How to fill out dutch accounting and audit?

Dutch accounting and audit reports can be filled out by hiring a qualified accountant or auditing firm to prepare and submit the required financial documents.

What is the purpose of dutch accounting and audit?

The purpose of dutch accounting and audit is to provide transparency and accountability in financial reporting, as well as ensure compliance with relevant regulations.

What information must be reported on dutch accounting and audit?

Dutch accounting and audit reports typically include income statements, balance sheets, cash flow statements, and notes to the financial statements.

Fill out your dutch accounting and audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dutch Accounting And Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.