Get the free Teaching opportunities for CPA Canada's in-depth tax program

Show details

Depth Tax Program

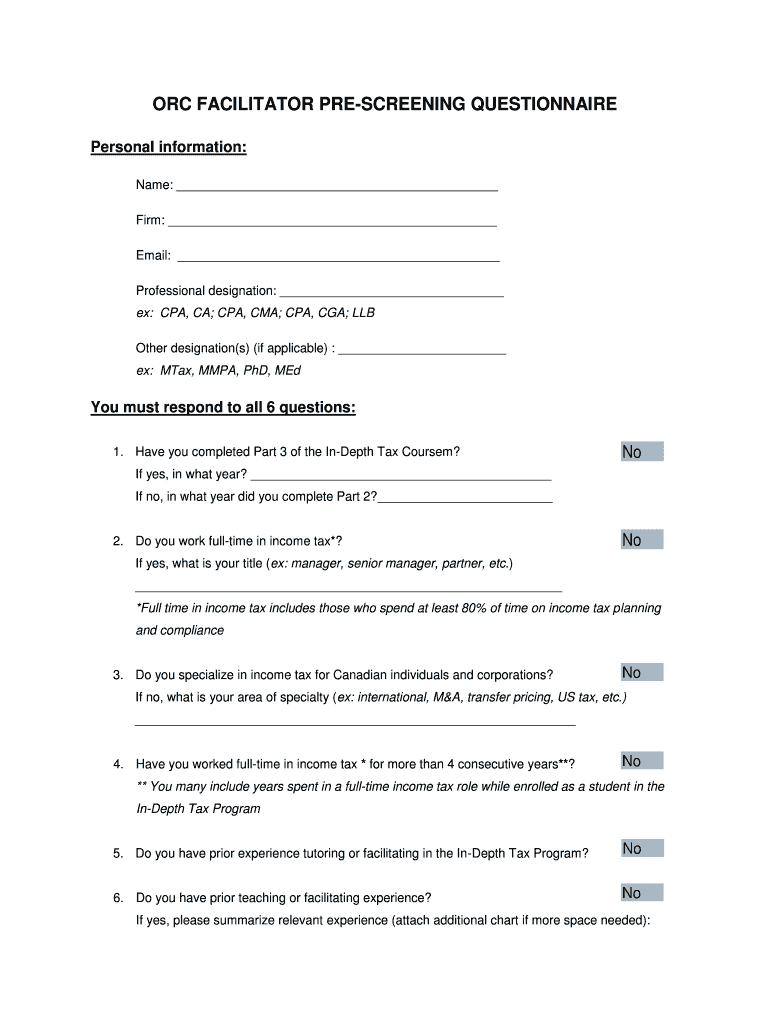

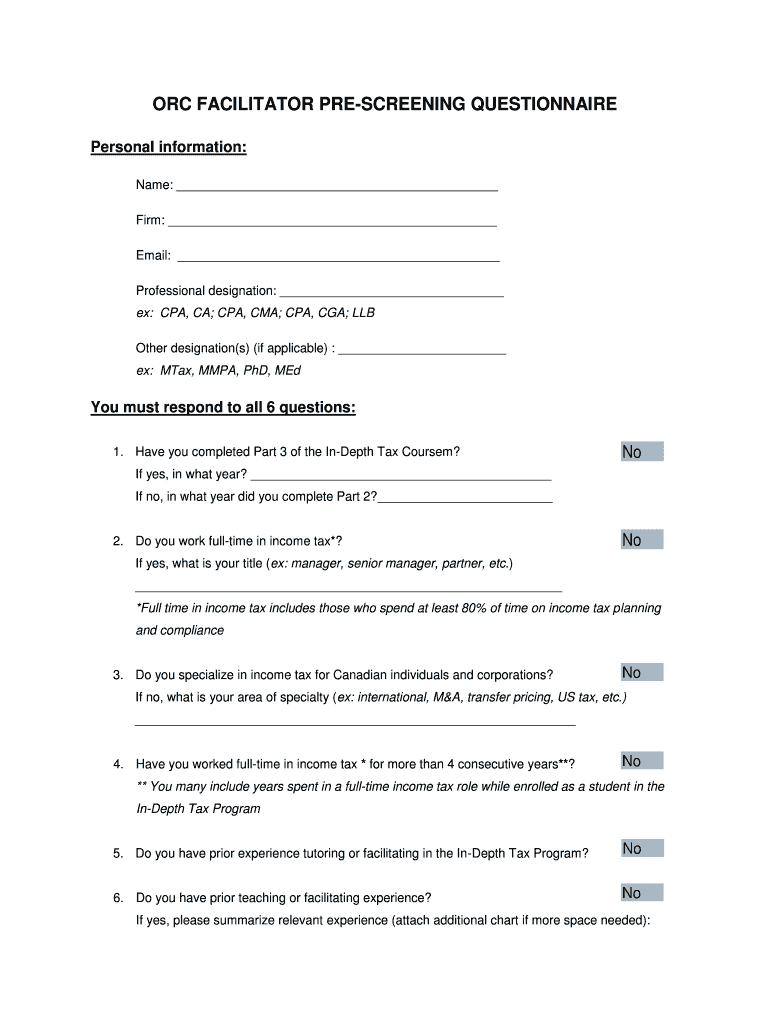

2019/20 Orientation, Research and Communications Course (ORC) Facilitators

The CPA Canada Depth Tax Program is the most comprehensive tax training available in Canada. It

is the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign teaching opportunities for cpa

Edit your teaching opportunities for cpa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your teaching opportunities for cpa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing teaching opportunities for cpa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit teaching opportunities for cpa. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out teaching opportunities for cpa

How to fill out teaching opportunities for cpa

01

To fill out teaching opportunities for CPA, follow these steps:

02

Research and understand the requirements and qualifications for teaching CPA.

03

Update your resume and highlight your relevant experience and knowledge in accounting and CPA.

04

Prepare a cover letter that explains your interest in teaching CPA and highlights your teaching experience and skills.

05

Connect with educational institutions or organizations that offer CPA courses or programs and inquire about teaching opportunities.

06

Submit your application, including your resume, cover letter, and any additional requested documents.

07

Prepare for interviews or demo classes if required.

08

Attend any training or orientation programs provided by the institution or organization before starting to teach.

09

Review the course materials and curriculum to familiarize yourself with the content and teaching objectives.

10

Plan and prepare lesson plans, presentations, and teaching materials in accordance with the course requirements.

11

Deliver engaging and interactive classes, incorporating real-life examples and practical exercises to enhance student learning.

12

Assess student progress and provide feedback on assignments, exams, and overall performance.

13

Continuously update your knowledge and skills in the field of CPA by attending professional development courses or workshops.

14

Maintain open communication with students, address their queries and concerns, and provide additional support when needed.

15

Collaborate with colleagues and participate in faculty meetings or workshops to share best practices and improve teaching effectiveness.

16

Evaluate the effectiveness of your teaching methods and make necessary adjustments for continuous improvement.

17

Stay updated with any changes or advancements in CPA regulations and standards to ensure the accuracy and relevance of the course content.

18

Build and maintain a professional network in the field of accounting and education, attending conferences or joining relevant associations.

19

Seek feedback from students and colleagues to identify areas of strength and areas for further development in your teaching approach.

Who needs teaching opportunities for cpa?

01

Teaching opportunities for CPA are needed by individuals who meet the following criteria:

02

- Certified Public Accountants (CPAs) who have a passion for teaching and sharing their knowledge and expertise.

03

- Accounting professionals who want to expand their career into the field of education and contribute to the development of future CPAs.

04

- Experienced educators with a background in accounting or finance who wish to specialize in teaching CPA courses.

05

- Professionals who hold relevant credentials and qualifications in accounting and want to explore teaching as a part-time or full-time career.

06

- Educational institutions or organizations offering CPA courses or programs that seek qualified instructors to provide quality education to their students.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my teaching opportunities for cpa in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your teaching opportunities for cpa as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete teaching opportunities for cpa online?

pdfFiller makes it easy to finish and sign teaching opportunities for cpa online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit teaching opportunities for cpa in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing teaching opportunities for cpa and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is teaching opportunities for cpa?

Teaching opportunities for CPA refer to the chance for certified public accountants to educate others in the field of accounting.

Who is required to file teaching opportunities for cpa?

CPAs who have taught accounting courses or workshops are required to file teaching opportunities for CPA.

How to fill out teaching opportunities for cpa?

To fill out teaching opportunities for CPA, CPAs must provide details of the courses or workshops they taught, along with the duration and type of audience.

What is the purpose of teaching opportunities for cpa?

The purpose of teaching opportunities for CPA is to track and ensure the quality of professional development activities for CPAs.

What information must be reported on teaching opportunities for cpa?

Information such as course/workshop name, duration, date, type of audience, and any certifications provided must be reported on teaching opportunities for CPA.

Fill out your teaching opportunities for cpa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Teaching Opportunities For Cpa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.