Get the free Small business HRAs and taxes: Reporting QSEHRA benefits ...

Show details

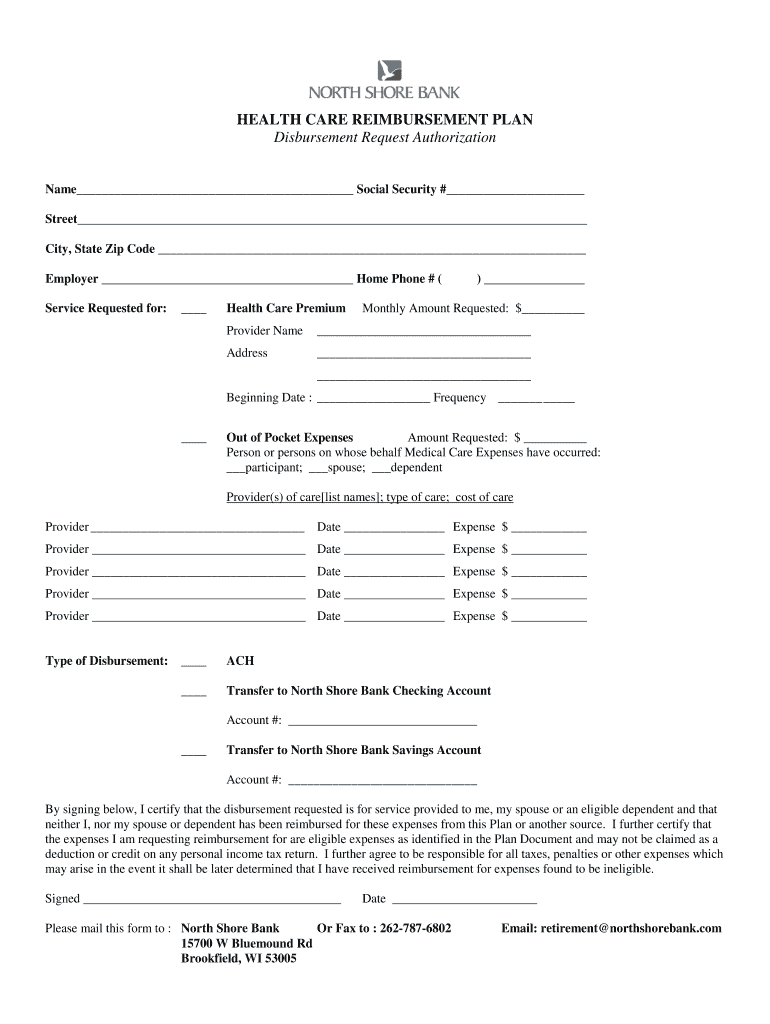

HEALTH CARE REIMBURSEMENT PLAN Disbursement Request AuthorizationName Social Security # Street City, State Zip Code Employer Home Phone # (Service Requested for: Health Care Premium) Monthly Amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business hras and

Edit your small business hras and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business hras and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business hras and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small business hras and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business hras and

How to fill out small business hras and

01

Step 1: Gather the necessary information about your small business, including the number of employees, their individual information, and the benefits you plan to offer.

02

Step 2: Research different small business HRAs available in the market and choose the one that best suits your business needs.

03

Step 3: Set up a small business HRA plan with the chosen provider, ensuring it complies with federal and state regulations.

04

Step 4: Communicate the small business HRA plan to your employees and provide them with the necessary enrollment documents.

05

Step 5: Train your employees on how to properly fill out the small business HRA forms and answer any questions they may have.

06

Step 6: Review the filled-out small business HRA forms for accuracy and completeness.

07

Step 7: Process the small business HRA forms, including verifying expenses and reimbursing eligible employees according to the plan guidelines.

08

Step 8: Keep track of small business HRA expenses and maintain proper records for tax and compliance purposes.

09

Step 9: Regularly review and update your small business HRA plan to ensure it remains compliant and meets the changing needs of your business and employees.

Who needs small business hras and?

01

Small business owners who want to provide cost-effective healthcare benefits to their employees.

02

Small business owners who want to offer personalized healthcare options to their employees.

03

Small business owners who want to attract and retain talented employees by providing competitive compensation packages.

04

Small business owners who want to take advantage of tax savings by offering a small business HRA.

05

Small business owners who want to comply with federal regulations regarding healthcare benefits and avoid penalties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my small business hras and in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your small business hras and along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the small business hras and in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your small business hras and and you'll be done in minutes.

How do I edit small business hras and straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit small business hras and.

What is small business hras and?

Small Business HRAs (Health Reimbursement Arrangements) are a type of health benefit plan that allows small businesses to reimburse employees for medical expenses and health insurance premiums.

Who is required to file small business hras and?

Small businesses with fewer than 50 full-time employees who do not offer group health insurance are required to file a small business HRA.

How to fill out small business hras and?

To fill out a small business HRA, businesses need to provide employees with a written notice of the HRA, set reimbursement amounts, and maintain records of reimbursements and expenses.

What is the purpose of small business hras and?

The purpose of small business HRAs is to help small businesses provide employees with a way to pay for eligible medical expenses and health insurance premiums.

What information must be reported on small business hras and?

Small business HRAs must report the total reimbursements made to employees, the types of medical expenses reimbursed, and any unused funds at the end of the year.

Fill out your small business hras and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Hras And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.