Get the free abbeville county tax assessor

Show details

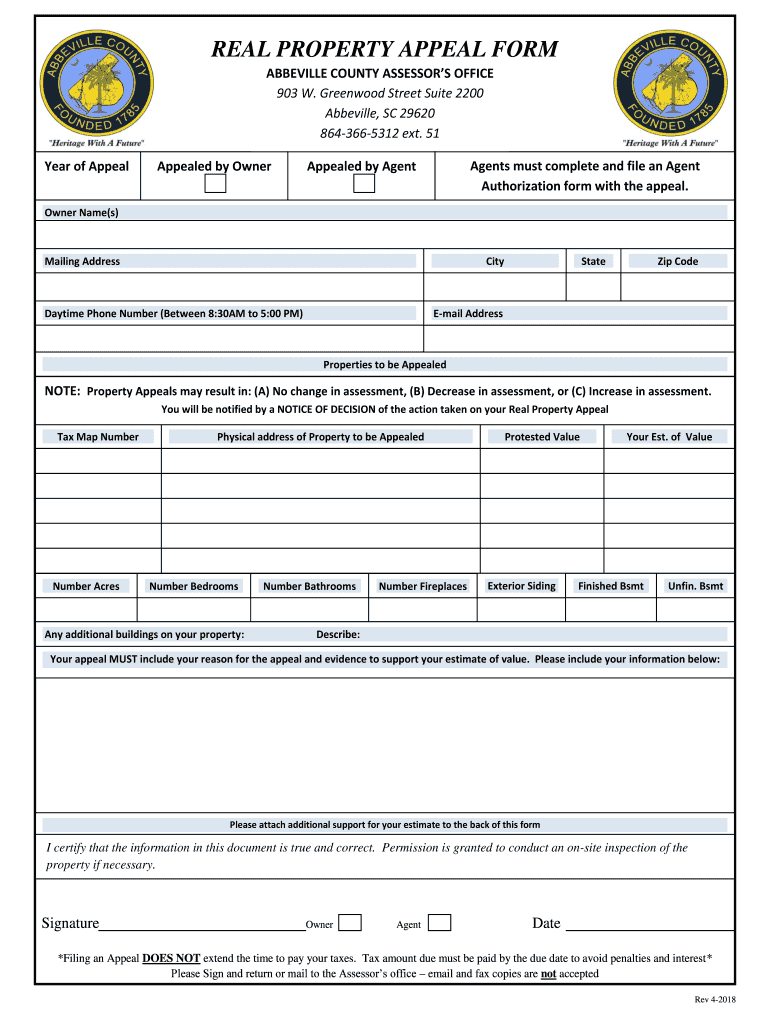

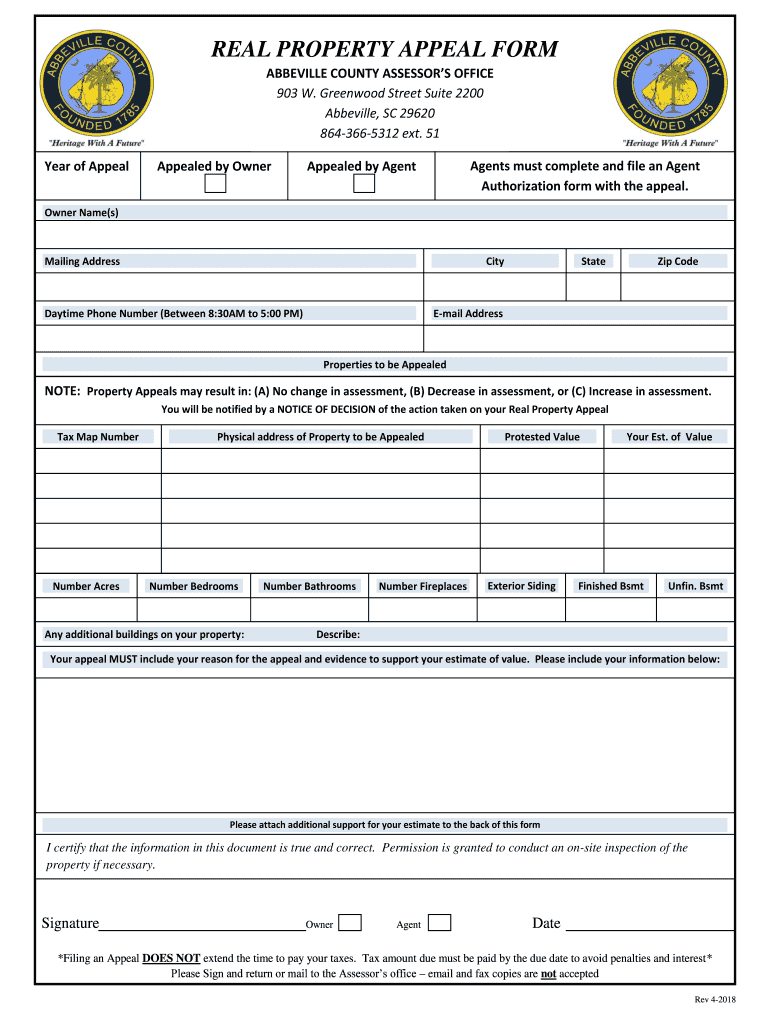

REAL PROPERTY APPEAL FORM

ASHEVILLE COUNTY ASSESSORS OFFICE

903 W. Greenwood Street Suite 2200

Asheville, SC 29620

8643665312 ext. 51

Year of AppealAppealed by OwnerAgents must complete and file an

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign abbeville county tax assessor qpublic form

Edit your abbeville county tax assessor qpublic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your abbeville county tax assessor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing abbeville county tax assessor online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit abbeville county tax assessor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out abbeville county tax assessor

How to fill out abbeville county tax assessor

01

To fill out the Abbeville County tax assessor form, follow these steps:

02

Start by downloading the tax assessor form from the official Abbeville County website.

03

Gather all the necessary information and documents required for assessment, such as property details, income statements, and any other relevant paperwork.

04

Carefully read through the instructions provided with the form to ensure you understand all the requirements and guidelines for accurate filling.

05

Fill out the form accurately and completely, providing all the necessary details as requested.

06

Double-check all the information you have entered to avoid any errors or omissions.

07

Once you have completed the form, review it again to make sure it is filled out correctly and all the required sections are filled.

08

Attach any supporting documents or proofs required by the tax assessor.

09

Finally, submit the filled-out form and accompanying documents to the Abbeville County tax assessor's office either in person or by mail.

10

It is advisable to keep a copy of the filled-out form and supporting documents for your records.

11

Wait for further instructions or communications from the Abbeville County tax assessor's office regarding the assessment.

Who needs abbeville county tax assessor?

01

Anyone who owns property or assets in Abbeville County needs to engage with the Abbeville County tax assessor.

02

Property owners who need to assess their properties for tax purposes will find the Abbeville County tax assessor invaluable.

03

Business owners who own land or buildings within Abbeville County will also need to interact with the tax assessor to meet their tax obligations.

04

Individuals or organizations applying for certain permits or licenses may require the assistance of the Abbeville County tax assessor to evaluate their property's value or eligibility.

05

Anyone involved in real estate transactions, including buyers, sellers, and real estate agents, may need the services of the tax assessor to determine the fair market value of the properties involved.

06

Additionally, individuals interested in researching property values, assessing the tax implications of owning property in Abbeville County, or obtaining property tax-related information may benefit from utilizing the resources provided by the tax assessor.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit abbeville county tax assessor in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing abbeville county tax assessor and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit abbeville county tax assessor on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit abbeville county tax assessor.

How do I complete abbeville county tax assessor on an Android device?

Complete your abbeville county tax assessor and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is abbeville county tax assessor?

The Abbeville County Tax Assessor is responsible for determining the value of all taxable property within the county for the purpose of calculating property taxes.

Who is required to file abbeville county tax assessor?

Property owners in Abbeville County are required to file the tax assessor forms to report their property information.

How to fill out abbeville county tax assessor?

To fill out the Abbeville County Tax Assessor forms, property owners must provide information such as property details, ownership information, and any changes since the last assessment.

What is the purpose of abbeville county tax assessor?

The purpose of the Abbeville County Tax Assessor is to fairly assess the value of properties in order to determine property taxes that owners are required to pay.

What information must be reported on abbeville county tax assessor?

Property owners must report details such as property address, ownership information, property improvements, and any changes that may affect the property value.

Fill out your abbeville county tax assessor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Abbeville County Tax Assessor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.