Get the free rules for interest on lawyers trust accounts - Pennsylvania Code

Show details

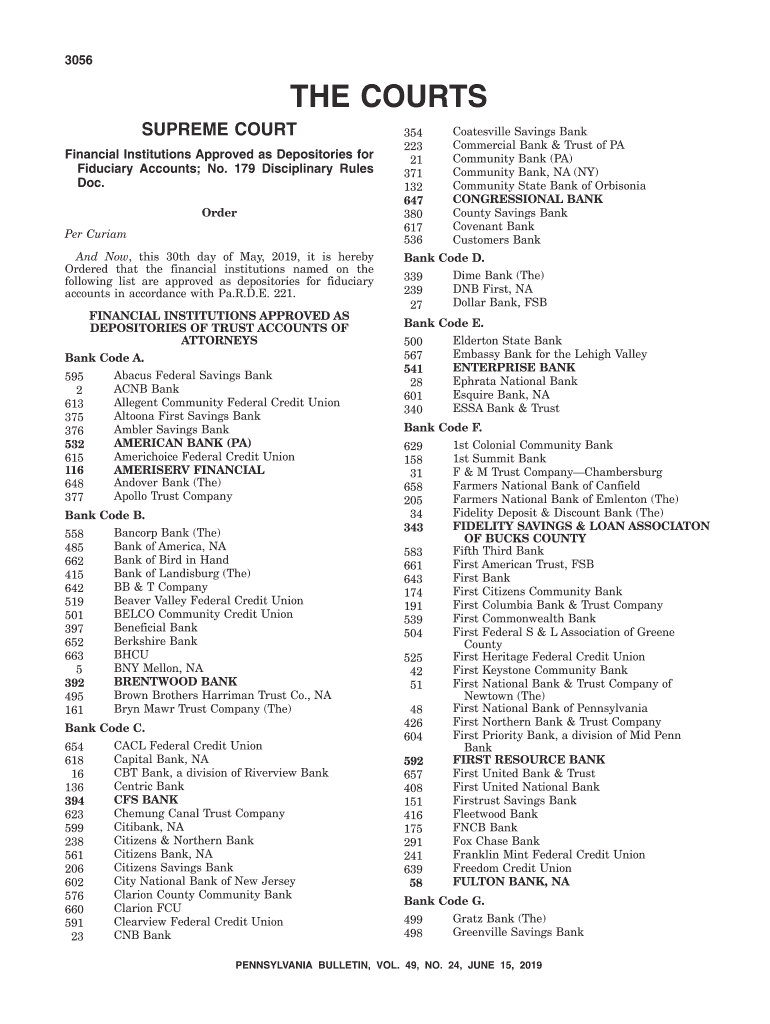

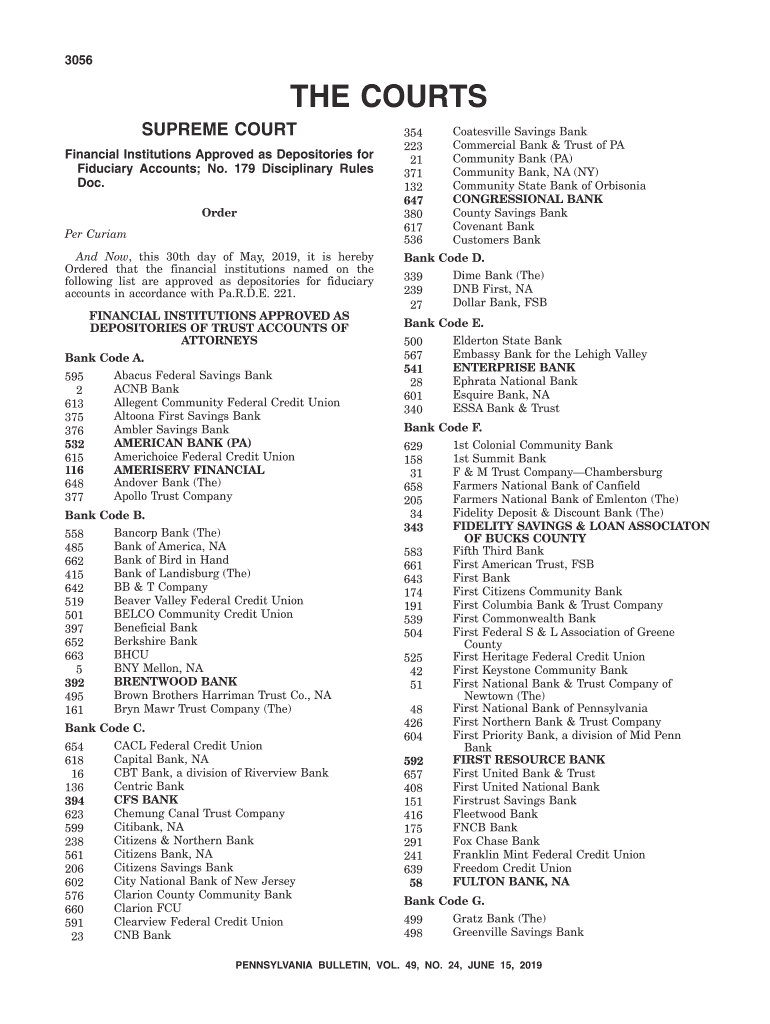

3056THE COURTS

SUPREME COURT

Financial Institutions Approved as Depositories for

Fiduciary Accounts; No. 179 Disciplinary Rules

Doc.

Order

Per Curia

And Now, this 30th day of May 2019, it is hereby

Ordered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rules for interest on

Edit your rules for interest on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rules for interest on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rules for interest on online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rules for interest on. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rules for interest on

How to fill out rules for interest on

01

Begin by understanding the purpose of the rules for interest on. Determine why you need to fill out these rules and what their objective is.

02

Gather all relevant information related to the interest on. This includes any documents, forms, or agreements that provide details about the interest calculation or repayment.

03

Consult legal or financial experts if necessary. They can provide guidance on how to accurately fill out the rules and ensure compliance with any applicable laws or regulations.

04

Review the rules thoroughly. Understand each section and its requirements. Pay attention to deadlines, calculations, and any specific instructions provided.

05

Start filling out the rules step by step. Use clear and concise language. Ensure that all necessary details are included and accurately represented.

06

Double-check your work for any errors or inconsistencies. It's important to avoid any inaccuracies that could lead to misunderstandings or legal issues.

07

Once completed, review the filled-out rules again to ensure everything is filled out correctly. Make any necessary amendments or additions.

08

If required, seek approval or review by supervisors or other authorized individuals. Obtain their signatures or confirmations if necessary.

09

Keep a copy or record of the filled-out rules for future reference. Ensure that it is stored securely and can be easily accessed when needed.

10

Monitor and update the rules as needed. If any changes occur in the interest calculation or repayment terms, make the necessary revisions to maintain accuracy and compliance.

Who needs rules for interest on?

01

Financial institutions such as banks, credit unions, and lending organizations often require rules for interest on. These rules help determine the interest amounts to be charged or paid by borrowers or depositors.

02

Businesses involved in lending or borrowing money may also need rules for interest on. These rules enable them to calculate and manage the interest amounts associated with loans, mortgages, or other financial transactions.

03

Individuals who want to calculate interest on their own investments, savings, or debts may find rules for interest on helpful. These rules provide a standardized framework for accurate interest calculations.

04

Regulatory bodies or government agencies overseeing financial transactions and institutions may utilize rules for interest on to ensure compliance with relevant laws and regulations.

05

Legal professionals involved in drafting or reviewing loan agreements, contracts, or other financial documents may benefit from rules for interest on. These rules can help ensure the accuracy and fairness of the interest calculations mentioned in the legal documents.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rules for interest on for eSignature?

rules for interest on is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my rules for interest on in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your rules for interest on and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete rules for interest on on an Android device?

Use the pdfFiller app for Android to finish your rules for interest on. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is rules for interest on?

Rules for interest on are regulations governing how interest is calculated and applied to financial transactions.

Who is required to file rules for interest on?

Any entity or individual who engages in financial transactions that involve accruing interest is required to file rules for interest on.

How to fill out rules for interest on?

Rules for interest on can be filled out by providing details on how interest rates are calculated, when interest is applied, and any specific rules or exceptions.

What is the purpose of rules for interest on?

The purpose of rules for interest on is to ensure transparency and consistency in how interest is calculated and applied in financial transactions.

What information must be reported on rules for interest on?

Information that must be reported on rules for interest on includes the method of interest calculation, the frequency of interest application, and any rules or exceptions regarding interest rates.

Fill out your rules for interest on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rules For Interest On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.