Get the free Opening a SIMPLE IRA Plan - Pensco Trust Company

Show details

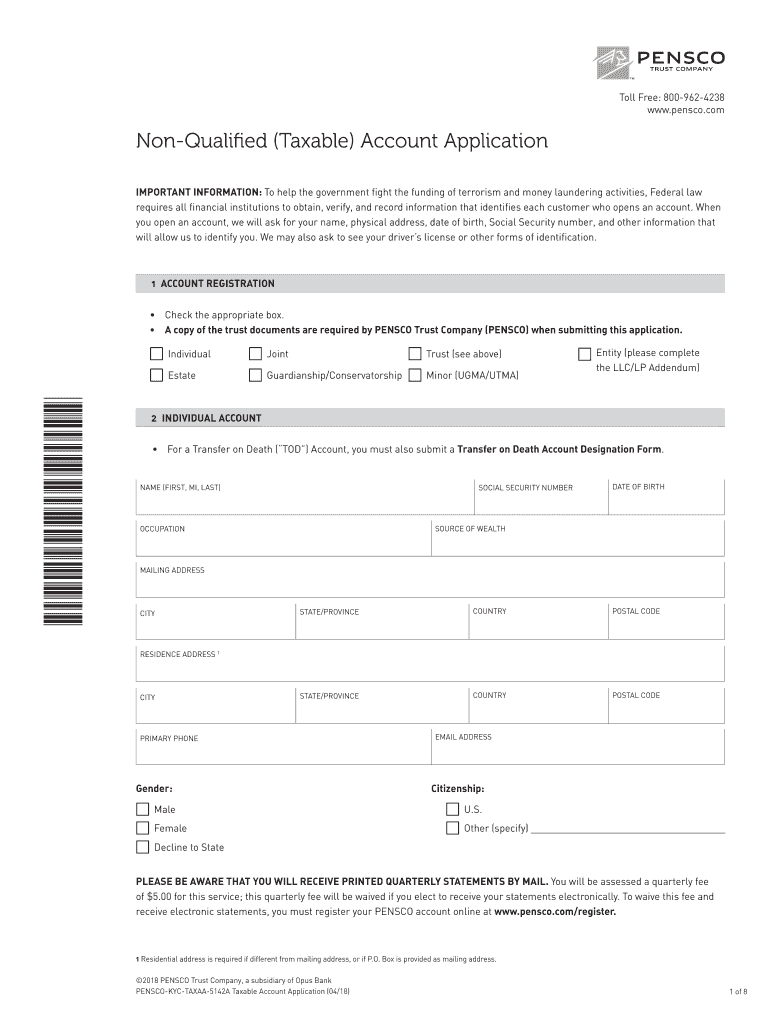

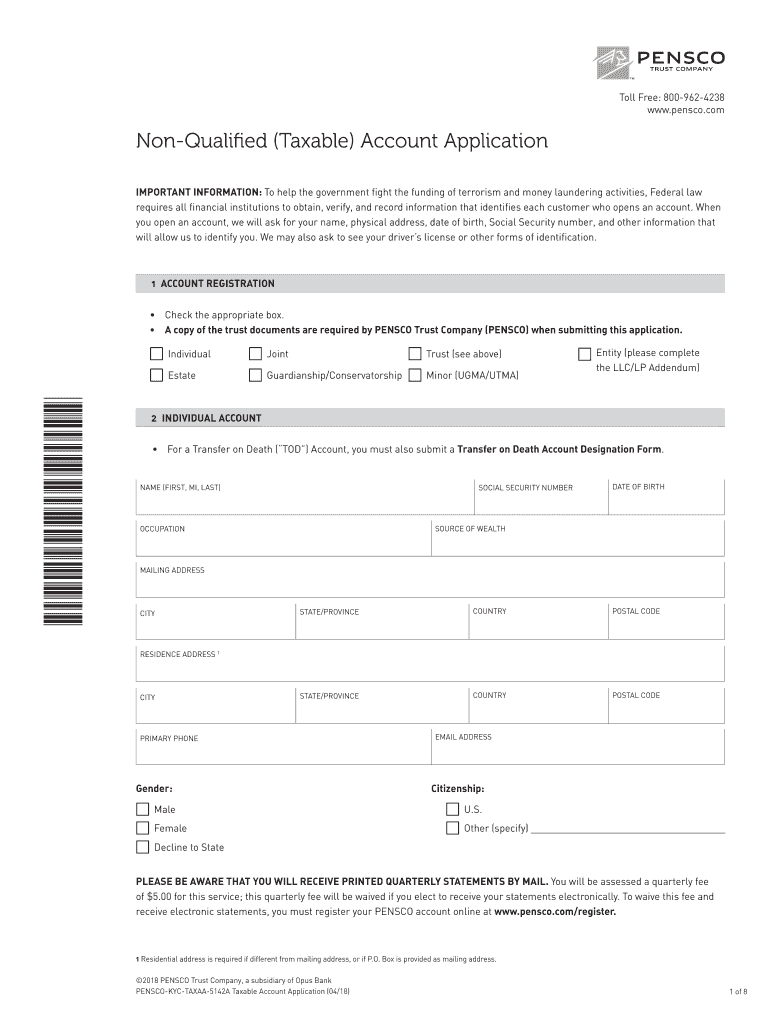

Toll Free: 8009624238

www.pensco.comNonQualified (Taxable) Account Application

IMPORTANT INFORMATION: To help the government fight the funding of terrorism and money laundering activities, Federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening a simple ira

Edit your opening a simple ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening a simple ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit opening a simple ira online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit opening a simple ira. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out opening a simple ira

How to fill out opening a simple ira

01

To fill out opening a Simple IRA, follow the steps below:

02

Find a financial institution: Look for a bank, credit union, brokerage firm, or mutual fund company that offers Simple IRAs.

03

Gather necessary documents: You will typically need your Social Security number, date of birth, employment details, and beneficiary information.

04

Complete the application: Fill out the application form provided by the financial institution. Provide accurate and complete information.

05

Choose investments: Decide on the investment options you want for your Simple IRA contributions. This can include stocks, bonds, mutual funds, or other investment vehicles.

06

Set contribution amounts: Determine the amount you want to contribute to your Simple IRA on a regular basis. This can be a fixed dollar amount or a percentage of your income.

07

Nominate beneficiaries: Designate beneficiaries who will receive the funds in your Simple IRA in case of your death.

08

Review and submit: Double-check the application for any errors or omissions. Once satisfied, submit the form to the financial institution.

09

Fund your Simple IRA: After your application is approved, deposit funds into your Simple IRA. This can be done through direct deposits, transfers, or check payments.

10

Monitor and manage: Regularly review your Simple IRA account and make investment changes as needed. Stay informed about any changes in tax laws or regulations.

11

Consult a financial advisor: If you are unsure about any aspect of opening a Simple IRA or need personalized guidance, seek advice from a financial advisor.

Who needs opening a simple ira?

01

Opening a Simple IRA is beneficial for:

02

- Small business owners who want to provide a retirement plan to their employees.

03

- Self-employed individuals who want a tax-efficient way to save for retirement.

04

- Employees of companies that offer Simple IRA plans as part of their employee benefits package.

05

- Individuals who want a simplified retirement savings plan with modest contribution limits and minimal administrative requirements.

06

- Individuals who are looking for a retirement savings option with potentially higher contribution limits compared to traditional IRAs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify opening a simple ira without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like opening a simple ira, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit opening a simple ira online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your opening a simple ira and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete opening a simple ira on an Android device?

Complete opening a simple ira and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is opening a simple ira?

Opening a simple ira is a retirement savings plan specifically designed for small businesses and self-employed individuals.

Who is required to file opening a simple ira?

Employers who want to offer a retirement plan to their employees and self-employed individuals are required to file opening a simple IRA.

How to fill out opening a simple ira?

To fill out opening a simple IRA, the employer or self-employed individual will need to complete the necessary paperwork provided by the financial institution or financial advisor.

What is the purpose of opening a simple ira?

The purpose of opening a simple IRA is to provide a tax-advantaged way for small businesses and self-employed individuals to save for retirement.

What information must be reported on opening a simple ira?

When opening a simple IRA, information such as the participant's personal details, contribution amounts, and investment choices must be reported.

Fill out your opening a simple ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening A Simple Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.