Get the free CLI Share buy-back as of September 11,2018

Show details

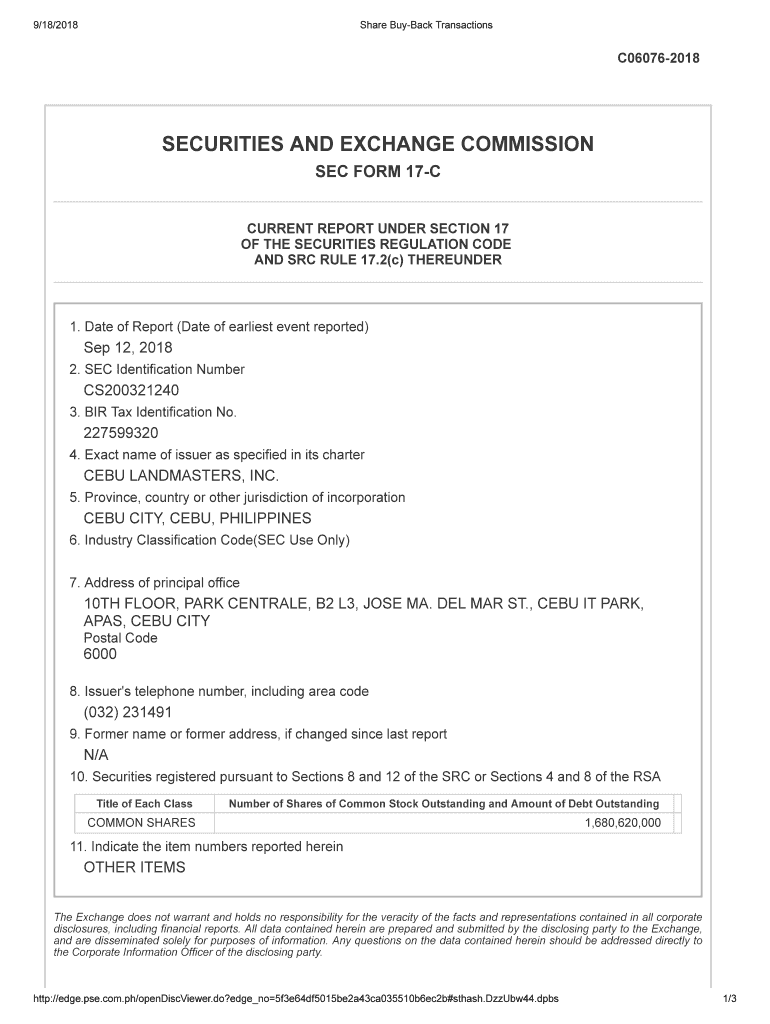

9/18/2018Share Buyback TransactionsC060762018SECURITIES AND EXCHANGE COMMISSION

SEC FORM 17C

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.2(c) THEREUNDER1. Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cli share buy-back as

Edit your cli share buy-back as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cli share buy-back as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cli share buy-back as online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cli share buy-back as. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cli share buy-back as

How to fill out cli share buy-back as

01

Collect all the necessary information about the company's shares, including the total number of authorized shares, outstanding shares, and current market price.

02

Determine the purpose of the share buy-back and ensure it complies with the company's articles of association and applicable legal regulations.

03

Prepare the necessary documentation, including a board resolution authorizing the buy-back, a share buy-back agreement, and any required notifications to regulatory authorities.

04

Determine the maximum number or value of shares to be bought back and the duration of the buy-back program.

05

Implement a mechanism to determine the purchase price, which could be a fixed price, market price, or a specified formula.

06

Communicate the share buy-back plan to shareholders and the public, if required by law.

07

Establish a procedure for the actual buy-back, which may involve purchasing shares through a stock exchange, private negotiations, or through a tender offer.

08

Keep accurate records of the buy-back transactions, including the number of shares bought back, the purchase price, and the date of each transaction.

09

Comply with any legal requirements regarding the cancellation or reissue of bought-back shares.

10

Evaluate the impact of the buy-back on the company's financials, including the reduction of share capital and potential tax implications.

Who needs cli share buy-back as?

01

Companies looking to return excess cash to shareholders: Share buy-backs can be an efficient way to distribute surplus funds to shareholders without incurring dividend tax or creating ongoing dividend obligations.

02

Companies seeking to increase shareholder value: By reducing the number of outstanding shares, a share buy-back can improve earnings per share and potentially increase the stock price.

03

Companies aiming to consolidate ownership: Share buy-backs can help consolidate ownership and reduce the number of shareholders, making the company easier to manage.

04

Companies looking to maintain control: Buying back shares can prevent dilution of control by reducing the number of shares available for purchase by outsiders.

05

Companies seeking to capitalize on undervalued stock: If a company believes its shares are undervalued in the market, a share buy-back can be a strategic move to increase shareholder confidence and potentially boost the stock price.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cli share buy-back as in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your cli share buy-back as and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in cli share buy-back as?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your cli share buy-back as and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out cli share buy-back as on an Android device?

Complete cli share buy-back as and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is cli share buy-back as?

cli share buy-back as refers to the process in which a company purchases its own shares from the market.

Who is required to file cli share buy-back as?

Companies that are buying back their own shares are required to file cli share buy-back as.

How to fill out cli share buy-back as?

cli share buy-back forms can be filled out online or submitted electronically through the designated platform.

What is the purpose of cli share buy-back as?

The purpose of cli share buy-back as is to provide transparency and regulatory compliance when a company repurchases its own shares.

What information must be reported on cli share buy-back as?

The information reported on cli share buy-back as includes details of the shares being repurchased, the price paid, and the purpose of the buy-back.

Fill out your cli share buy-back as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cli Share Buy-Back As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.