Get the free FAQs regarding Form T-2 under Delhi VAT RulesCorporate ... - cec nic

Show details

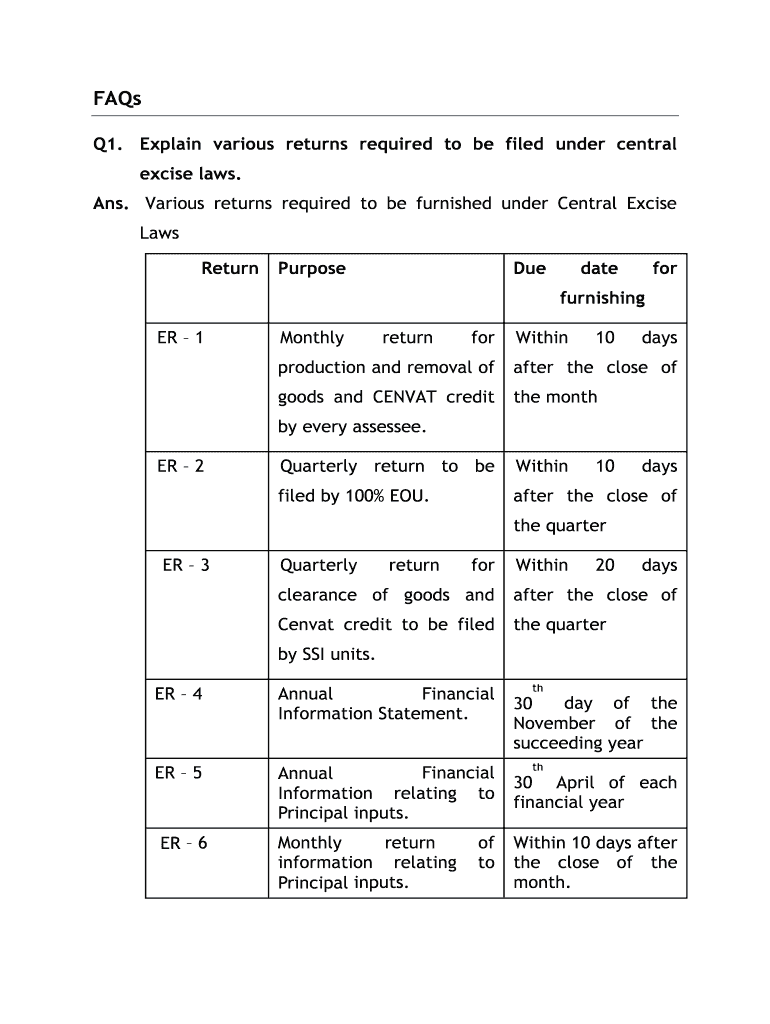

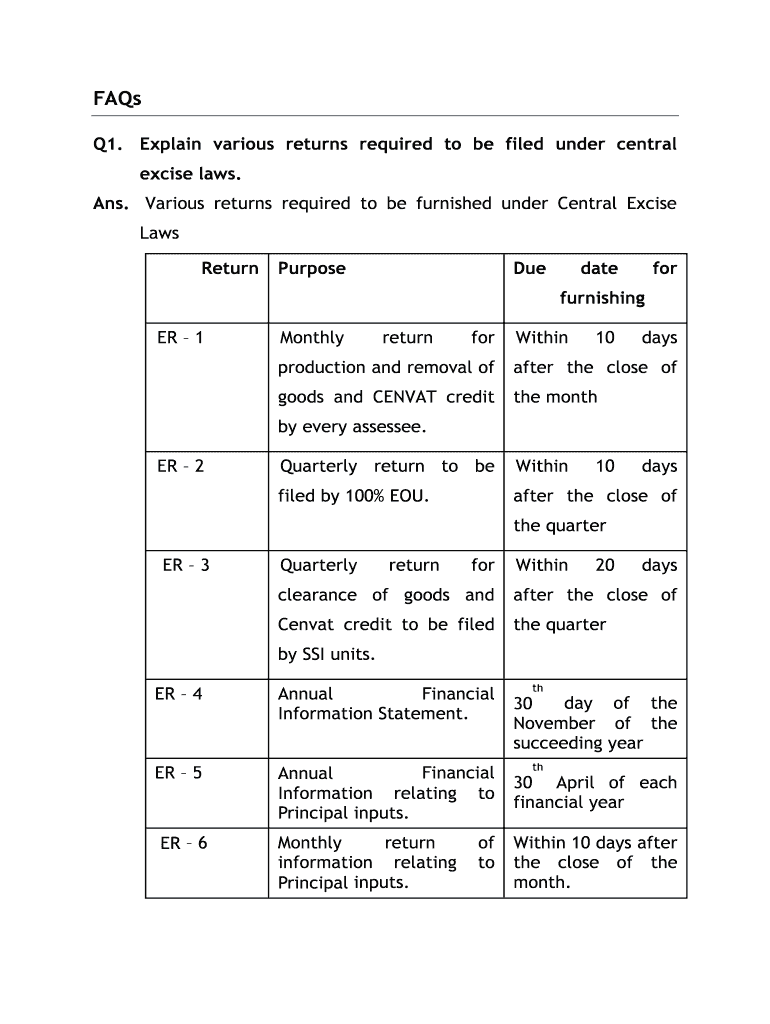

FAQs Q1. Explain various returns required to be filed under central excise laws. Ans. Various returns required to be furnished under Central Excise Laws ReturnPurposeDuedateforfurnishing ER 1MonthlyreturnforWithin10daysproduction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign faqs regarding form t-2

Edit your faqs regarding form t-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your faqs regarding form t-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit faqs regarding form t-2 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit faqs regarding form t-2. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out faqs regarding form t-2

How to fill out faqs regarding form t-2

01

Start by understanding the purpose of FAQ for Form T-2. It is to provide users with clear and concise answers to commonly asked questions about filling out the form.

02

Gather all necessary information about Form T-2 and its requirements. This may include studying the instructions provided by the relevant authority or organization.

03

Identify the most frequently asked questions related to Form T-2. These can be based on past experiences or by conducting surveys among users.

04

Create a question template for each FAQ, ensuring that they are easy to understand and specific to the form.

05

Provide accurate and up-to-date answers for each FAQ. It is important to support the answers with relevant references or sources.

06

Organize the FAQs in a clear and logical manner, either by categorizing them or arranging them in an intuitive order.

07

Review and revise the FAQs to ensure they are well-written, free of errors, and easily comprehensible for the users.

08

Make the FAQs easily accessible to the users. This can be done by adding them to the company's website, including them in the form's instructions, or creating a separate document for FAQs.

09

Regularly update the FAQs as needed to reflect any changes in the form or its requirements.

10

Monitor feedback from users and make necessary improvements to the FAQs based on their suggestions or queries.

Who needs faqs regarding form t-2?

01

Individuals or businesses required to fill out Form T-2: Any individual, company, or organization that falls under the jurisdiction of the authority mandating the use of Form T-2 may need FAQs to assist them in accurately completing the form.

02

Employees tasked with assisting form fillers: Companies or organizations that provide assistance or support to individuals or other entities filling out Form T-2 may need FAQs to streamline the process and provide consistent guidance.

03

Form designers or developers: Professionals responsible for designing or developing the Form T-2 may use FAQs as a reference to enhance the form's usability and address potential user queries.

04

Regulatory authorities or organizations: Entities responsible for the regulation or administration of Form T-2 may require FAQs to inform users about the form's requirements and ensure compliance.

05

Users seeking self-help resources: Individuals or businesses interested in completing Form T-2 accurately and independently may rely on FAQs as a self-help resource to clarify any doubts or uncertainties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify faqs regarding form t-2 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your faqs regarding form t-2 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I edit faqs regarding form t-2 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing faqs regarding form t-2, you need to install and log in to the app.

How do I fill out faqs regarding form t-2 using my mobile device?

Use the pdfFiller mobile app to fill out and sign faqs regarding form t-2 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your faqs regarding form t-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Faqs Regarding Form T-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.