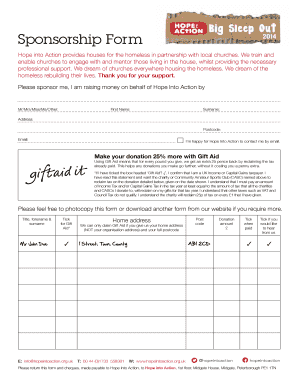

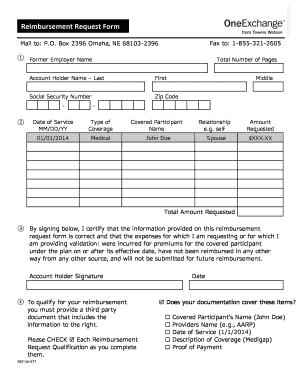

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Get the free Request for Accounting

Show details

This document is a formal request for an accounting of payments made under a Contract for Deed, including a breakdown of interest, fees, costs, taxes, and insurance, along with the balance due.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for accounting

Edit your request for accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for accounting

How to fill out Request for Accounting

01

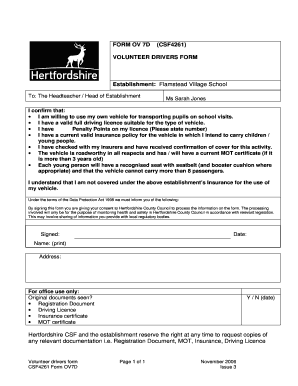

Obtain the Request for Accounting form from the appropriate department or website.

02

Fill in your personal information, including your name, contact information, and any identification numbers if required.

03

Specify the time period for which you are requesting the accounting records.

04

Clearly state the type of accounting records you are requesting.

05

Include any additional details or supporting documents that may assist in processing your request.

06

Review the form for accuracy and completeness.

07

Submit the form to the designated office or department, following any specific submission guidelines.

Who needs Request for Accounting?

01

Individuals seeking transparency regarding financial transactions related to their accounts.

02

Beneficiaries wanting information about the handling of an estate or trust.

03

Clients wishing to understand account management fees or charges.

04

Anyone involved in a legal dispute that requires detailed accounting records.

Fill

form

: Try Risk Free

People Also Ask about

How do I request an accounting of an estate?

How to Get an Accounting. The California Probate Code gives beneficiaries the right to demand a full and complete accounting of the trust's assets, starting from the date of death of the decedent to the date of demand. A letter, directly to the trustee, making a demand for an accounting is the first step.

What is the basic of accounting in English?

What are the basics of accounting? Basic accounting concepts used in the business world encompass revenues, expenses, assets, and liabilities. Accountants track and record these elements in documents like balance sheets, income statements, and cash flow statements.

What is a right to an accounting?

As in the proposed rule, individuals have a right to receive an accounting of disclosures made by a covered entity, including disclosures by or to a business associate of the covered entity, for purposes other than treatment, payment, and health care operations, subject to certain exceptions as discussed below.

What is accounting in 100 words?

Accounting is a system meant for measuring business activities, processing of information into reports and making the findings available to decision-makers. The documents, which communicate these findings about the performance of an organisation in monetary terms, are called financial statements.

What is the right to request an accounting?

Individuals have a right to receive, upon request, an accounting of disclosures of protected health information made by a covered entity (or its business associate), with certain exceptions.

Do patients have the right to request an accounting of disclosure?

Individuals have a right to receive, upon request, an accounting of disclosures of protected health information made by a covered entity (or its business associate), with certain exceptions.

What English do you need for accounting?

Accepted evidence Minimum test scoresListeningWriting IELTS Academic 7 7 TOEFL iBT 24 27 PTE Academic 65 65 Cambridge 185 185

What does it mean to request an accounting?

(2) “Request for an accounting” means a record signed by a debtor requesting that the recipient provide an accounting of the unpaid obligations secured by collateral and reasonably identifying the transaction or relationship that is the subject of the request.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Accounting?

A Request for Accounting is a formal request made by a beneficiary to an entity managing a trust or estate, asking for a detailed account of financial transactions and balances related to that trust or estate.

Who is required to file Request for Accounting?

Generally, any beneficiary of a trust or estate can file a Request for Accounting to ensure transparency and verify that the fiduciary is managing the assets properly.

How to fill out Request for Accounting?

To fill out a Request for Accounting, provide your name, contact information, the name of the trust or estate, and a clear request for the accounting details you wish to receive. It is essential to be specific about the period for which you are requesting the accounting.

What is the purpose of Request for Accounting?

The purpose of a Request for Accounting is to ensure that beneficiaries receive a transparent and detailed report of the financial activities and status of a trust or estate, allowing them to confirm that the fiduciary is performing their duties appropriately.

What information must be reported on Request for Accounting?

The Request for Accounting must report the financial transactions, including income received, expenses paid, assets acquired or disposed of, and the current balance of the trust or estate. It should also provide a summary of the fiduciary's management activities during the reported period.

Fill out your request for accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.