IA BLS 3020 2023-2026 free printable template

Show details

Multiple Worksite Report BLS 3020Iowa Workforce Development

Employment Statistics Bureau QC EW

1000 East Grand Avenue

Des Moines IA 503190209

Phone: (800) 5321249Form Approved, O.M.B. No. 12200134

Expiration

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA BLS 3020

Edit your IA BLS 3020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA BLS 3020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IA BLS 3020 online

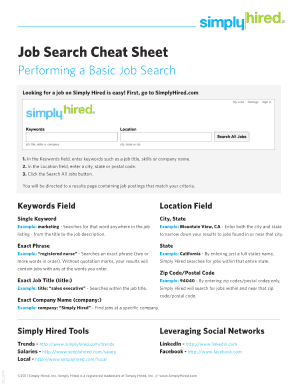

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IA BLS 3020. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA BLS 3020 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA BLS 3020

How to fill out IA BLS 3020

01

Begin by gathering all necessary personal information, including your name, address, and Social Security number.

02

Provide information about your employment history, including your employer's name, address, and your job title.

03

Indicate your income details, including wages, tips, and any additional sources of income.

04

Fill out the sections related to your dependents if applicable, providing their names and Social Security numbers.

05

Ensure you review all entries for accuracy to avoid processing delays.

06

Sign and date the form at the designated area.

Who needs IA BLS 3020?

01

Individuals seeking to apply for benefits related to unemployment or economic assistance.

02

People who have experienced job loss or reduced work hours and need to report their situation to the relevant authority.

03

Employers who need to provide details about their employees' eligibility for benefits.

Fill

form

: Try Risk Free

People Also Ask about

Is BLS 3020 mandatory in Texas?

County Codes for Employer's Quarterly Report NOTE: All multi-location employers in Texas with a total of 10 or more employment outside their primary establishment (establishment with the largest employment) should file Form BLS 3020, Multiple Worksite Report.

What is BLS 3020?

The Multiple Worksite Report (MWR), also known as the BLS 3020 form, was developed by the U.S. Department of Labor, Bureau of Labor Statistics (BLS) to gather employment data showing the distribution of the employment and wages of business establishments with multiple business locations by industry and geographic area.

Is BLS survey mandatory in New York?

This report is mandatory under Section 531 of the New York labor law, and is authorized by law, 29 U.S.C.

Is Form BLS 3020 mandatory?

This report is mandatory under Section 320.5 of the California Unemployment Insurance Code and Section 320-1 Title 22 of the California Code of Regulations, and is authorized by law, 29 U.S.C.

Is the BLS 3020 form mandatory?

This report is mandatory under Section 320.5 of the California Unemployment Insurance Code and Section 320-1 Title 22 of the California Code of Regulations, and is authorized by law, 29 U.S.C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IA BLS 3020 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your IA BLS 3020 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send IA BLS 3020 for eSignature?

Once your IA BLS 3020 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find IA BLS 3020?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the IA BLS 3020 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is IA BLS 3020?

IA BLS 3020 is a business tax form used in the state of Iowa for reporting specific business tax information to the Iowa Department of Revenue.

Who is required to file IA BLS 3020?

Businesses operating within Iowa that meet certain criteria, including those engaged in specific activities or possessing certain tax liabilities, are required to file IA BLS 3020.

How to fill out IA BLS 3020?

To fill out IA BLS 3020, businesses need to provide accurate financial information regarding their operations and any relevant tax information as specified in the form's instructions.

What is the purpose of IA BLS 3020?

The purpose of IA BLS 3020 is to collect essential business information for tax compliance and to assist the Iowa Department of Revenue in monitoring business activities.

What information must be reported on IA BLS 3020?

The information required on IA BLS 3020 includes business identification details, financial figures, tax liability information, and any other data necessary for tax assessment.

Fill out your IA BLS 3020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA BLS 3020 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.