Get the free overview accrual basis accounting general ledger expense ... - uco rutgers

Show details

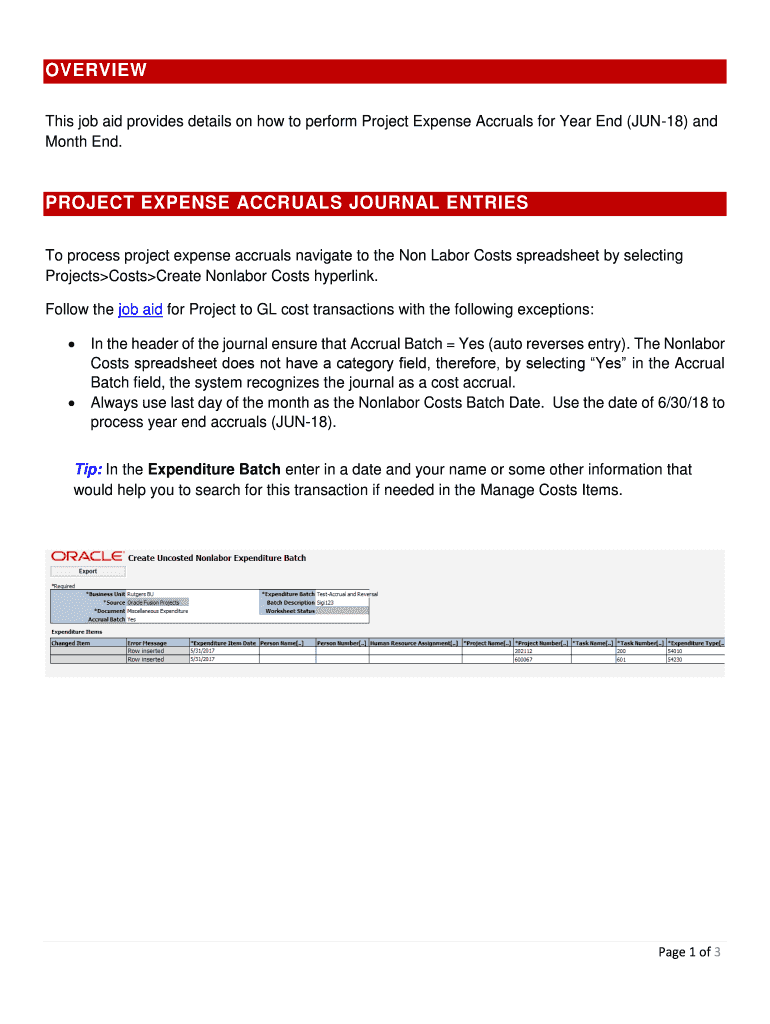

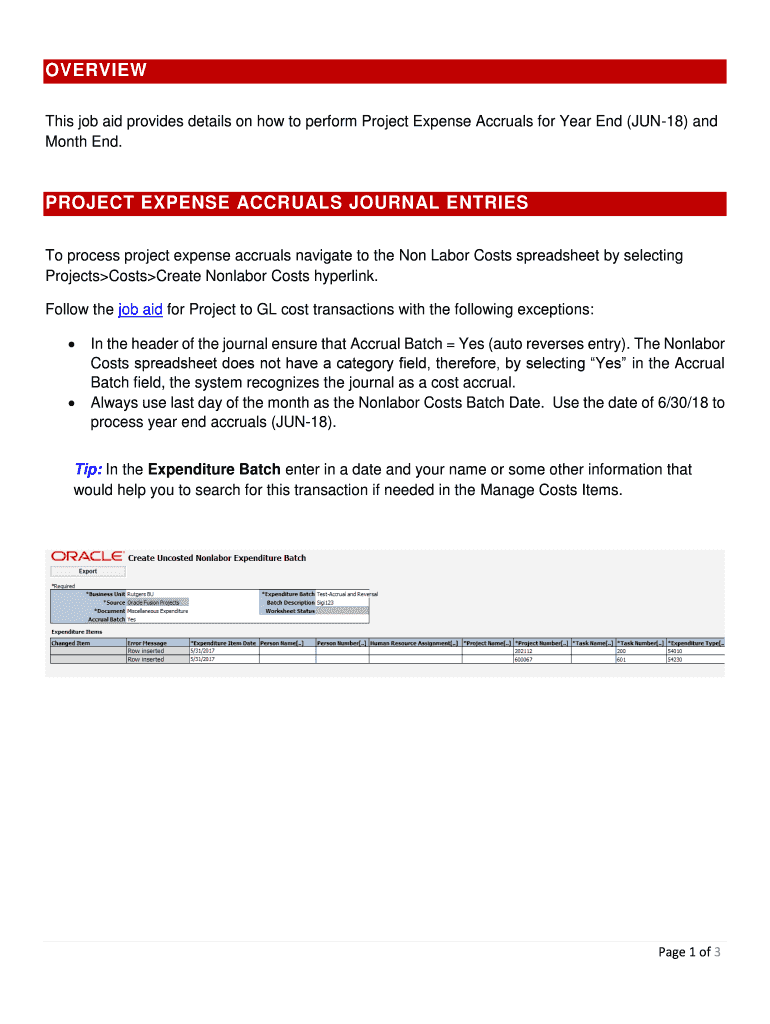

OVERVIEW This job aid provides details on how to perform Project Expense Accruals for Year End (JUN18) and Month End. PROJECT EXPENSE ACCRUALS JOURNAL ENTRIES To process project expense accruals navigate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign overview accrual basis accounting

Edit your overview accrual basis accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your overview accrual basis accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit overview accrual basis accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit overview accrual basis accounting. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out overview accrual basis accounting

How to fill out overview accrual basis accounting

01

To fill out the overview for accrual basis accounting, follow these steps:

02

Start by gathering all necessary financial information, including income and expenses, for the specified period.

03

Separate the income and expenses into relevant categories, such as sales, expenses, and other operating costs.

04

Calculate the total income by summing up all sales and other income sources for the period.

05

Calculate the total expenses by summing up all expenses and operating costs for the period.

06

Subtract the total expenses from the total income to calculate the net income.

07

Determine any adjustments needed for accrued revenue or expenses that might be recognized in different periods.

08

Include any additional information or explanations regarding significant financial events or changes.

09

Review and double-check all calculations and information before finalizing the overview.

10

Present the accrual basis accounting overview in a clear and organized manner, ensuring all essential details are included.

11

Retain the overview for future reference and compliance purposes.

Who needs overview accrual basis accounting?

01

Overview accrual basis accounting is beneficial for various entities, including:

02

- Businesses and corporations that want to accurately track their financial performance over a specific period.

03

- Investors and shareholders who require detailed financial information to make informed decisions.

04

- Government agencies and regulatory bodies that enforce compliance and financial reporting standards.

05

- Accounting professionals who need to prepare financial statements and analyze financial health.

06

- Auditors who need to assess the accuracy and reliability of financial records.

07

- Non-profit organizations that rely on transparent financial reporting to gain public trust and attract donors.

08

- Any individual or entity interested in understanding the financial position and performance of an organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my overview accrual basis accounting directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your overview accrual basis accounting and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit overview accrual basis accounting from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your overview accrual basis accounting into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I fill out overview accrual basis accounting on an Android device?

Complete overview accrual basis accounting and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is overview accrual basis accounting?

Accrual basis accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is exchanged.

Who is required to file overview accrual basis accounting?

Businesses and organizations that want to accurately reflect their financial position and performance are required to use accrual basis accounting.

How to fill out overview accrual basis accounting?

To fill out accrual basis accounting, you need to record revenues when they are earned and expenses when they are incurred, regardless of when the cash is exchanged.

What is the purpose of overview accrual basis accounting?

The purpose of accrual basis accounting is to provide a more accurate representation of a company's financial position and performance by matching revenues with expenses in the same accounting period.

What information must be reported on overview accrual basis accounting?

On accrual basis accounting, both revenues earned and expenses incurred during a specific period must be reported, regardless of when the cash is actually received or paid.

Fill out your overview accrual basis accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Overview Accrual Basis Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.