Get the free Private Flood Insurance and the National Flood Insurance ...

Show details

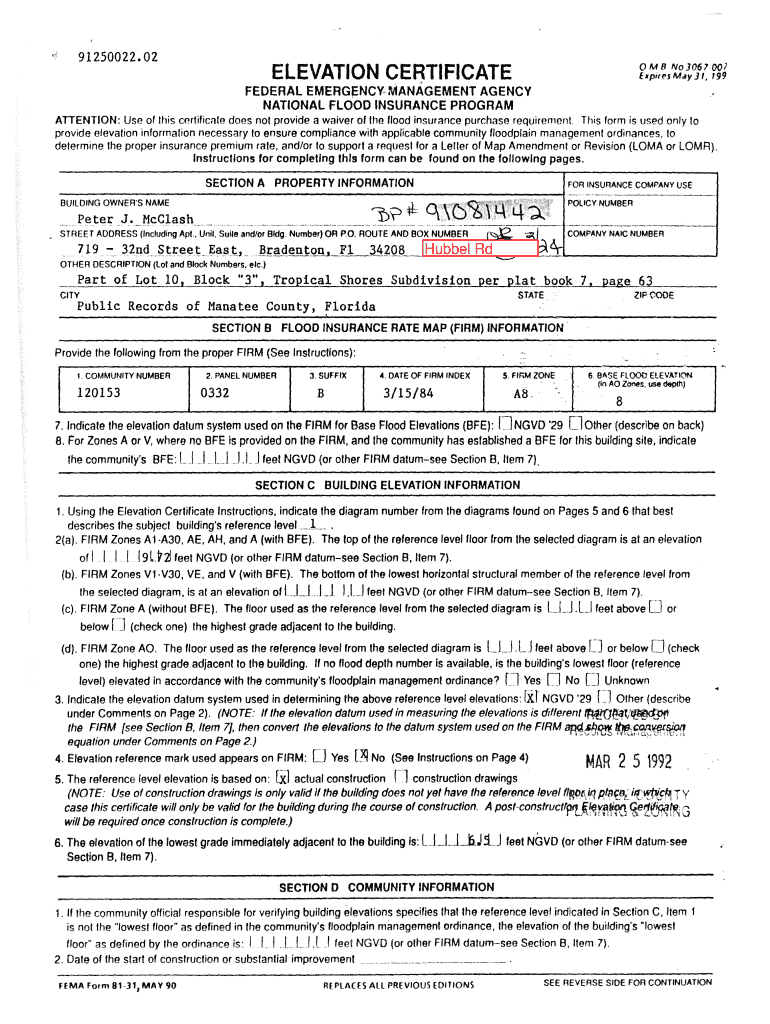

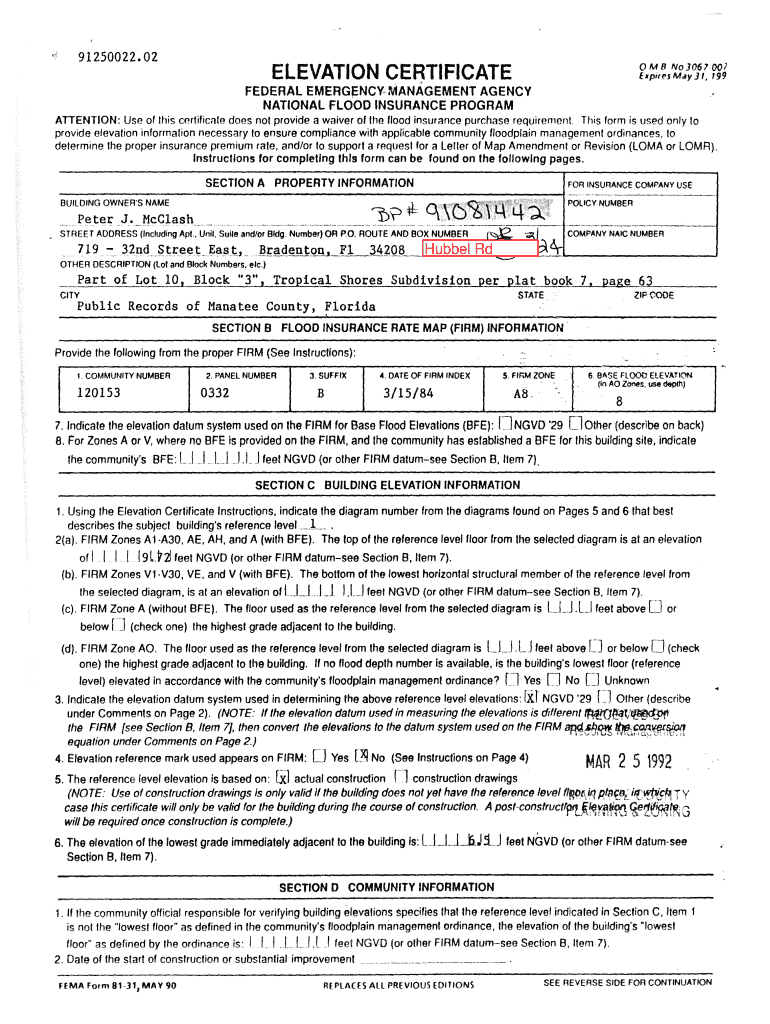

91250022.02OM 8 No J06700 JLPT, ('may '.199ELEVATION CERTIFICATE FEDERALEMERGNCMANAGEMENTAGENCYNATIONAL FLOOD INSURANCE PROGRAM ATTENTION: Use of this cmtificnle does not provide a waiver of the flood

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private flood insurance and

Edit your private flood insurance and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private flood insurance and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private flood insurance and online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit private flood insurance and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private flood insurance and

How to fill out private flood insurance and

01

To fill out private flood insurance:

02

Contact a licensed insurance agent or broker who offers private flood insurance.

03

Provide the necessary information such as your address, property details, and current flood insurance policy information (if applicable).

04

Go through the underwriting process which may involve the evaluation of flood risks, property inspections, and flood zone determinations.

05

Review and select the desired coverage options, including the dwelling coverage, personal property coverage, and additional endorsements.

06

Determine the policy term and payment options.

07

Complete the application form accurately and truthfully.

08

Submit the application along with any required documentation such as elevation certificates, photos, or proof of prior flood insurance.

09

Pay the premium amount based on the agreed-upon terms.

10

Review the policy documents thoroughly before signing and make sure you understand the terms, conditions, and exclusions.

11

Keep a copy of the policy for your records and contact your insurance provider for any further inquiries or assistance.

Who needs private flood insurance and?

01

Private flood insurance is typically needed by:

02

- Homeowners residing in flood-prone areas where traditional insurance policies do not provide adequate coverage for flood damage.

03

- Homeowners who want additional coverage beyond what is offered by the National Flood Insurance Program (NFIP).

04

- Homeowners with high-value properties or unique structures that may require specialized coverage.

05

- Property owners who have experienced flooding in the past and want to protect their investment against future flood-related damages.

06

- Business owners or commercial property owners who want to safeguard their assets and ensure business continuity in the event of a flood.

07

- Individuals living near bodies of water such as rivers, lakes, or coastal regions where the risk of flooding is higher.

08

- Homebuyers purchasing properties in flood-prone areas as a requirement by mortgage lenders.

09

It is advisable to consult with a licensed insurance professional to determine if private flood insurance is suitable for your specific needs and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send private flood insurance and to be eSigned by others?

Once your private flood insurance and is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out private flood insurance and using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign private flood insurance and. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit private flood insurance and on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share private flood insurance and on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is private flood insurance?

Private flood insurance is a type of flood insurance coverage that is not provided by the National Flood Insurance Program (NFIP) and is instead offered by private insurers.

Who is required to file private flood insurance?

Lenders are required to file private flood insurance to ensure that a property is adequately covered in case of a flood.

How to fill out private flood insurance?

Private flood insurance can be filled out by providing information about the property, the coverage desired, and any additional options like excess flood coverage.

What is the purpose of private flood insurance?

The purpose of private flood insurance is to provide financial protection to property owners in the event of a flood that is not covered by a standard homeowners insurance policy.

What information must be reported on private flood insurance?

The information that must be reported on private flood insurance includes details about the property location, flood risk assessment, coverage limits, and premium payments.

Fill out your private flood insurance and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Flood Insurance And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.