KS DO-41 2018 free printable template

Show details

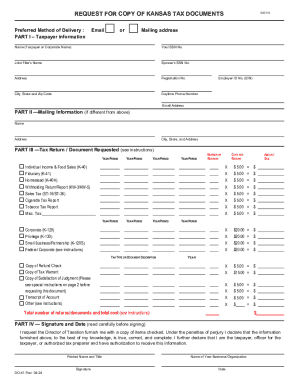

800718REQUEST FOR COPY OF KANSAS TAX DOCUMENTARY I Taxpayer Information Name (Taxpayer or Corporate Name)Your SS No. Joint Filers Espouses SS No. AddressRegistration No. Employer ID No. (EIN)City,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS DO-41

Edit your KS DO-41 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS DO-41 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS DO-41 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KS DO-41. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DO-41 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS DO-41

How to fill out KS DO-41

01

Obtain the KS DO-41 form from the official website or the relevant department.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal details such as name, address, and contact information in the designated fields.

04

Provide the necessary information regarding your tax status or financial activities, as required by the form.

05

Review your entries for accuracy to avoid mistakes or omissions.

06

Sign and date the form at the bottom before submission.

07

Submit the completed form according to the instructions provided (either online or via mail).

Who needs KS DO-41?

01

Individuals or businesses who are required to report specific tax information in Kansas.

02

Taxpayers needing to document certain financial transactions for compliance purposes.

03

Anyone who has received a request from the state tax authority to complete the KS DO-41.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my tax documents?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How can I get a copy of my tax return quickly?

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.

Does Missouri require a copy of the federal tax return with the state return?

You must allocate your Missouri source income on Form MO-NRI and complete Form MO-1040. You must include a copy of your federal return with your state return.

Who is required to file Kansas state tax return?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

Do I need to send a copy of my federal return with my Kansas state return?

If your Form K-40 shows an address other than Kansas, you must enclose a copy of your federal return (1040EZ, 1040A or 1040 and applicable Schedules A through F) with your Kansas return. Income tax information disclosed to KDOR, either on returns or through department investigation, is held in strict confidence by law.

What is a K-40 form?

If you need to change or amend an accepted Kansas State Income Tax Return for the current or previous Tax Year you need to complete Form K-40. Form K-40 is a Form used for the Tax Return and Tax Amendment.

How much money do you have to make in Kansas to file taxes?

Unearned income (such as interest and dividends) over $500 is taxable to Kansas and a Kansas return must be filed. If the taxable income (line 7, Form K-40) is zero, a return is not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify KS DO-41 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including KS DO-41. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Where do I find KS DO-41?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific KS DO-41 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my KS DO-41 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your KS DO-41 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is KS DO-41?

KS DO-41 is a specific tax form used in the state of Kansas for reporting certain income or deductions related to individual taxpayers.

Who is required to file KS DO-41?

Individuals who have specific income types or deductions that need to be reported to the state of Kansas are required to file KS DO-41.

How to fill out KS DO-41?

To fill out KS DO-41, taxpayers must provide personal information, details of their income, and relevant deductions as specified in the form instructions.

What is the purpose of KS DO-41?

The purpose of KS DO-41 is to facilitate the reporting of specific income adjustments and deductions for Kansas state income tax purposes.

What information must be reported on KS DO-41?

KS DO-41 requires reporting of taxpayer identification information, details of income sources, deductions claimed, and any other relevant financial information as required by the form.

Fill out your KS DO-41 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS DO-41 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.