Get the free claim for refund - School Nutrition and Fitness

Show details

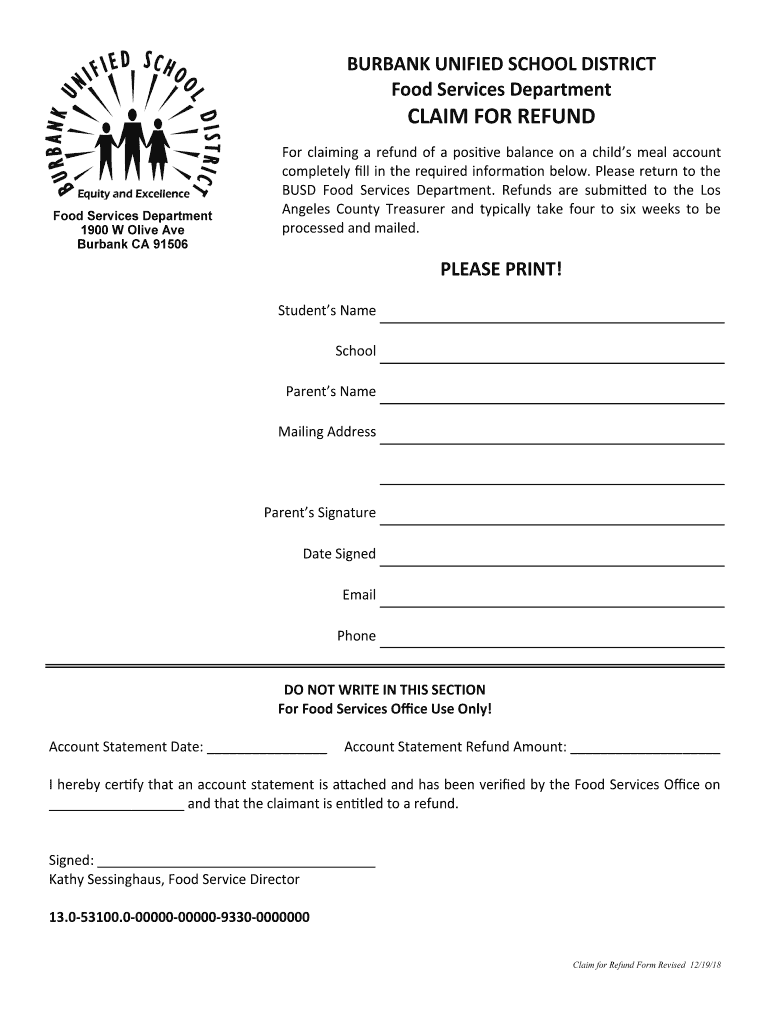

BURBANK UNIFIED SCHOOL DISTRICT

Food Services DepartmentCLAIM FOR Refunded Services Department

1900 W Olive Ave

Burbank CA 91506For claiming a refund of a positive balance on a children meal account

completely

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for refund

Edit your claim for refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for refund online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit claim for refund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for refund

How to fill out claim for refund

01

Step 1: Gather all the necessary documents and information related to the refund, such as receipts, invoices, and proof of purchase.

02

Step 2: Carefully read the refund policy of the company or organization from which you are seeking a refund. Understand the specific requirements and conditions for eligibility.

03

Step 3: Contact the customer service department of the company or organization to inquire about the specific process for submitting a claim for refund. They may provide you with a specific form or direct you to an online portal.

04

Step 4: Fill out the claim form accurately and provide all the requested information. Make sure to include supporting documentation to strengthen your case, if required.

05

Step 5: Double-check all the information provided in the claim form for accuracy and completeness. Errors or missing information may lead to delays in processing your refund.

06

Step 6: Submit the completed claim form and supporting documentation either online, via mail, or through any other specified method provided by the company or organization.

07

Step 7: Keep a copy of the claim form and all the supporting documents for your records. It's always good to have a reference in case of any future issues or disputes.

08

Step 8: Follow up with the company or organization if you don't receive a response within the specified time frame. Inquire about the status of your claim and ask for any updates.

09

Step 9: Once your claim is approved, carefully review the refund amount and the mode of refund (e.g., credit back to your payment card, cheque, or bank transfer). If you have any concerns or discrepancies, contact the company's customer service for clarification.

10

Step 10: If your claim is denied or rejected, review the reasons provided by the company or organization. If you believe the decision is unfair or unjust, you may consider reaching out to a consumer protection agency or seeking legal advice.

Who needs claim for refund?

01

Anyone who has made a purchase and wishes to seek a refund for various reasons such as receiving defective or damaged goods, dissatisfaction with the product or service, cancellation of an event or reservation, or any other legitimate grounds as per the refund policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claim for refund without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like claim for refund, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute claim for refund online?

Completing and signing claim for refund online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit claim for refund on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign claim for refund on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is claim for refund?

A claim for refund is a formal request made by a taxpayer to the government to return excess payments made to the tax authorities.

Who is required to file claim for refund?

Any taxpayer who believes they have overpaid taxes and is seeking a refund is required to file a claim for refund.

How to fill out claim for refund?

To fill out a claim for refund, taxpayers must provide details of the overpayment, including the amount, the tax year in question, and any supporting documentation.

What is the purpose of claim for refund?

The purpose of a claim for refund is to request the return of excess payments made to the tax authorities.

What information must be reported on claim for refund?

Information such as the overpaid amount, the tax year in question, and any supporting documentation must be reported on a claim for refund.

Fill out your claim for refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.