Get the free Texas Exemption Certificate - Xcel Energy

Show details

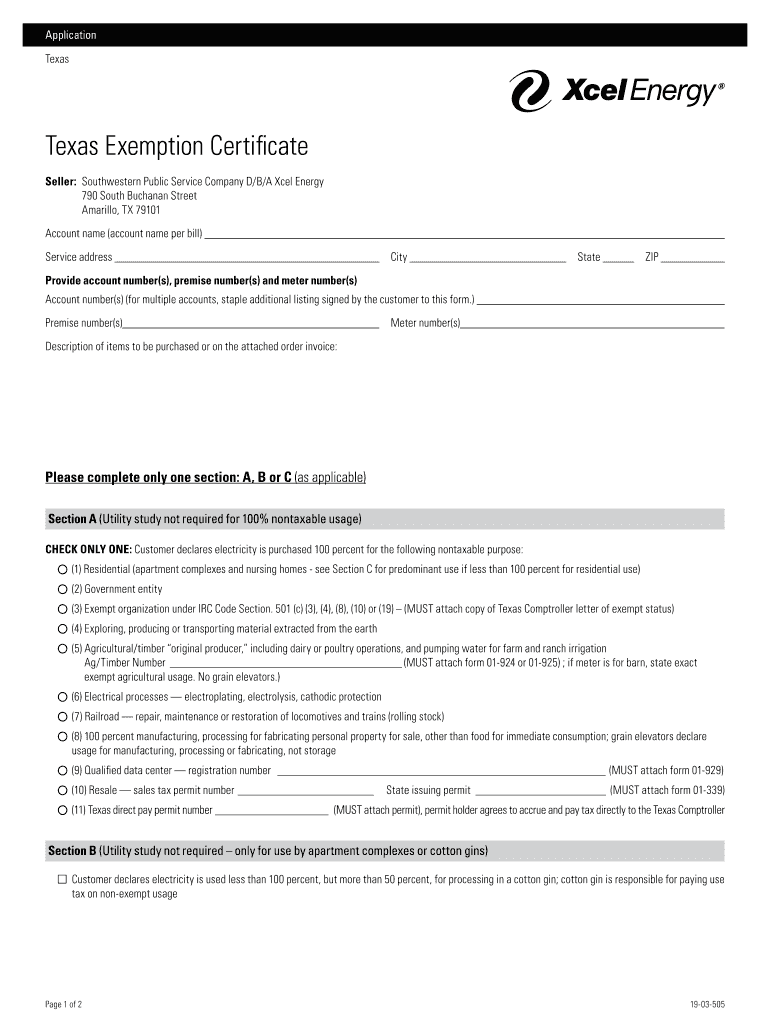

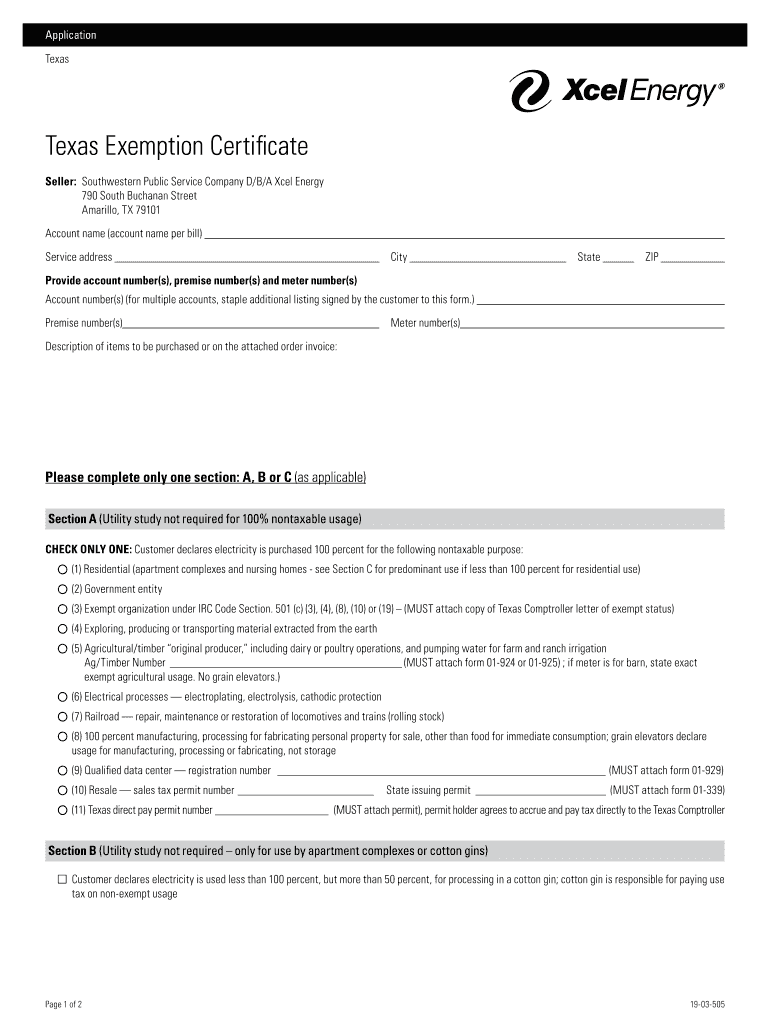

Application

Texas

Clear Texas Exemption Certificate

Seller:Southwestern Public Service Company D/B/A Excel Energy790 South Buchanan Street Amarillo, TX 79101

Account name (account name per bill)Service

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas exemption certificate

Edit your texas exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas exemption certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas exemption certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas exemption certificate. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas exemption certificate

How to fill out texas exemption certificate

01

To fill out Texas exemption certificate, follow the steps below:

02

Obtain the Texas exemption certificate form. This can be found on the official website of the Texas Comptroller of Public Accounts.

03

Fill out the general information section of the form, including your full name, address, and the name of your business.

04

Indicate the reason for claiming the exemption by selecting the appropriate category from the provided options. These categories may include agricultural production, manufacturing, resale, etc.

05

Provide any additional required information specific to the category you selected. This may include details about the goods or services you offer, your industry classification code, or any supporting documentation that may be necessary.

06

Review the completed form to ensure accuracy and completeness.

07

Sign and date the form.

08

Submit the completed exemption certificate to the appropriate authority as instructed on the form. This may vary depending on your specific circumstances and usage of the certificate.

09

Keep a copy of the exemption certificate for your records.

10

Note: It is always recommended to consult with a tax professional or advisor for guidance specific to your situation.

Who needs texas exemption certificate?

01

Individuals or businesses in Texas who engage in certain activities or transactions may need a Texas exemption certificate.

02

Specific examples of those who may need a Texas exemption certificate include:

03

- Businesses engaged in reselling products or services, as they may be eligible to claim an exemption from paying sales tax on purchases made for resale.

04

- Manufacturers who purchase raw materials or components to be used in the production of a finished product.

05

- Farmers or agricultural producers who purchase goods used in their farming operations.

06

- Non-profit organizations that qualify for tax-exempt status.

07

It is important to note that the specific eligibility requirements for obtaining a Texas exemption certificate may vary depending on the nature of the exemption being claimed. It is recommended to consult with the Texas Comptroller of Public Accounts or a tax professional for guidance specific to your circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit texas exemption certificate from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including texas exemption certificate, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in texas exemption certificate?

With pdfFiller, it's easy to make changes. Open your texas exemption certificate in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out texas exemption certificate on an Android device?

Use the pdfFiller mobile app and complete your texas exemption certificate and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is texas exemption certificate?

A Texas exemption certificate is a document used to claim an exemption from sales tax on qualifying purchases.

Who is required to file texas exemption certificate?

Any individual or business making a purchase that qualifies for a sales tax exemption in Texas is required to file a Texas exemption certificate.

How to fill out texas exemption certificate?

To fill out a Texas exemption certificate, you need to provide your name or business name, address, Texas sales tax permit number, and reason for the sales tax exemption.

What is the purpose of texas exemption certificate?

The purpose of a Texas exemption certificate is to allow individuals or businesses to claim a sales tax exemption on qualifying purchases.

What information must be reported on texas exemption certificate?

The information that must be reported on a Texas exemption certificate includes the purchaser's name or business name, address, Texas sales tax permit number, and reason for the exemption.

Fill out your texas exemption certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Exemption Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.