Get the free For a Non-Profit Ownership (NPO) entity to acquire and

Show details

DRC CPP Project 18192

Page 1Request for Proposal (RFP)

For a Nonprofit Ownership (NPO) entity to acquire and

develop a Community Crisis Home

San Diego Regional Center

Community Placement Plan

For

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for a non-profit ownership

Edit your for a non-profit ownership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for a non-profit ownership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing for a non-profit ownership online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit for a non-profit ownership. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

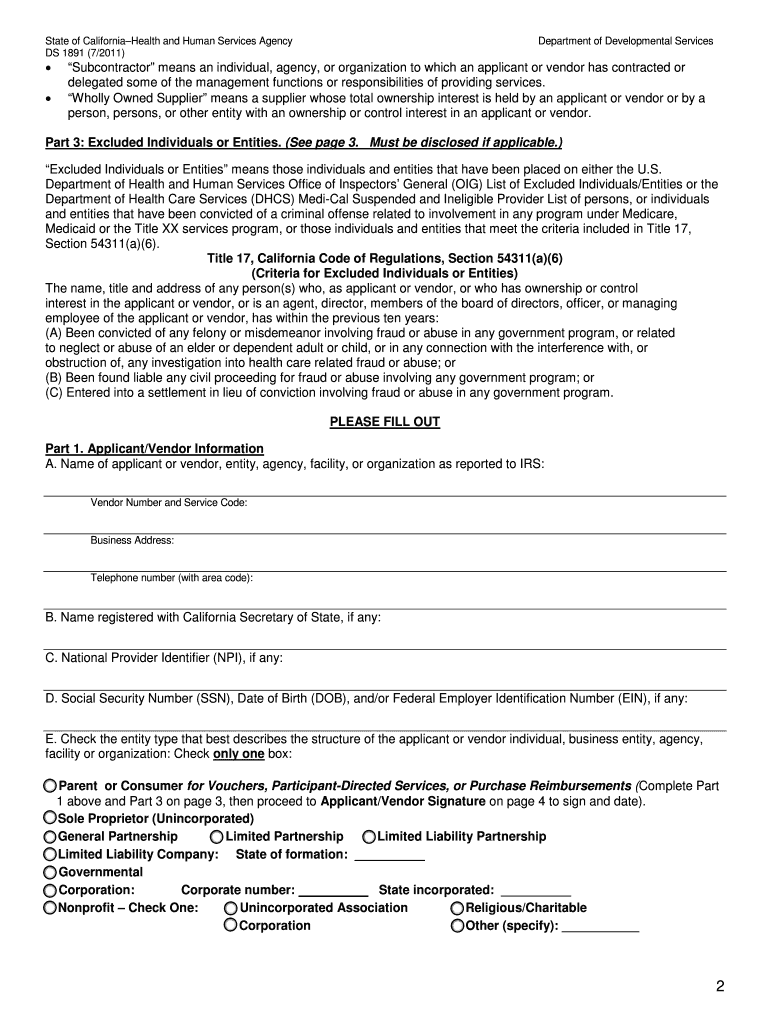

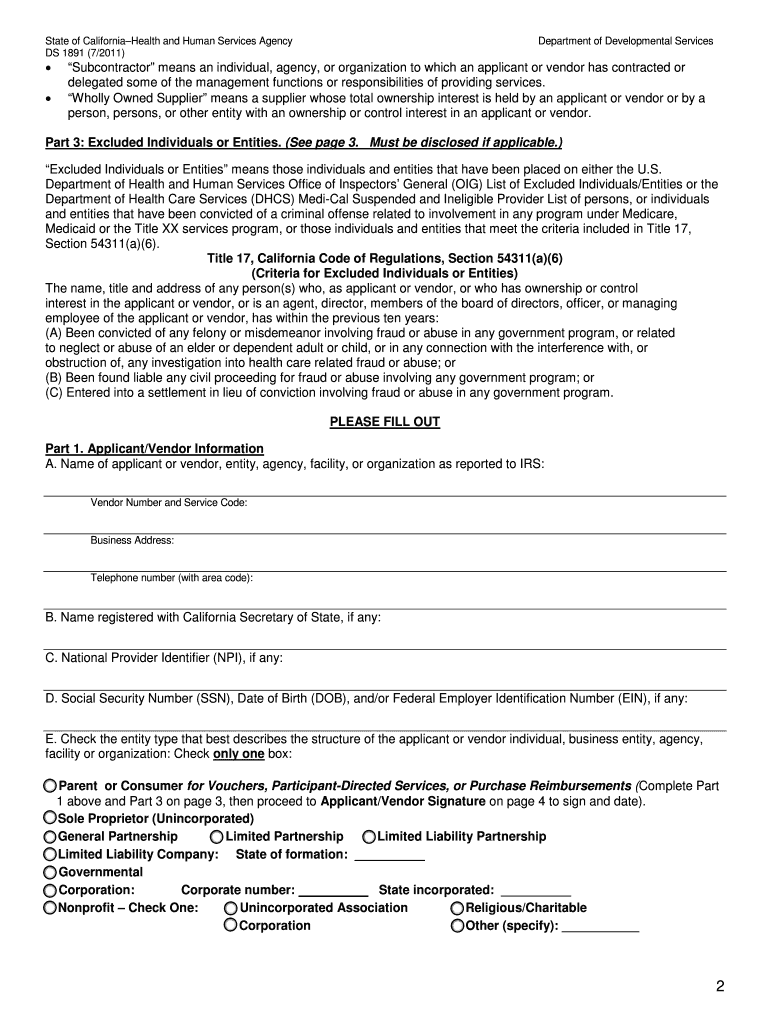

How to fill out for a non-profit ownership

How to fill out for a non-profit ownership

01

Gather information about the non-profit organization, such as its name, purpose, mission, and goals.

02

Determine the type of non-profit ownership structure, whether it is a trust, association, corporation, or foundation.

03

Prepare the necessary documents, including articles of incorporation or formation, bylaws, and any other required legal documents.

04

Consult with an attorney or legal professional to ensure compliance with local, state, and federal laws regarding non-profit organizations.

05

Complete the relevant application forms, providing accurate and detailed information about the organization's leadership, board members, and purpose.

06

Pay any required fees or obtain necessary approvals from government or regulatory agencies.

07

Submit the completed application and all supporting documents to the appropriate authority or government agency.

08

Await the review and approval of the non-profit ownership application, which may take some time.

09

Once approved, ensure ongoing compliance with reporting requirements, tax obligations, and other legal responsibilities.

10

Regularly review and update the non-profit's governance documents and policies to ensure continued compliance and effectiveness.

Who needs for a non-profit ownership?

01

Non-profit ownership is needed by individuals or groups who wish to establish and operate a charitable or socially beneficial organization.

02

This can include organizations dedicated to educational, religious, scientific, literary, or public safety causes, among others.

03

Non-profit ownership may be sought by individuals, community groups, or businesses looking to make a positive impact and receive tax-exempt status.

04

It is important for those seeking non-profit ownership to have a genuine purpose and commitment to the organization's mission and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify for a non-profit ownership without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your for a non-profit ownership into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit for a non-profit ownership online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your for a non-profit ownership to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the for a non-profit ownership electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your for a non-profit ownership in minutes.

What is for a non-profit ownership?

Non-profit ownership refers to an organization or entity that is formed for charitable, religious, educational, or other socially beneficial purposes, rather than for the financial benefit of its owners.

Who is required to file for a non-profit ownership?

Non-profit organizations are required to file for non-profit ownership if they want to attain tax-exempt status and operate as a charitable organization.

How to fill out for a non-profit ownership?

Filling out for a non-profit ownership involves completing the necessary forms such as Form 1023 for federal tax-exempt status, providing information about the organization's mission, activities, and governance structure.

What is the purpose of for a non-profit ownership?

The purpose of a non-profit ownership is to establish and maintain an organization that benefits the public good, such as providing charitable services, promoting education, or advancing social causes.

What information must be reported on for a non-profit ownership?

Non-profit ownership requires reporting information such as the organization's mission statement, activities, governance structure, board members, financial information, and compliance with tax regulations.

Fill out your for a non-profit ownership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For A Non-Profit Ownership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.