Get the free igi life insurance online check annual statement

Show details

Request for Policy Status IGI Life Insurance Limited To:Customer Services & Conservation Departments is to request you to please provide me with the status of my undermentioned Policy(IES): My current

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign igi insurance policy status check form

Edit your igi life insurance claim form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your igi life insurance policy status check form via URL. You can also download, print, or export forms to your preferred cloud storage service.

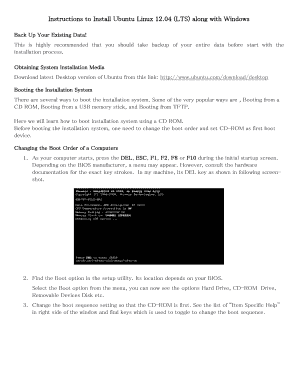

Editing igi life insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit igi insurance check online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out igi life insurance limited form

How to fill out igi life insurance policy:

01

Visit the official website or contact an authorized agent of IGI Life Insurance to obtain the necessary forms and documents required to apply for a policy.

02

Carefully review the application form and make sure to fill out all the sections accurately and truthfully. Provide personal information such as your name, date of birth, address, occupation, and contact details.

03

Determine the coverage amount you require based on your financial needs and goals. Consider factors like outstanding debts, mortgage, education expenses, and living costs for your beneficiaries.

04

Select the type of life insurance policy that suits your requirements. This could be term life insurance, whole life insurance, universal life insurance, or any other product offered by IGI Life Insurance.

05

Provide details about your medical history, including any pre-existing conditions or previous surgeries. This information is crucial for underwriting purposes.

06

Consider adding optional riders or features to your policy, such as critical illness coverage, disability income protection, or premium waiver in case of disability.

07

Review the policy terms, conditions, and exclusions carefully before signing the application form. Make sure you understand all the clauses and have clarifications for any doubts.

08

Pay the required premium amount for the selected policy. IGI Life Insurance offers multiple payment options, including monthly, quarterly, semi-annually, or annually.

09

Submit the completed application form along with any supporting documents, such as identification proof, income proof, and medical reports, as per the instructions provided by IGI Life Insurance.

10

Wait for the application to be reviewed and approved by the insurer. This process may involve medical underwriting or additional document requests.

11

Upon approval, you will receive the policy documents and a policy number. Keep these documents in a safe place and inform your beneficiaries or family members about the policy details.

Who needs igi life insurance policy:

01

Individuals who have dependents and want to financially protect their loved ones in case of untimely death.

02

Breadwinners who want to ensure that their family can maintain their current lifestyle and meet financial obligations in their absence.

03

People with outstanding debts, such as mortgages or loans, who want to ensure that these liabilities are taken care of if they pass away.

04

Business owners or partners who want to safeguard their business interests and ensure a smooth transition of ownership.

05

Individuals with financial goals, such as funding their child's education or leaving a legacy for future generations, can benefit from life insurance.

06

Those who want to use life insurance as an investment tool to accumulate wealth or generate a retirement income stream can consider policies like universal life insurance.

Note: It is advisable to consult with a financial advisor or insurance expert to understand your unique needs and determine the most suitable life insurance policy for you.

Fill

life insurance policy check

: Try Risk Free

People Also Ask about igi insurance online check

Who is the CEO of IGI life insurance?

Syed Hyder Ali is the Executive Director of the Company. He is also the Chief Executive and Managing Director of Packages Ltd., Lahore, Pakistan.

What are the benefits of IGI vitality?

Enjoy the Rewards Weekly Active Rewards. Reach your weekly physical activity target and choose an Easy Tickets voucher to watch a movie for half the price OR a Foodpanda voucher worth PKR 500. Monthly Active Reward. Up to 100% cashback on Samsung wearable device.* Annual Reward (Integrated Benefit)

What are the benefits of life insurance in Pakistan?

Whole Life Insurance The death benefit is guaranteed to be paid to the beneficiaries, regardless of when the policyholder dies. Whole life insurance also accumulates cash value over time, which can be used to pay premiums or borrowed against.

What is the company profile of IGI?

Established in 2001, we are an entrepreneurial business with a risk portfolio of Energy, Property, General Aviation, Construction & Engineering, Ports & Terminals, Marine Cargo, Marine Trades, Contingency, Political Violence, Financial Institutions, General Third-Party Liability (Casualty), Legal Expenses, Professional

How do I find a life insurance policy for a deceased parent?

There are ways you can find a parent's life insurance policy, though you may not be a beneficiary. Checking filing cabinets, safety deposit boxes or other areas a parent may keep information can help you locate the policy. If you still can't find a policy, consider using the NAIC life insurance policy locator.

Is there a database for life insurance policies?

That's where the Life Insurance Policy Locator comes in. This free online tool is maintained by the NAIC and requests are secure and confidential. Any matches found by participating insurers are reported to state insurance agencies through the NAIC Life Policy Locator.

How can I check the status of a life insurance policy?

5 ways to find someone's life insurance policy Using Life Policy Locators from NAIC, MIB Group, or NAUPA. Reaching out to financial contacts. Combing through old documentation. Submitting a request to state registries. Reaching out to the life insurance company directly.

What is the full form of IGI in insurance?

IGI - International General Insurance Co. Ltd. - IGI.

Who is the founder of IGI insurance?

The success story of IGI was grounded in the lofty ambition of the founder, Mr. Remi Olowude (1951-2014), a distinguished insurance professional reputed for revolutionising the insurance industry in Nigeria.

Can you find out if someone took out a life insurance policy on you?

Speak to an agent. The NAIC is the most widely used life insurance policy locator. Other resources that may provide a similar service include: Certain states have a State Department of Insurance life insurance policy locator. Several major life insurance companies provide their own online life insurance policy finder.

How do I check my life insurance policy status?

Check the State Controller's Office Life Insurance Settlement Property Search engine or call them at 800-992-4647.

What is the return policy of IGI life insurance?

If you cancel your policy within a free look period of 14 days from the date of receipt of the policy documents, you are entitled for a full refund of premium less any expenses incurred by IGI Life in connection with your medical or clinical examinations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my igi life insurance online in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your igi life insurance online and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send igi life insurance online to be eSigned by others?

igi life insurance online is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the igi life insurance online in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your igi life insurance online in seconds.

What is igi life insurance policy?

IGI Life Insurance Policy is a financial product that provides coverage in the event of the policyholder's death, offering a payout to beneficiaries. It may also include savings or investment components.

Who is required to file igi life insurance policy?

Individuals seeking life insurance coverage, such as policyholders or applicants, are required to fill out and submit the igi life insurance policy application.

How to fill out igi life insurance policy?

To fill out the igi life insurance policy, you need to provide personal information, such as name, age, occupation, and health details, along with the desired coverage amount and premium payment options.

What is the purpose of igi life insurance policy?

The purpose of the igi life insurance policy is to provide financial protection and support to the policyholder's beneficiaries in the event of their untimely death, helping them manage expenses and maintain financial stability.

What information must be reported on igi life insurance policy?

Information required on the igi life insurance policy includes personal details, health history, occupation, lifestyle habits, beneficiary information, and the amount of coverage desired.

Fill out your igi life insurance online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Igi Life Insurance Online is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.