Get the free Declarations of trust and addendumsNational Bank Financial

Show details

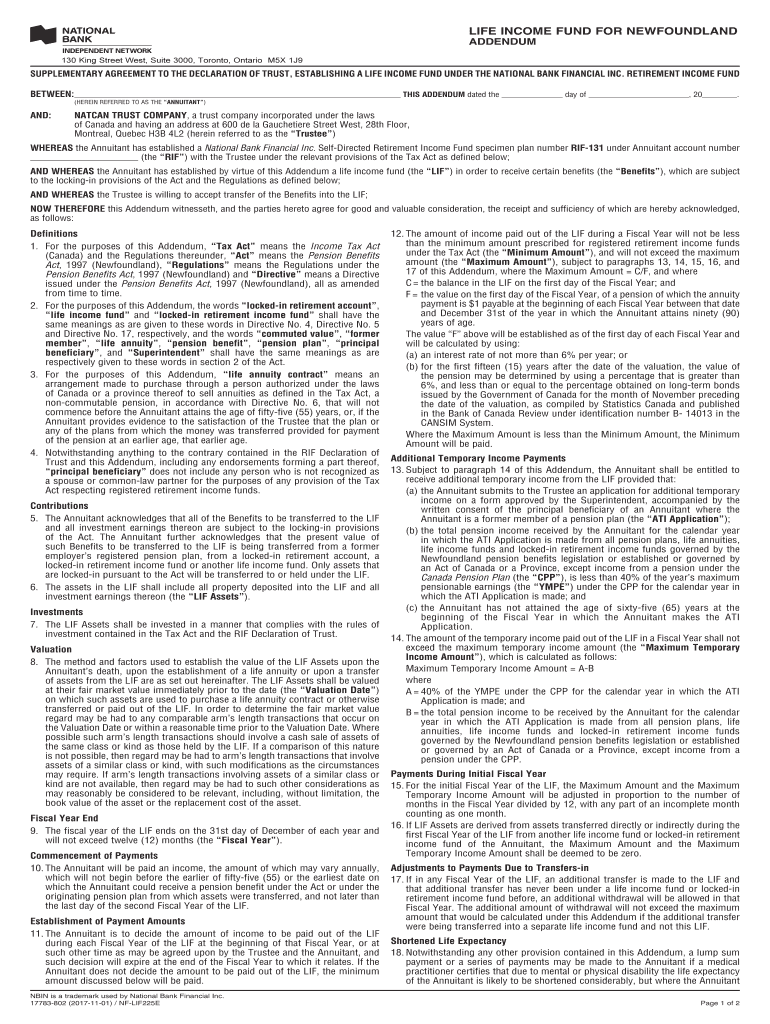

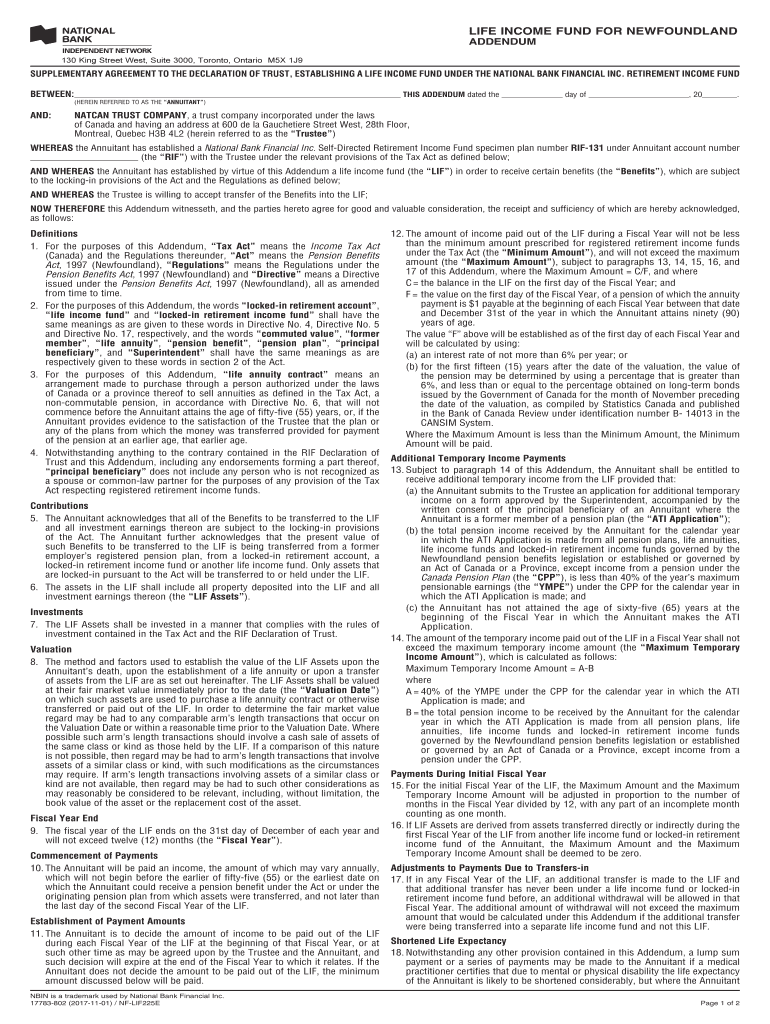

LIFE INCOME FUND FOR NEWFOUNDLAND ADDENDUM 130 King Street West, Suite 3000, Toronto, Ontario M5X 1J9SUPPLEMENTARY AGREEMENT TO THE DECLARATION OF TRUST, ESTABLISHING A LIFE INCOME FUND UNDER THE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declarations of trust and

Edit your declarations of trust and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declarations of trust and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declarations of trust and online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit declarations of trust and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declarations of trust and

How to fill out declarations of trust and

01

To fill out a declaration of trust, follow these steps:

02

Begin by providing the details of the settlor, the person creating the trust. Include their full name, address, and contact information.

03

Identify the trustee, the person or entity responsible for managing the assets in the trust. Provide their name, address, and contact information as well.

04

Clearly state the purpose of the trust and describe the assets that will be included in it. Specify whether it is a revocable or irrevocable trust.

05

Outline any specific instructions or conditions related to the trust. This could include the distribution of assets, the management of investments, or any restrictions on the use of funds.

06

Include provisions for the replacement of the trustee and any alternate beneficiaries in case the original trustee or beneficiary is unable or unwilling to fulfill their duties.

07

Determine the duration of the trust, whether it is for a fixed period or continues indefinitely until certain conditions are met.

08

Consider adding a provision for the amendment or revocation of the trust if necessary.

09

Review the declaration of trust thoroughly for accuracy and completeness before signing and dating it.

10

Make sure all parties involved in the trust, including the settlor, trustee, and witnesses, sign the declaration of trust in the presence of a notary public.

11

Keep a copy of the filled-out declaration of trust for your records. Consider consulting with a legal professional for guidance and to ensure compliance with applicable laws and regulations.

Who needs declarations of trust and?

01

Declarations of trust can be beneficial for various individuals and entities, including:

02

- Individuals looking to protect their assets and ensure their proper distribution to beneficiaries upon their death.

03

- Parents or guardians who want to set up a trust to manage and protect assets for their children until they reach a certain age or meet specific conditions.

04

- Business owners who wish to separate certain assets or property from their personal holdings to minimize liability and protect them from business risks.

05

- Charitable organizations that receive donations and need to manage and distribute the funds according to specific guidelines and purposes.

06

- Investors who want to establish a trust to hold and manage their assets, such as real estate, stocks, or other investments. This can provide benefits like asset protection and tax planning.

07

It is advisable to consult with a legal professional to determine if a declaration of trust is suitable and beneficial for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send declarations of trust and to be eSigned by others?

When your declarations of trust and is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the declarations of trust and in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your declarations of trust and in minutes.

How do I edit declarations of trust and on an iOS device?

Create, modify, and share declarations of trust and using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is declarations of trust and?

Declarations of trust are legal documents that establish the ownership of assets and specify how those assets are to be managed or distributed.

Who is required to file declarations of trust and?

Individuals or entities that have created a trust or are named as beneficiaries or trustees in a trust are required to file declarations of trust.

How to fill out declarations of trust and?

Declarations of trust can be filled out by providing detailed information about the trust, including the names of the parties involved, the assets included in the trust, and the terms of the trust.

What is the purpose of declarations of trust and?

The purpose of declarations of trust is to provide transparency and clarity regarding the ownership and management of assets held in trust.

What information must be reported on declarations of trust and?

Information such as the names of the parties involved, a description of the assets held in trust, and the terms of the trust must be reported on declarations of trust.

Fill out your declarations of trust and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declarations Of Trust And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.