IRS 8879-EO 2019 free printable template

Show details

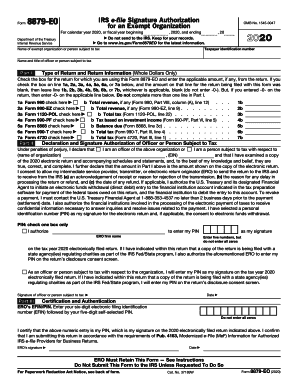

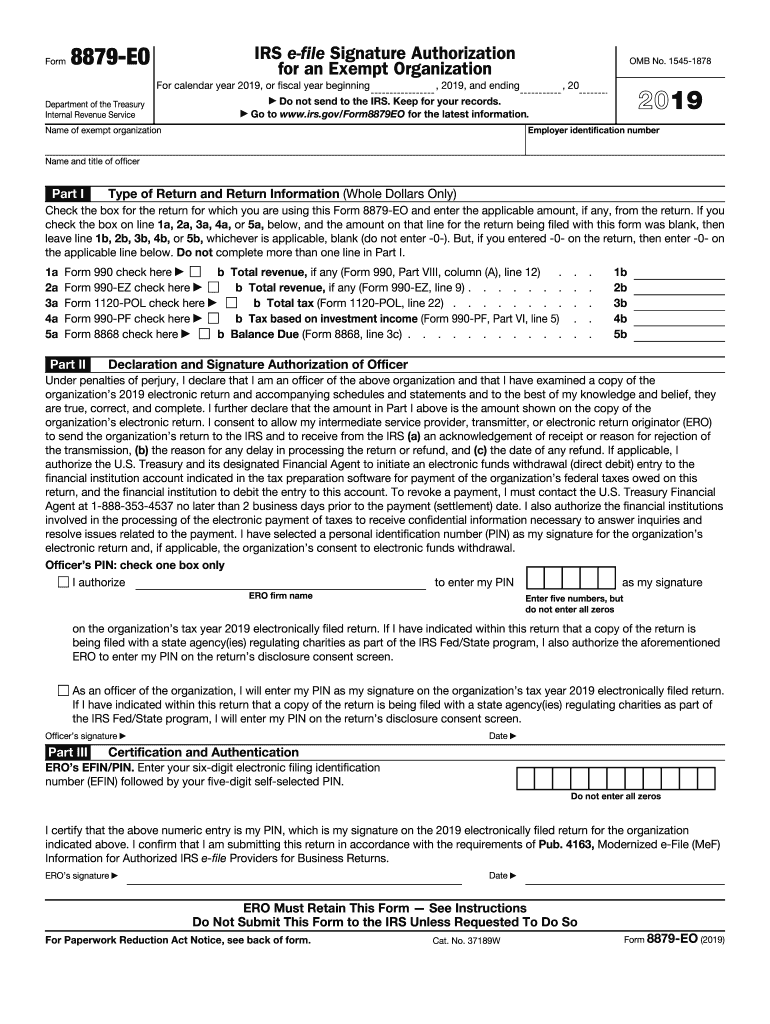

Form8879EOIRS file Signature Authorization for an Exempt Organization calendar year 2019, or fiscal year beginning OMB No. 15451878, 2019, and ending, 202019Do not send to the IRS. Keep for your records.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8879-EO

How to edit IRS 8879-EO

How to fill out IRS 8879-EO

Instructions and Help about IRS 8879-EO

How to edit IRS 8879-EO

To edit IRS 8879-EO, you can utilize online tools like pdfFiller. These tools allow users to modify text fields and make necessary adjustments. Once the editing is complete, ensure that the document maintains its integrity and complies with IRS guidelines.

How to fill out IRS 8879-EO

Filling out IRS 8879-EO involves several steps for accuracy. Follow the guide below to ensure proper completion:

01

Gather required information, including your organization's Employer Identification Number (EIN) and the name of the officer authorized to sign.

02

Enter the tax year and confirm that the information provided aligns with what is reported on the corresponding Form 990 or 990-EZ.

03

Confirm that the authorized officer's signature is present to authenticate the filing.

04

Review the completed form carefully before final submission.

About IRS 8879-EO 2019 previous version

What is IRS 8879-EO?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8879-EO 2019 previous version

What is IRS 8879-EO?

IRS 8879-EO is a tax form used by exempt organizations to authorize the electronic filing of their Form 990 or Form 990-EZ. This form ensures that the organization's designated officer provides consent for electronic submission. It simplifies the filing process by streamlining the electronic signature requirement.

What is the purpose of this form?

The purpose of IRS 8879-EO is to provide a secure and efficient method for organizations to electronically file their annual information returns. The form safeguards against unauthorized filings by ensuring that only authorized personnel can approve the submission. This process helps maintain the integrity of the information reported to the IRS.

Who needs the form?

IRS 8879-EO is required for any tax-exempt organization that chooses to file their IRS Form 990 or 990-EZ electronically. This includes charities, nonprofit entities, and other qualifying groups that meet IRS criteria for tax exemption. Organizations must ensure that the appropriate representative signs this form to validate the electronic submission.

When am I exempt from filling out this form?

Organizations that choose to file their Form 990 or 990-EZ by mail do not need to complete IRS 8879-EO. Additionally, if an organization is not eligible for electronic filing based on their size, type, or other IRS restrictions, they do not require this form. It is essential to review IRS guidelines to determine your filing obligations accurately.

Components of the form

IRS 8879-EO contains several key components, including the organization's identification information, the signature area for the authorized officer, and sections confirming the organization's compliance with IRS rules. Proper completion ensures all necessary information is included for validation of the electronic filing.

What are the penalties for not issuing the form?

Not issuing IRS 8879-EO when filing electronically can result in complications with the IRS. The primary penalty involves the potential rejection of the electronic filing, which can lead to late fees or penalties for failure to file. Ensuring that this form is included when claiming electronic filing is critical to avoid these repercussions.

What information do you need when you file the form?

When filing IRS 8879-EO, you need comprehensive details about your organization, including the EIN, the names of the officers, and the specific tax year being filed. It's also necessary to include any prior filings that may influence the current return. Gathering this information beforehand will aid in completing the form accurately.

Is the form accompanied by other forms?

IRS 8879-EO is typically submitted alongside Form 990 or 990-EZ. These forms must correlate in terms of reported data to ensure compliance with IRS regulations. Other supplemental forms may be required based on the organization's specific situation, so reviewing IRS requirements is advisable.

Where do I send the form?

Once completed, IRS 8879-EO should not be mailed separately to the IRS. It serves as a part of the electronic filing process and is electronically submitted during the filing of Form 990 or 990-EZ. Make sure that any filing confirmations are retained for your records.

See what our users say