IRS 2350 2019 free printable template

Show details

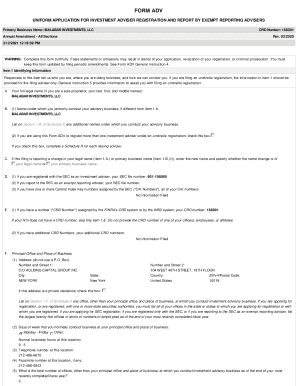

File a Paper Form 2350 If you wish to file on paper instead of electronically fill in the Form 2350 and mail it to the address shown under Where To File below. Write your social security number daytime phone number and 2017 Form 2350 on your check or money order. Attach a statement to your return not to the Form 2350 explaining the reason. Page 4 Late filing penalty. You should file Form 2350 early enough so that if it isn t approved you can still file your return on time. Who Should File You...should file Form 2350 if all three of the following apply. 1. You are a U.S. citizen or resident alien. 2. For more information go to www.irs.gov/payments. Paying by Check or Money Order When paying by check or money order with Form 2350 see Where To File on page 3. Do not send in Form 2350 if you file electronically. If you think you may owe tax and wish to make a payment see How To Make a Payment With Your Extension on page 4. Agents Always include taxpayer s name on Return Label. Cat. No....11780H Form 2350 2017 This page left blank intentionally Page 3 It s Convenient Safe and Secure IRS e-file is the IRS s electronic filing program. You can get an extension of time to file your tax return by filing Form 2350 electronically. Form Application for Extension of Time To File U*S* Income Tax Return OMB No* 1545-0074 For U*S* Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment Please print or type. See instructions on page 3. Go to www*irs*gov/Form2350...for the latest information* Department of the Treasury Internal Revenue Service Your first name and initial Last name Your social security number If a joint return spouse s first name and initial Spouse s social security number Home address number and street. If you have a P. O. box see instructions. File by the due date for filing your return* City town or post office state and ZIP code. If you have a foreign address enter only the city name on this line then complete the spaces below see...instructions. Foreign country name Foreign province/county Foreign postal code Please fill in the Return Label at the bottom of this page. 4a I request an extension of time until to file my income tax return for the calendar year 2017 or other tax year ending because my tax home is in a foreign country and I expect to qualify for special tax treatment by meeting the bona fide residence test or the physical presence test see instructions. Were you previously granted an extension of time to file...for this tax year. Yes No Will you need additional time to allocate moving expenses. Date you first arrived in the foreign country b Date qualifying period begins c ends Your foreign home address d Date you expect to return to the United States Note This is not an extension of time to pay tax. Full payment is required to avoid interest and late payment charges. Enter the amount of income tax paid with this form. Signature and Verification Under penalties of perjury I declare that I have examined...this form including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete and if prepared by someone other than the taxpayer that I am authorized to prepare this form* Signature of taxpayer Date Signature of spouse Signature of preparer other than taxpayer agent acting for you enter the other address and add the agent s name.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 2350

How to edit IRS 2350

How to fill out IRS 2350

Instructions and Help about IRS 2350

How to edit IRS 2350

Editing IRS 2350 can be essential if you find errors after completing the form. To make corrections, you should first print the original completed form. Then, make the necessary changes with black or blue ink, ensuring the corrections are clear and legible. After editing, the corrected form must be submitted through the appropriate channels to ensure compliance.

How to fill out IRS 2350

Filling out IRS Form 2350 is straightforward but requires attention to detail. Follow these steps:

01

Obtain a copy of Form 2350 from the IRS website or through authorized sources.

02

Complete personal information, such as your name and Social Security number, in the designated fields.

03

Fill out the specifics regarding your tax situation, including any foreign income details if applicable.

04

Review each section for accuracy before signing and dating the form.

About IRS 2 previous version

What is IRS 2350?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 2 previous version

What is IRS 2350?

IRS Form 2350, titled "Application for Extension of Time to File U.S. Income Tax Return," is used by U.S. taxpayers abroad or those with eligible foreign income to request an extension of time to file their federal income tax returns. This form is particularly beneficial for individuals who need additional time to report their income accurately.

What is the purpose of this form?

The primary purpose of IRS Form 2350 is to provide taxpayers with an opportunity to extend the filing deadline for their tax returns, allowing for up to six additional months to prepare accurate submissions. This extended timeframe is crucial for individuals requiring more time due to complex foreign earnings or tax situations.

Who needs the form?

Taxpayers who are U.S. citizens or resident aliens living abroad and planning to claim the foreign income exclusion or the foreign tax credit typically need to file IRS Form 2350. Additionally, those anticipating delays in collecting necessary documentation for accurate reporting should also utilize this form.

When am I exempt from filling out this form?

Individuals may be exempt from filling out IRS Form 2350 if they do not owe any taxes or if they have already made arrangements for timely filing through other IRS extensions. Additionally, non-resident aliens who meet certain criteria may not be required to file this form.

Components of the form

IRS Form 2350 consists of several components, including personal identification information, details about the foreign income claimed, the reason for requesting the extension, and any relevant dates. Ensuring the accuracy of each component is essential to prevent processing delays.

What are the penalties for not issuing the form?

Failing to file IRS Form 2350 or submitting your tax return late without an accepted extension can lead to significant penalties. These penalties may include late fees, interest on unpaid taxes, and additional charges for failing to file. To avoid these consequences, timely submission is crucial.

What information do you need when you file the form?

When filing IRS Form 2350, you will need detailed information including your name, Social Security number, address, tax year for which you’re requesting an extension, and an explanation of why you need additional time. Having this information ready will facilitate a smoother filing process.

Is the form accompanied by other forms?

IRS Form 2350 may not need to be accompanied by other forms; however, if you are claiming extension on a specific tax return that requires supporting documentation, you should ensure to include these additional forms if applicable.

Where do I send the form?

Once completed, IRS Form 2350 should be mailed to the address listed in the instructions specific to your situation. Ensure that you send the form to the correct IRS office to avoid delays in processing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.