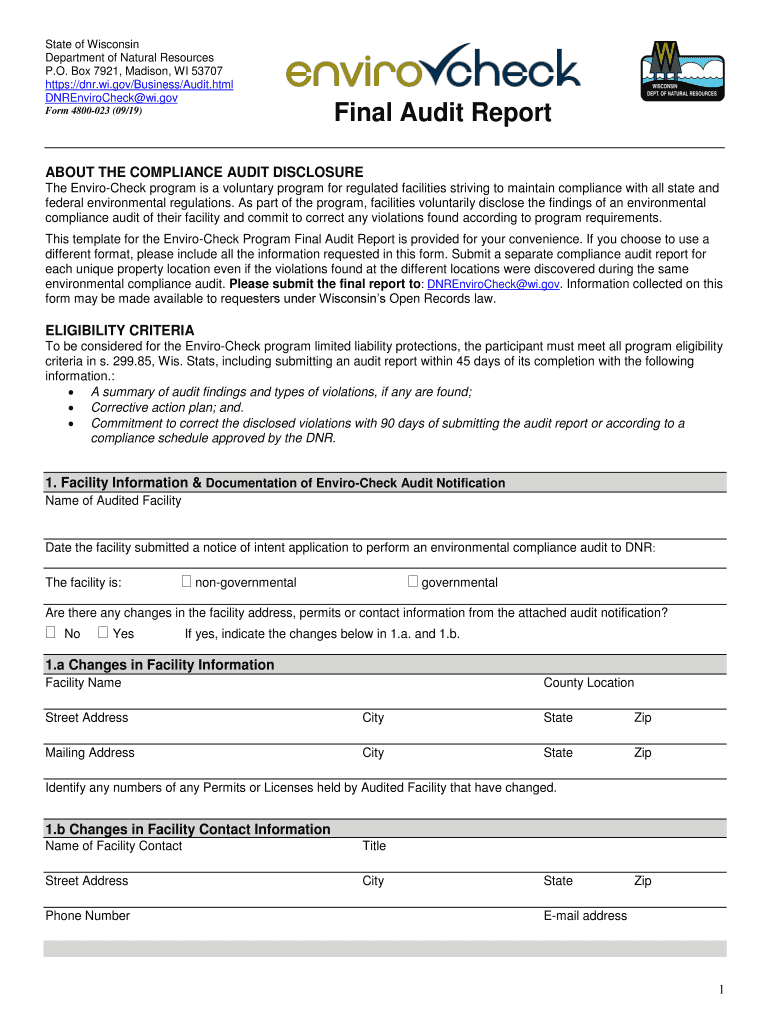

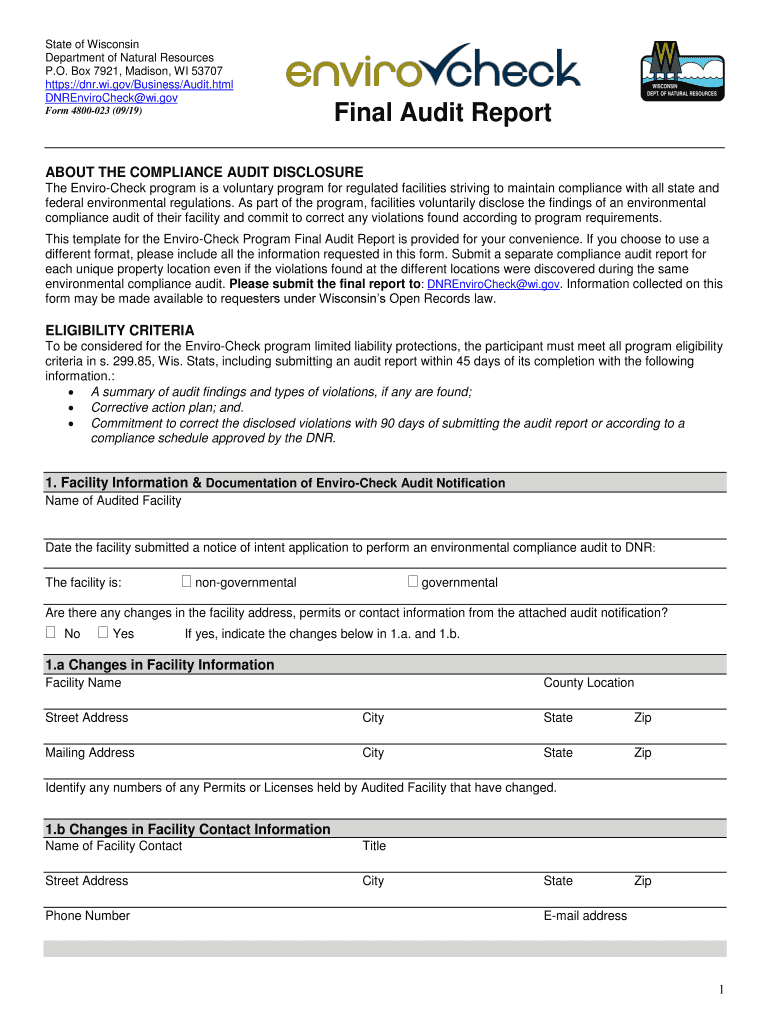

WI 4800-023 2019 free printable template

Get, Create, Make and Sign WI 4800-023

Editing WI 4800-023 online

Uncompromising security for your PDF editing and eSignature needs

WI 4800-023 Form Versions

How to fill out WI 4800-023

How to fill out WI 4800-023

Who needs WI 4800-023?

Instructions and Help about WI 4800-023

Music you Music welcome to our continuing 2019 educational webinar series I am Catherine short partnership marketing manager for first Healthcare Compliance at first health care compliance we help you with a comprehensive compliance management solution tailored to your business a hospital hospital network health care practice of any size billing company or skilled nursing facility as part of our complimentary educational webinar series we bring you experts from around the country to discuss relevant topics in the healthcare industry we are so pleased to have Pam Joslin mm CPC CMC CMAs See Mom cm Co SEMA cm CA East m with us today pam has more than 20 years of medical practice management billing and coding reimbursement auditing and compliance experience she is an engaging presenter via webinar classroom and conference on various topics that impact each step of the revenue cycle in healthcare practices pam has managed in medical practices ranging from single to multi specialty groups including ASC she is an advocate of process improvement and maximizing and empowering employees to bring about the best practice results to your organization she received her master's of management from the University of Phoenix Pam ment maintains met memberships in professional organizations to support her continuing cycle of learning in the ever-changing healthcare industry pam is a part-time instructor in the college of health care professionals where she actively serves on their advisory board and the CEO of her own consulting firm innovative healthcare consulting a copy of the slides is available for download on the control panel feel free to submit questions into the question box on your control panel during the presentation we will address questions at the conclusion of the presentation your PACOM and PMI CEU certificates will be emailed to you following the broad cast your PACOM certificate will come directly from PACOM and your PMI certificate will come from our email there is no need to request either one additional CEU opportunities will be available for two BC advantage members following the live broadcast see their website for details a download of the handout is available with a button on the bottom right-hand side of your screen so Pam welcome thank you very much Catherine it's my translator feedback with you today and to be able to talk to everyone about the compliance program effectiveness taking a closer look at auditing and monitoring for ages the Office of Inspector General that are known to us as uoy G has been reminding it that one of the seven critical elements of the compliance program is the ongoing auditing and monitoring so we're going to look at in this webinar so the steep differences and also looking at the relationship and the roles and responsibilities between these two functions how they should operate independently for your organization and also how they work together in tandem to ensure that your organization is fully compliant and...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the WI 4800-023 in Chrome?

Can I create an electronic signature for signing my WI 4800-023 in Gmail?

How do I fill out WI 4800-023 on an Android device?

What is WI 4800-023?

Who is required to file WI 4800-023?

How to fill out WI 4800-023?

What is the purpose of WI 4800-023?

What information must be reported on WI 4800-023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.