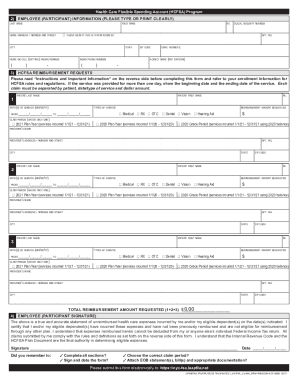

NY Health Care Flexible Spending Account (HCFSA) Program Claims Form 2019 free printable template

Show details

Print Forrest Fields

Health Care Flexible Spending Account (CSA) Program

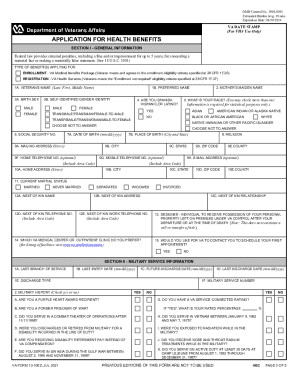

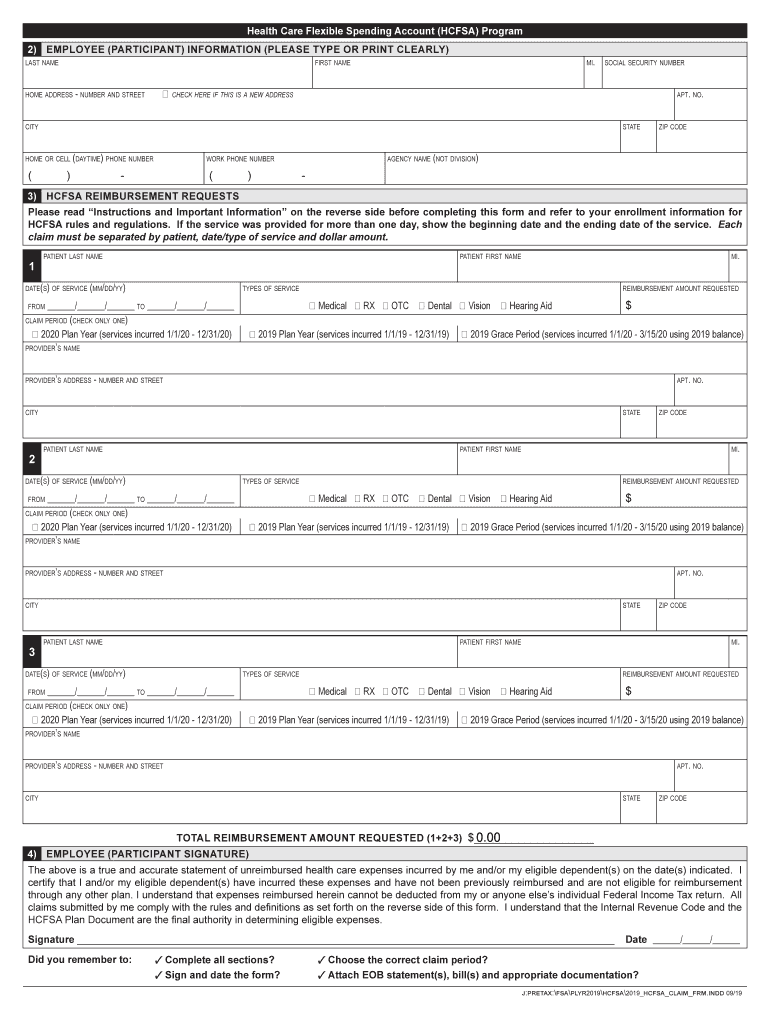

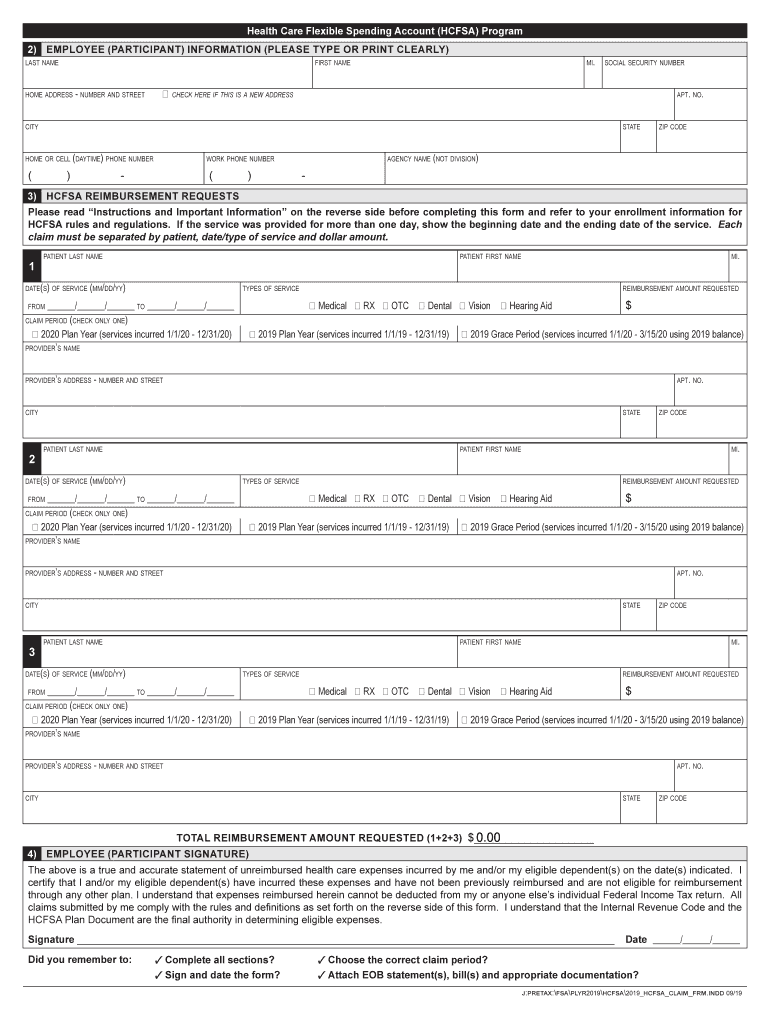

2) EMPLOYEE (PARTICIPANT) INFORMATION (PLEASE TYPE OR PRINT CLEARLY)

last name me. First name home address number and street

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY Health Care Flexible Spending Account

Edit your NY Health Care Flexible Spending Account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY Health Care Flexible Spending Account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY Health Care Flexible Spending Account online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY Health Care Flexible Spending Account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Health Care Flexible Spending Account (HCFSA) Program Claims Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY Health Care Flexible Spending Account

How to fill out NY Health Care Flexible Spending Account (HCFSA)

01

Obtain the HCFSA enrollment form from your employer or the NY Health website.

02

Fill out your personal information including your name, address, and Social Security number.

03

Select the amount you wish to contribute to your HCFSA for the plan year.

04

Review the eligible expenses list and select the services you plan to use.

05

Sign and date the form to certify your agreement to the terms.

06

Submit the completed form to your HR department or benefits administrator by the deadline.

Who needs NY Health Care Flexible Spending Account (HCFSA)?

01

Employees looking to save on out-of-pocket health care costs.

02

Individuals with anticipated medical expenses such as co-pays, deductibles, and prescriptions.

03

Those seeking to maximize their tax savings by using pre-tax dollars for eligible expenses.

04

Families with dependents needing regular medical care or services.

Fill

form

: Try Risk Free

People Also Ask about

What does an FSA not cover?

Eligible & Ineligible Expenses These items include antacids, allergy medicine, pain relievers, cold medicine, feminine products and more. Any item that is purchased to maintain good health and not to treat or alleviate an illness or injury is not reimbursable.

What is the purpose of an FSA account?

A flexible spending account or arrangement is an account you use to save on taxes and pay for qualified expenses. Other key things to know about FSAs are: Your employer provides and owns the account. Only you and your employer can put money in an FSA, up to a limit set each year by the IRS.

What qualifies for FSA reimbursement?

The IRS determines which expenses are eligible for reimbursement. Eligible expenses include health plan co-payments, dental work and orthodontia, eyeglasses and contact lenses, and prescriptions. This type of FSA is offered by most employers. It covers medical, dental, vision, and pharmacy expenses.

How long does it take for FSA to reimburse?

Most claims are processed within one to two business days after they are received and verified. Payments are sent shortly thereafter via direct deposit. You can update your direct deposit information any time through your online account.

How are FSA reimbursements paid?

Set up direct deposit, and once a claim has been processed and approved, your reimbursement will be deposited directly into your bank account. This is the quickest and most secure way to receive your reimbursements. Plus, there's no waiting around for a check in the mail.

What does an FSA pay for?

Kinds of FSAs Your employer will tell you which one of these FSAs is available to you. Also called a medical FSA, you use it to pay for qualified medical, pharmacy, dental and vision expenses as defined in Publication 502 from the IRS. Sometimes, employers offer an account called a post-deductible health FSA.

What is the difference between FSA and Hcfsa?

The most significant difference between flexible spending accounts (FSA) and health savings accounts (HSA) is that an individual controls an HSA and allows contributions to roll over, while FSAs are less flexible and are owned by an employer.

Does FSA reimburse?

With an FSA, you submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that it hasn't been covered by your plan. Then, you'll get reimbursed for your costs. Ask your employer about how to use your specific FSA.

What can you use Hcfsa for?

A Health Care FSA (HCFSA) is a pre-tax benefit account that's used to pay for eligible medical, dental, and vision care expenses - those not covered by your health care plan or elsewhere. It's a smart, simple way to save money while keeping you and your family healthy and protected.

Is FSA money available immediately?

For the Healthcare FSA, all funds selected will be immediately available to you on day one of your plan and you do not need to wait to accrue the funds. For example, if you enroll on January 1st and elect to defer $500 in total for the year to your FSA, you could spend all $500 on the first day the plan is effective.

What expenses are eligible for flexible spending account?

Allowed expenses include insurance copayments and deductibles, qualified prescription drugs, insulin, and medical devices. You decide how much to put in an FSA, up to a limit set by your employer. You aren't taxed on this money.

What happens to Hcfsa funds not used?

HSA money is yours to keep. Unlike a flexible spending account (FSA), unused money in your HSA isn't forfeited at the end of the year; it continues to grow, tax-deferred.

Does FSA reimburse tax?

Sales Tax on medical items is eligible for reimbursement with flexible spending accounts (FSA), health savings accounts (HSA), health reimbursement accounts (HRA), and limited purpose flexible spending accounts (LPFSA- for dental and vision related expenses only).

How long does it take for FSA reimbursement direct deposit?

It may take up to 10 to 12 business days from the time your FEHB plan submits your claim until your funds are deposited into your account. The payment schedule for retail and mail-order pharmacy vendors is generally longer than what you may experience for medical, dental and vision claims.

What can Hcfsa be used for?

A Health Care FSA (HCFSA) is a pre-tax benefit account that's used to pay for eligible medical, dental, and vision care expenses - those not covered by your health care plan or elsewhere. It's a smart, simple way to save money while keeping you and your family healthy and protected.

Can Hcfsa be used for dental?

You can use your Limited Expense Health Care FSA (LEX HCFSA) funds to pay for a variety of dental and vision care products and services for you, your spouse, and your dependents. The IRS determines which expenses can be reimbursed by an FSA.

Should I get an Hcfsa?

A health care FSA is also “worth it” to account holders because it gives them access to the entire annual amount elected beginning on the very first day of the plan year for medical, dental, & vision costs.

Is it good to have Hcfsa?

By allowing you to utilize pre-tax funds for these eligible expenses, FSAs also save you money when compared to paying with after-tax dollars. As time-sensitive funds, HCFSAs can be used first to cover healthcare costs. This saves HSA savings (which don't expire) for the future.

What are 3 things an FSA can be used for?

How to use FSA money. Common purchases include everyday health care products like bandages, thermometers and glasses. Everything from medical expenses that aren't covered by a health plan (like deductibles and co-pays to dependent day care) to over-the-counter medication can also be eligible.

Does FSA card cover toilet paper?

Toiletries are not eligible for reimbursement with a flexible spending account (FSA), health savings account (HSA), health reimbursement arrangement (HRA), limited-purpose flexible spending account (LPFSA) or a dependent care flexible spending account (DCFSA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the NY Health Care Flexible Spending Account in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NY Health Care Flexible Spending Account in seconds.

How can I edit NY Health Care Flexible Spending Account on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NY Health Care Flexible Spending Account.

How do I complete NY Health Care Flexible Spending Account on an Android device?

On Android, use the pdfFiller mobile app to finish your NY Health Care Flexible Spending Account. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is NY Health Care Flexible Spending Account (HCFSA)?

The NY Health Care Flexible Spending Account (HCFSA) is a tax-advantaged account that allows state employees to set aside pre-tax dollars to pay for eligible medical expenses not covered by their health insurance.

Who is required to file NY Health Care Flexible Spending Account (HCFSA)?

Employees participating in the HCFSA are required to file claims for reimbursement of eligible expenses incurred during the plan year.

How to fill out NY Health Care Flexible Spending Account (HCFSA)?

To fill out the HCFSA, you need to complete a reimbursement claim form, providing details of the expenses, attaching relevant receipts, and submitting it to the plan administrator for processing.

What is the purpose of NY Health Care Flexible Spending Account (HCFSA)?

The purpose of the HCFSA is to help employees save money on out-of-pocket medical expenses by using pre-tax dollars, thereby reducing their taxable income.

What information must be reported on NY Health Care Flexible Spending Account (HCFSA)?

The information that must be reported includes the date of service, type of expense, the amount charged, and any supporting documentation such as receipts to validate the claim.

Fill out your NY Health Care Flexible Spending Account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Health Care Flexible Spending Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.