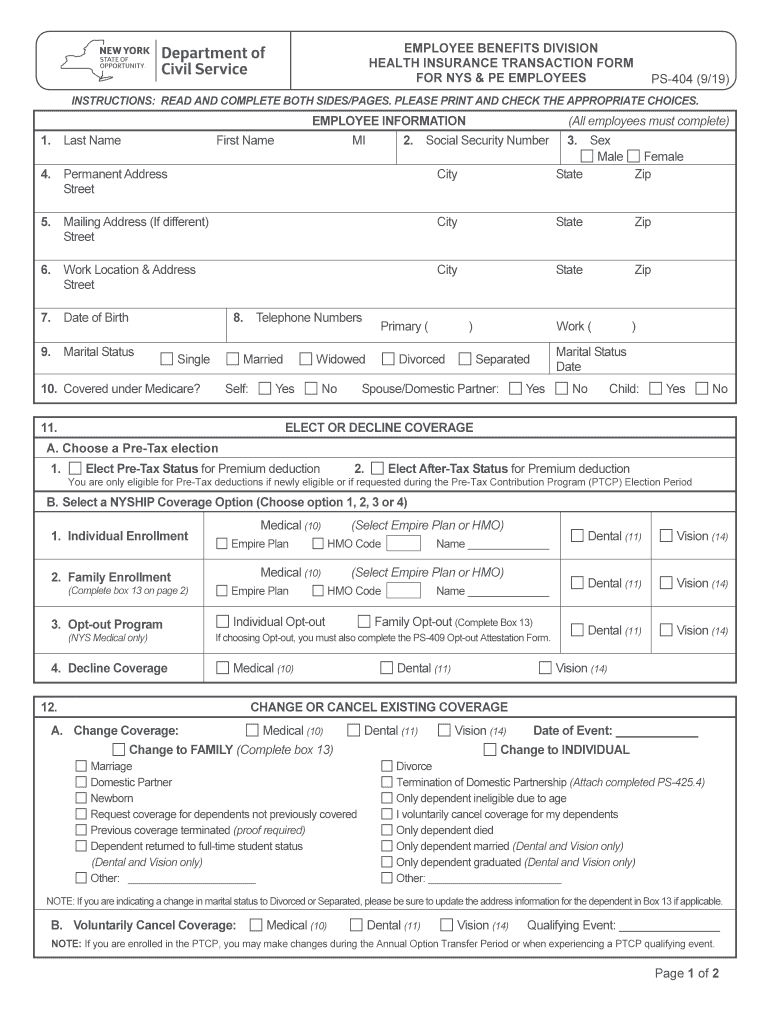

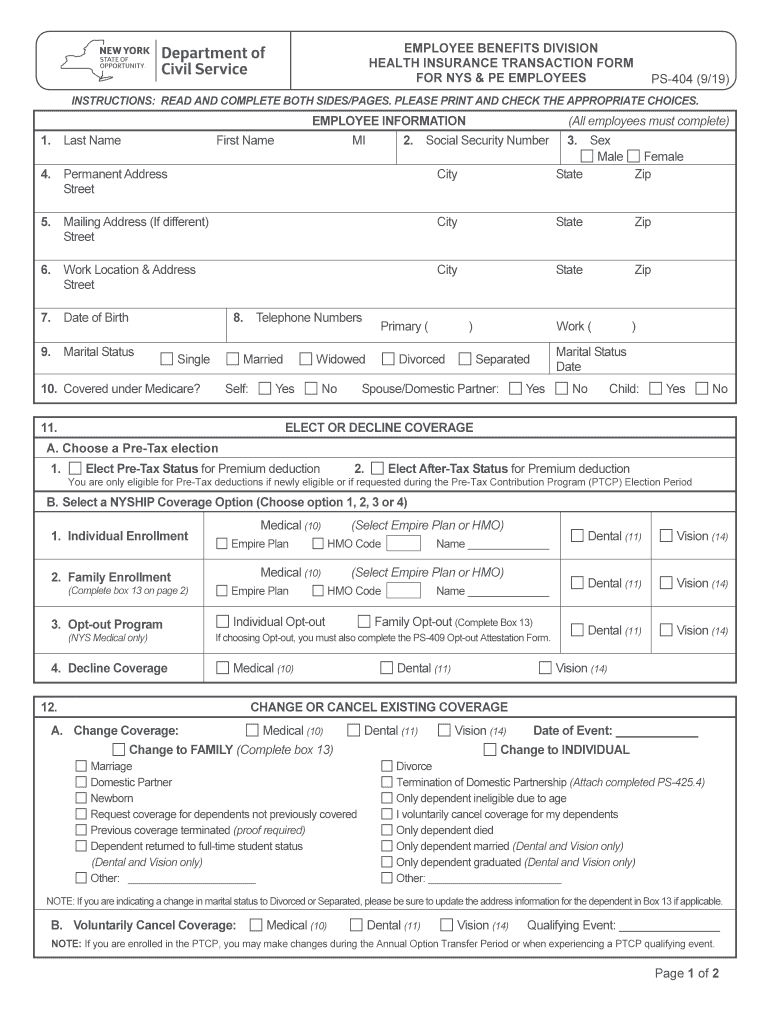

NY PS-404 2019 free printable template

Get, Create, Make and Sign NY PS-404

How to edit NY PS-404 online

Uncompromising security for your PDF editing and eSignature needs

NY PS-404 Form Versions

How to fill out NY PS-404

How to fill out NY PS-404

Who needs NY PS-404?

Instructions and Help about NY PS-404

>Sgt;Intro Music<< Each year, you receive a Member Annual Statement that contains a projection of your retirement benefits. That projection can be helpful as you begin to consider retirement, but as you get closer to that big day, you'll want more precise figures. When you are within 18 months of retirement eligibility, we highly recommend you send us a completed Request for Estimate form to get a formal estimate of what your pension could be. One important section of this form is Number 8: Information About Your Public Employment And Membership(s). Fill it out accurately and completely, so we can check your public employment history against our records. If you need more space, feel free to attach another sheet. You'll also want to complete Section 11: Information About Your Intended Beneficiary. This is not a legal beneficiary designation; it just allows us to provide you with benefit information under all the payment options. Why should you request an estimate of your retirement benefits? There are several reasons. First, with an estimate, you can verify that you received service credit for all your public employment. Service credit directly affects the amount of your pension, and you want to be certain our records are accurate, so that your pension is correct. Your estimate also includes information about your final average salary, your total member contributions, the amount of any outstanding loan balances, the Retirement Plan used to determine your benefit, and the name and birthdate of your beneficiary. Plus it can help in your financial planning. It provides information about your retirement benefits, and the approximate amount you can expect to receive each month under the available payment options. Keep in mind that your estimate won't include the money you may receive for any unused vacation or lump sum payments, and it won't include credit for your unused sick leave. These are items we can't account for until you actually retire. Your retirement benefit will be adjusted to include all allowable payments, and credit for your sick leave if your employer provides that benefit. When you get your estimate, be sure to review the information carefully and report any inconsistencies to us as soon as possible. If you decide you aren't ready for retirement, don't worry; you can always request a new estimate when your circumstances change. Our website features additional information on estimates. We've included the links to some helpful web pages below this video. Please be sure to contact us with any questions you have. Thanks for watching. Sgt;>Outro Music<<

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NY PS-404 directly from Gmail?

How do I make changes in NY PS-404?

How can I edit NY PS-404 on a smartphone?

What is NY PS-404?

Who is required to file NY PS-404?

How to fill out NY PS-404?

What is the purpose of NY PS-404?

What information must be reported on NY PS-404?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.