Get the free Do not spend too much time

Show details

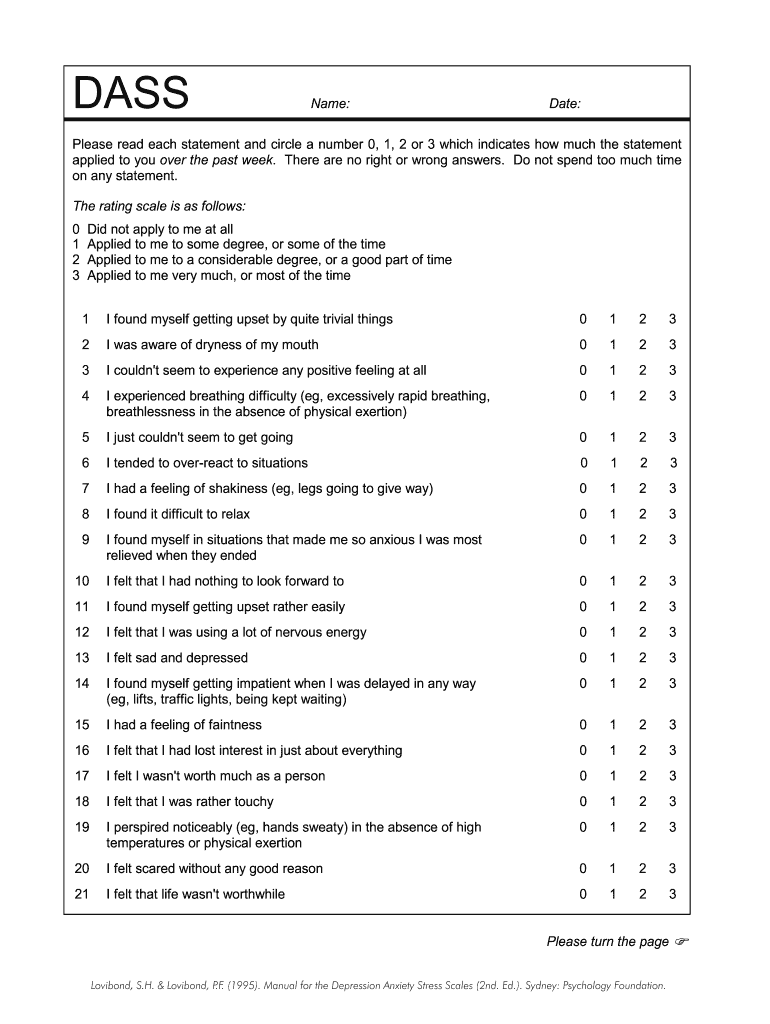

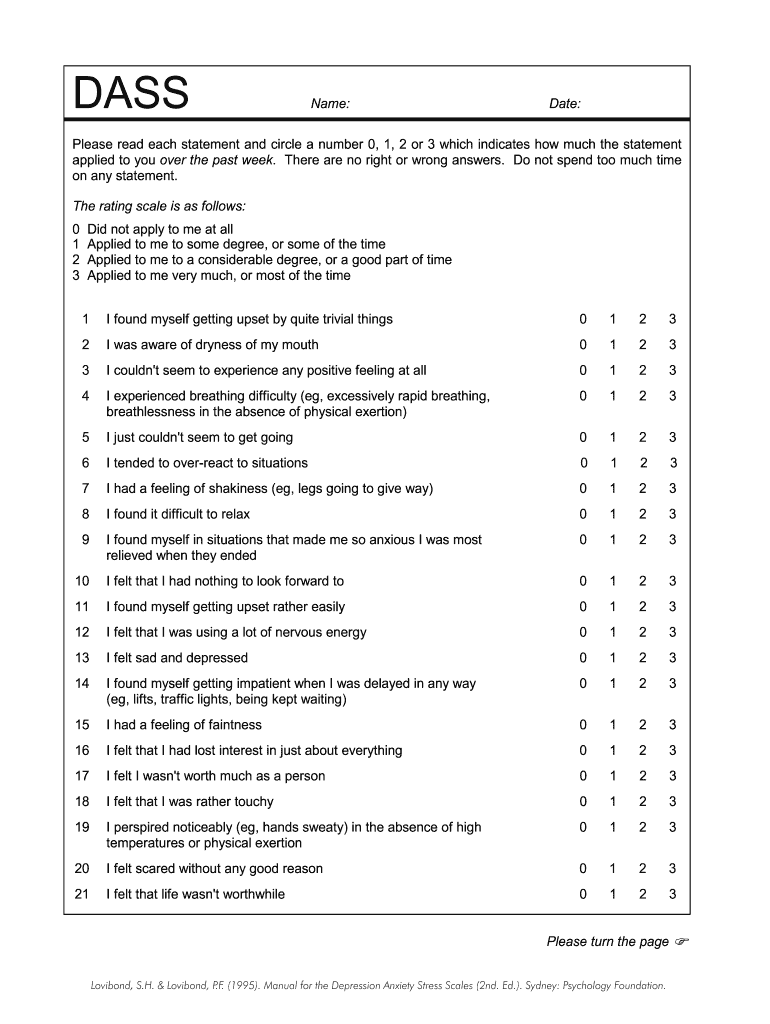

Passage:Date:Please read each statement and circle a number 0, 1, 2 or 3 which indicates how much the statement

applied to you over the past week. There are no right or wrong answers. Do not spend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign do not spend too

Edit your do not spend too form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your do not spend too form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit do not spend too online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit do not spend too. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out do not spend too

How to fill out do not spend too:

01

Start by assessing your current spending habits. Take a look at your expenses and identify areas where you tend to overspend. This could include eating out too often, impulse purchases, or unnecessary subscriptions.

02

Create a budget that aligns with your financial goals. Determine how much money you need for essential expenses such as rent, bills, and groceries. Allocate a reasonable amount for discretionary spending, but be mindful not to exceed this limit.

03

Prioritize your spending based on your needs and values. Focus on fulfilling essential needs before indulging in wants. Ask yourself if a purchase is necessary and if it aligns with your financial goals. If not, reconsider spending on that item or activity.

04

Practice self-discipline and avoid impulsive buying. Think twice before making a purchase, especially for non-essential items. Consider waiting for a cooling-off period before deciding whether to buy. This will help you avoid unnecessary spending.

05

Find alternative ways to enjoy activities without spending too much money. Look for free or low-cost entertainment options, such as visiting parks, attending community events, or exploring local attractions. Engage in hobbies that don't require excessive spending.

06

Track your expenses regularly to stay accountable. Use a budgeting app or spreadsheet to monitor your spending habits. Review your financial progress and make necessary adjustments to ensure you're on track to meet your goals.

Who needs do not spend too?

01

Individuals on a tight budget: People who have limited disposable income can benefit from adopting a "do not spend too" approach. By prioritizing their spending and avoiding unnecessary expenses, they can make the most of their limited funds.

02

Those aiming for financial independence: Individuals striving to build wealth or achieve financial independence often focus on saving and investing their money wisely. Embracing a "do not spend too" mindset can help them curb unnecessary spending and allocate more resources towards financial goals.

03

People looking to reduce debt: Those burdened with debt can find relief by adopting a "do not spend too" mentality. By cutting back on unnecessary spending and redirecting funds towards debt repayment, individuals can accelerate their journey towards becoming debt-free.

Overall, anyone who wants to take control of their finances, optimize their spending habits, and work towards financial goals can benefit from implementing a "do not spend too" approach.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my do not spend too in Gmail?

do not spend too and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send do not spend too for eSignature?

When you're ready to share your do not spend too, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit do not spend too on an Android device?

You can edit, sign, and distribute do not spend too on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is do not spend too?

Do not spend too is a document that tracks expenses and ensures that a certain budget or limit is not exceeded.

Who is required to file do not spend too?

Anyone who is responsible for managing or tracking expenses is required to file do not spend too.

How to fill out do not spend too?

Do not spend too can be filled out by recording all expenses incurred and comparing them to the budget or limit set.

What is the purpose of do not spend too?

The purpose of do not spend too is to control expenses and ensure that financial limits are not exceeded.

What information must be reported on do not spend too?

Information such as date of expense, amount spent, category of expense, and remaining budget or limit must be reported on do not spend too.

Fill out your do not spend too online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Do Not Spend Too is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.