Get the free Whole Life Insurance Policy - Mutual of Omaha Life Insurance

Show details

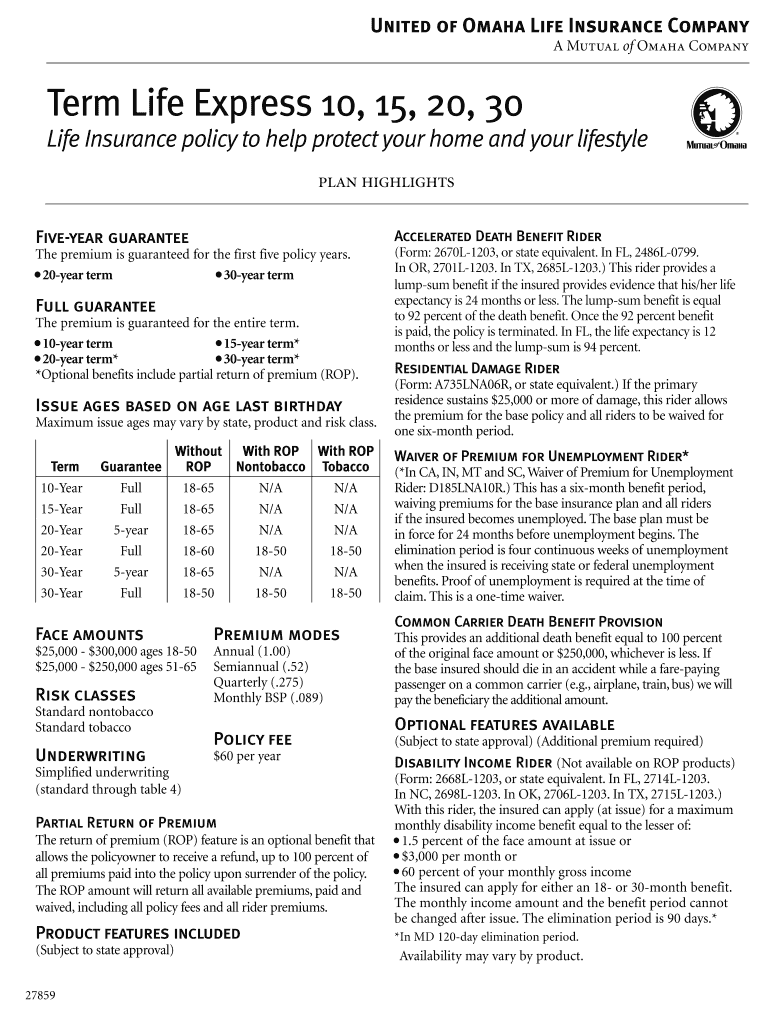

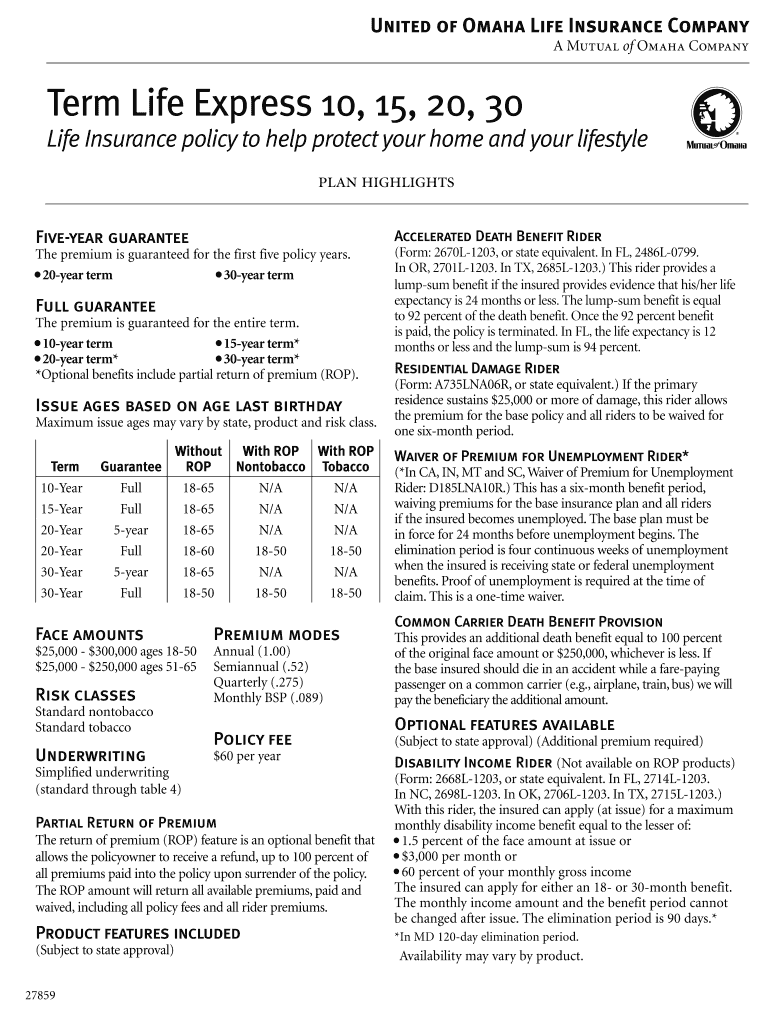

United of Omaha Life Insurance Company A Mutual of Omaha Compacter Life Express 10, 15, 20, 30 Life Insurance policy to help protect your home and your lifestyle plan highlights Five year guaranteeAccelerated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign whole life insurance policy

Edit your whole life insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your whole life insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing whole life insurance policy online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit whole life insurance policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out whole life insurance policy

How to fill out whole life insurance policy

01

Start by gathering all the necessary documents, such as identification, social security number, and medical records.

02

Research different insurance providers to find the one that best suits your needs and budget.

03

Contact the chosen insurance provider and request an application form for a whole life insurance policy.

04

Carefully read through the application form and fill out all the required fields accurately.

05

Provide any additional information or documentation as requested by the insurance provider.

06

Review the filled-out application form thoroughly to ensure accuracy and completeness.

07

Sign the completed application form and submit it to the insurance provider either online or through mail.

08

Pay the initial premium amount as specified by the insurance provider.

09

Await the underwriting process, during which the insurance provider will assess your application and determine the policy terms.

10

Once approved, carefully review the terms and conditions of the policy before accepting it.

11

Make the required premium payments on time to keep the policy active.

12

Review and update the policy as necessary to suit your changing needs and circumstances.

Who needs whole life insurance policy?

01

Individuals who want to provide financial protection for their loved ones and beneficiaries in the event of their death.

02

Those looking for a long-term investment option and potential cash value accumulation.

03

Individuals who want to leave an inheritance or legacy for their family members or charitable organizations.

04

People who have dependents, such as children or aging parents, who rely on their income for financial support.

05

Business owners who want to protect their business and provide key person coverage.

06

Individuals who want to have a guaranteed death benefit that remains in force for their lifetime.

07

Those who want to avoid the risk of outliving their coverage, as whole life insurance provides lifelong protection.

08

Individuals who are interested in utilizing the policy's cash value for loans, withdrawals, or supplementing retirement income.

09

People who have concerns about future insurability and want to secure coverage at a young and healthy age.

10

Those seeking to have a fixed premium amount that remains level throughout the life of the policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify whole life insurance policy without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including whole life insurance policy, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get whole life insurance policy?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the whole life insurance policy in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit whole life insurance policy online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your whole life insurance policy to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is whole life insurance policy?

Whole life insurance policy is a type of permanent life insurance that provides coverage for the entire life of the insured, as long as premiums are paid.

Who is required to file whole life insurance policy?

Individuals who purchase a whole life insurance policy are required to file it with the insurance company and keep their beneficiaries informed.

How to fill out whole life insurance policy?

To fill out a whole life insurance policy, individuals must provide personal information, health history, coverage amount, and beneficiary details.

What is the purpose of whole life insurance policy?

The purpose of whole life insurance policy is to provide financial protection to the insured's beneficiaries upon the insured's death, as well as to accumulate cash value over time.

What information must be reported on whole life insurance policy?

Information such as personal details, health status, coverage amount, beneficiaries, and premium payment details must be reported on a whole life insurance policy.

Fill out your whole life insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Whole Life Insurance Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.