Get the free Canadian Non Profit and Charity Legal Audits: Forget about It!

Show details

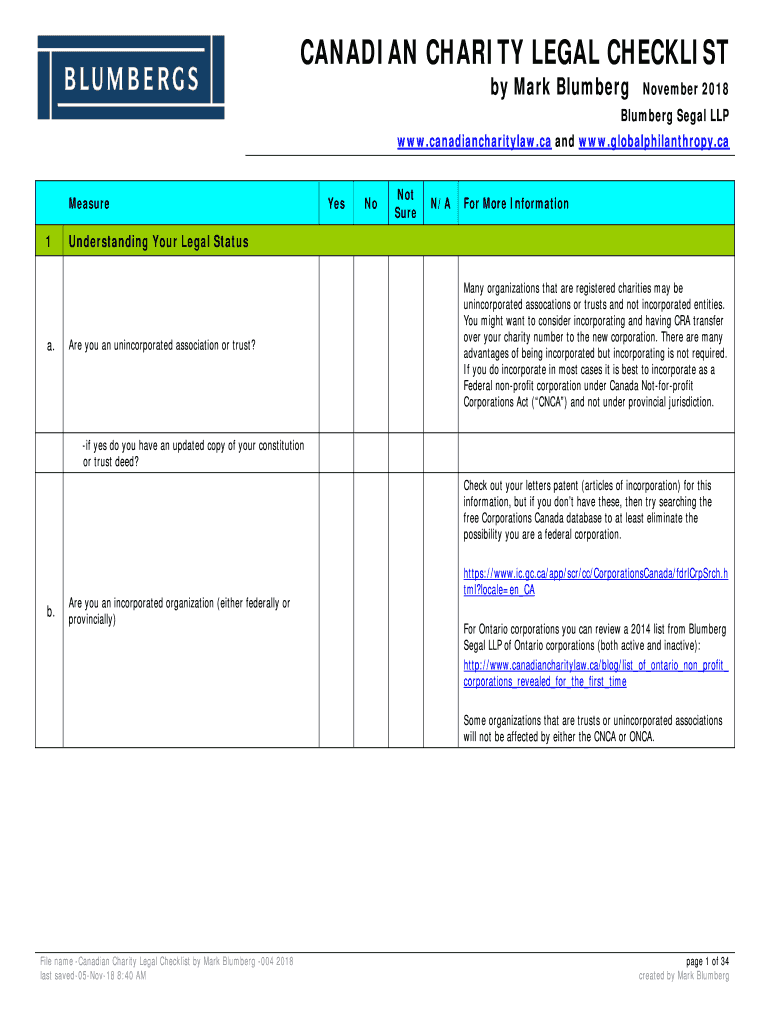

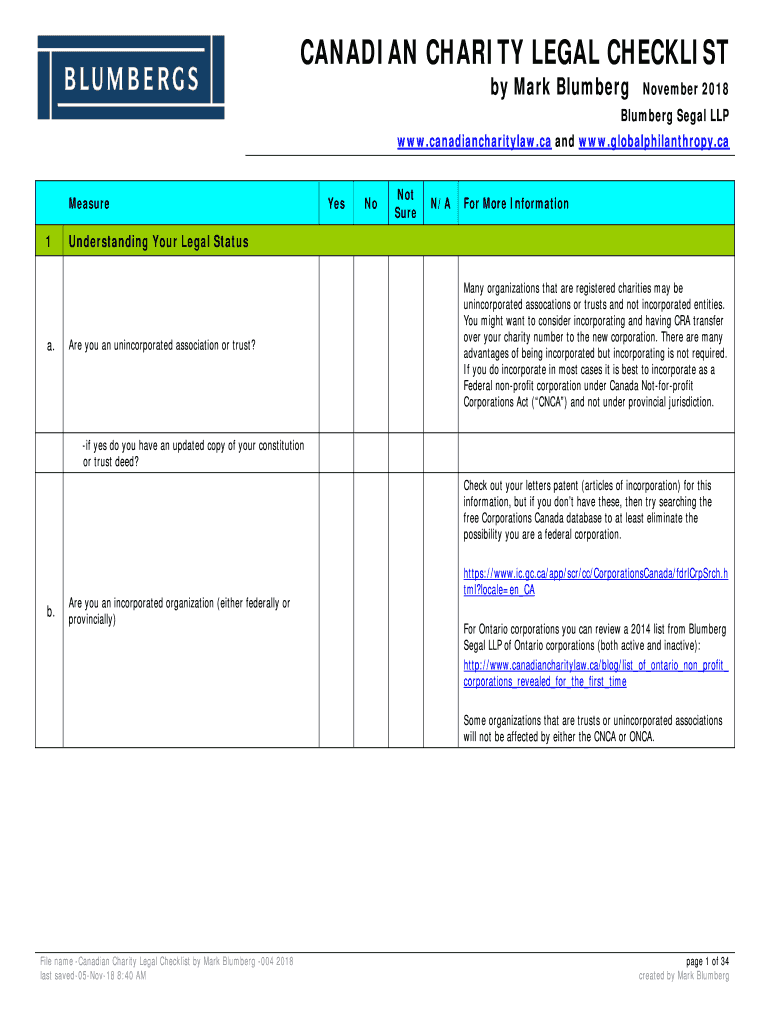

CANADIAN CHARITY LEGAL CHECKLIST

by Mark BlumbergNovember 2018Blumberg Legal LLP

www.canadiancharitylaw.ca and www.globalphilanthropy.ca

Measure1a. Snoot

Sure/For More InformationUnderstanding Your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canadian non profit and

Edit your canadian non profit and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canadian non profit and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canadian non profit and online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit canadian non profit and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canadian non profit and

How to fill out canadian non profit and

01

Start by gathering the necessary information and documents, such as the organization's name, purpose, structure, and activities.

02

Choose a name for your non-profit organization that complies with the regulations and guidelines set by the Canadian government.

03

Determine the legal structure of your non-profit organization. This can be a corporation, a cooperative, an unincorporated association, or a trust.

04

Complete the necessary forms and documents required by the Canada Revenue Agency (CRA), such as the Application for Registration and the T2050 form.

05

Provide detailed information about your organization's activities, charitable purposes, and the beneficiaries it will serve.

06

Prepare a governing document, such as articles of incorporation, bylaws, or a constitution, that outlines the rules and regulations for operating the organization.

07

Submit the completed forms, documents, and fees to the appropriate government authorities, such as the CRA or the provincial/territorial government.

08

Wait for the government to review your application and make a decision regarding your non-profit registration.

09

Once approved, comply with any reporting and filing requirements set by the government, such as submitting annual financial statements and maintaining proper records.

10

Promote your non-profit organization, engage with the community, and continue fulfilling your charitable purposes.

Who needs canadian non profit and?

01

Non-profit organizations in Canada are needed by various individuals and communities, including:

02

- Individuals or groups who want to address social issues, support a cause, or pursue philanthropic goals.

03

- Charitable organizations that aim to provide services or support to vulnerable populations, such as the homeless, the elderly, the disabled, or those in need of healthcare.

04

- Cultural, educational, or religious groups that seek to promote their values, traditions, or beliefs.

05

- Advocacy groups that work towards policy change or raising awareness about specific issues.

06

- Community organizations that aim to strengthen local communities, foster collaboration, and improve quality of life.

07

- Researchers, scientists, or professionals who want to conduct studies or contribute to the advancement of knowledge in a particular field.

08

- Donors and philanthropists who wish to support and fund non-profit initiatives to create positive social impact.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in canadian non profit and without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your canadian non profit and, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit canadian non profit and on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing canadian non profit and.

How do I edit canadian non profit and on an Android device?

You can make any changes to PDF files, like canadian non profit and, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is canadian non profit and?

Canadian non profit and refers to the required annual information return that must be filed by registered charities in Canada.

Who is required to file canadian non profit and?

Registered charities in Canada are required to file canadian non profit and.

How to fill out canadian non profit and?

Canadian non profit and can be filled out online through the Canada Revenue Agency website.

What is the purpose of canadian non profit and?

The purpose of canadian non profit and is to provide information about the activities and financial status of registered charities in Canada.

What information must be reported on canadian non profit and?

Information such as income, expenses, fundraising activities, and charitable programs must be reported on canadian non profit and.

Fill out your canadian non profit and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canadian Non Profit And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.