Get the free Low-Income Housing Tax Credit ProgramWVHDF - West ...

Show details

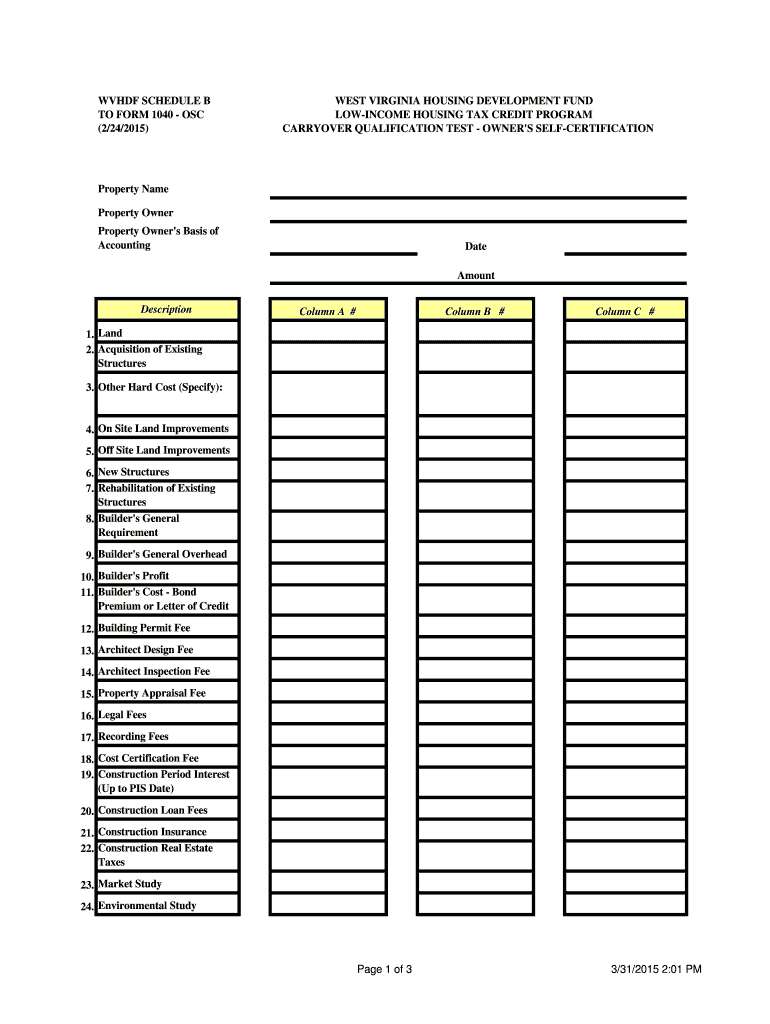

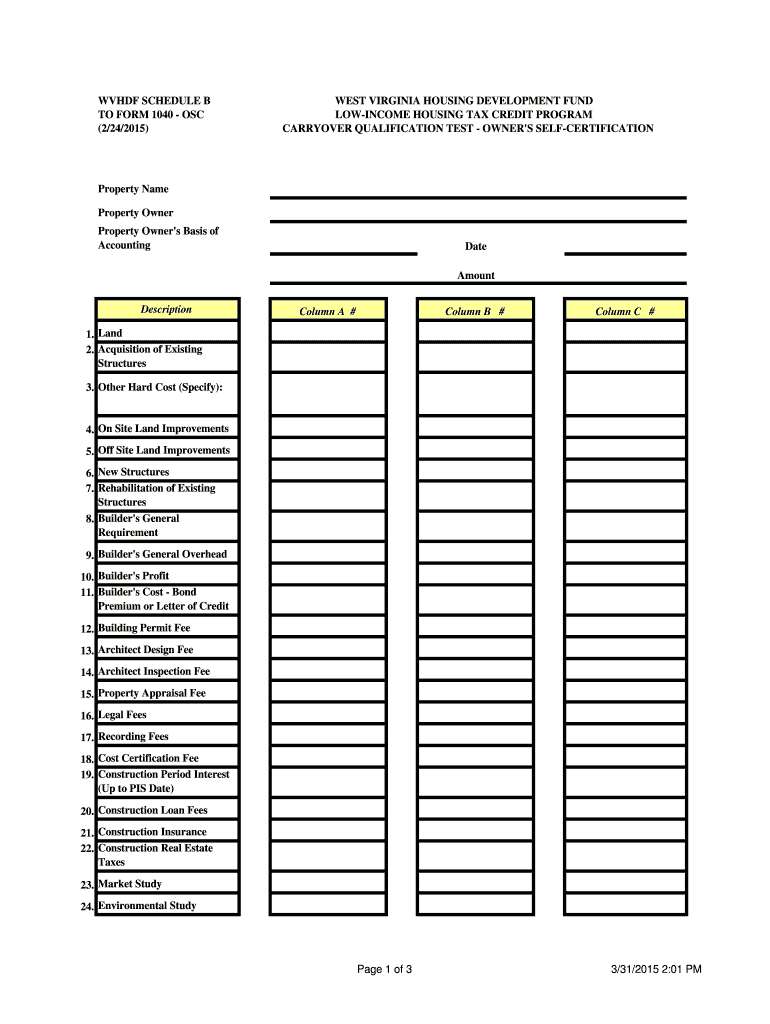

WV HDF SCHEDULE B TO FORM 1040 OSC (2/24/2015)WEST VIRGINIA HOUSING DEVELOPMENT FUND INCOME HOUSING TAX CREDIT PROGRAM CARRYOVER QUALIFICATION TEST OWNER IS SELFCERTIFICATIONProperty Name Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low-income housing tax credit

Edit your low-income housing tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low-income housing tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit low-income housing tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit low-income housing tax credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low-income housing tax credit

How to fill out low-income housing tax credit

01

Obtain the necessary application forms for the Low-Income Housing Tax Credit (LIHTC) program from the appropriate government agency or organization.

02

Fill out the forms completely and accurately, providing all the required information and supporting documentation as specified.

03

Include detailed information about the low-income housing project for which you are seeking the tax credit, such as the location, number of units, and income eligibility criteria.

04

Submit the completed application forms and supporting materials to the designated authority within the specified deadline.

05

Wait for the review process to be completed and for a decision to be made on your application.

06

If approved, comply with any additional requirements or conditions set by the government agency or organization, such as annual reporting and compliance monitoring.

07

Start utilizing the tax credit to offset your federal tax liability for eligible low-income housing projects.

Who needs low-income housing tax credit?

01

Low-income housing tax credit is primarily designed to benefit developers and investors who want to invest in affordable housing projects for low-income individuals and families.

02

It is also beneficial for local governments and housing authorities seeking to increase the availability of affordable housing in their communities.

03

Additionally, low-income individuals and families in need of affordable housing can indirectly benefit from the program as it helps in increasing the supply of such housing options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the low-income housing tax credit electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out low-income housing tax credit using my mobile device?

Use the pdfFiller mobile app to fill out and sign low-income housing tax credit on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit low-income housing tax credit on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute low-income housing tax credit from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is low-income housing tax credit?

Low-income housing tax credit is a tax incentive program created to encourage the development of affordable rental housing.

Who is required to file low-income housing tax credit?

Property owners or developers who have received low-income housing tax credits are required to file for the credit.

How to fill out low-income housing tax credit?

To fill out low-income housing tax credit, applicants must provide detailed information about the affordable rental housing project.

What is the purpose of low-income housing tax credit?

The purpose of low-income housing tax credit is to provide financial incentives for the development of affordable rental housing for low-income individuals and families.

What information must be reported on low-income housing tax credit?

Information required includes detailed project costs, income and demographic information of tenants, and compliance with program requirements.

Fill out your low-income housing tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low-Income Housing Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.